Helium (HNT) cracks trendline support, but is a 30% rally really possible?

- Helium’s daily chart appeared free of major hurdles, which could help the asset rally smoothly

- HNT’s Open Interest jumped by 7% over the past 24 hours, suggesting growing demand and interest from investors

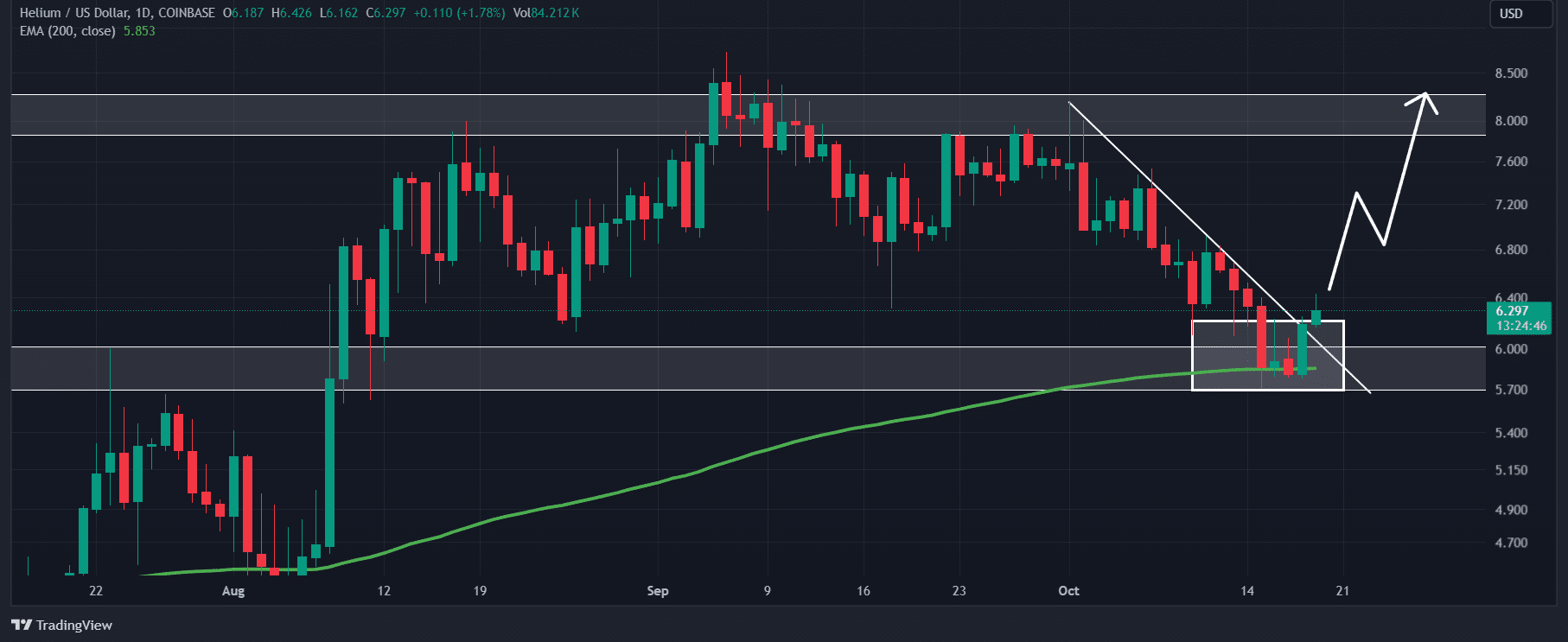

Helium [HNT], at press time, appeared all set for a massive upside rally after retesting its crucial support and breaking out from a descending trendline. As expected, this movement seems to have shifted sentiment entirely from a downtrend to an uptrend.

Helium’s technical analysis

According to AMBCrypto’s assessment, HNT appeared bullish after it broke out from the descending trendline which had been acting as resistance since 1 October 2024.

In fact, the altcoin also broke the consolidation zone at $5.8 support.

In light of this positive outlook and its recent price action, there is a strong possibility that HNT could soar by 30% to hit the $8.40-level in the coming days.

At the time of writing, Helium’s daily chart appeared free of major hurdles. This could help the asset rally smoothly in the coming days.

Additionally, HNT’s Relative Strength Index (RSI) and the 200-day Exponential Moving Average (EMA) alluded to a bullish outlook, while also hinting at significant upside rallies.

Bullish on-chain metrics

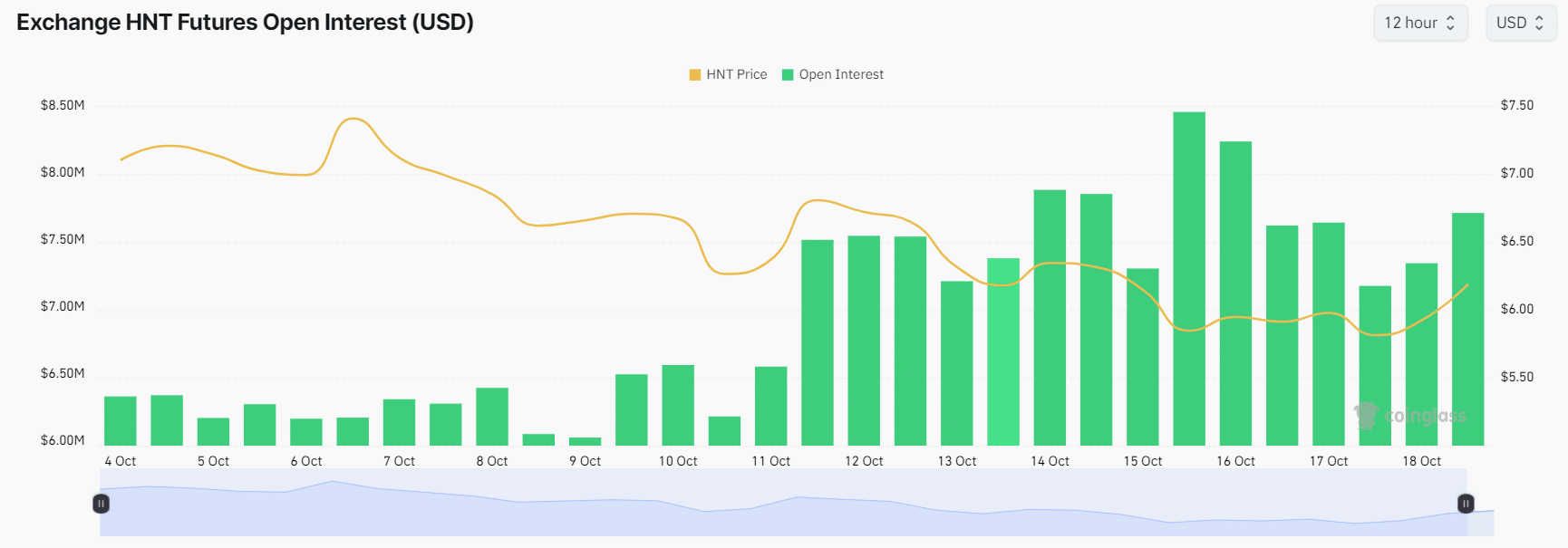

HNT’s positive outlook can be further supported by its on-chain metrics. According to Coinglass, HNT’s Long/Short Ratio had a value of 1.008 at press time. This implied strong bullish sentiment among the altcoin’s traders.

The coin’s Open Interest (OI) hiked by 7% over the past 24 hours, with the same steadily increasing on the charts in the week prior too.

This rising OI can be interpreted as a sign of growing demand and interest from investors. This may be likely due to the crypto’s recent breakout and its bullish market sentiment.

Traders and investors often use rising OI and a Long/Short Ratio above 1 when building long positions.

According to Coinglass, major liquidation levels were at $6.06 on the lower side and $6.5 on the upper side, with traders over-leveraged at these levels.

Combining these on-chain metrics with technical analysis, it can be inferred that bulls are currently dominating the asset. They can support HNT and help it reach the $8.40 level in the coming days.

Read Helium’s [HNT] Price Prediction 2024-25

At press time, HNT was trading near $6.37 after recording a price surge of over 8.2% in the last 24 hours.

Over the same period, its trading volume jumped by 20%, indicating higher participation from traders and investors, compared to the previous few days.

![Ripple [XRP] is 'free to dump on you,' Pierre Rochard claims](https://ambcrypto.com/wp-content/uploads/2025/03/Ripple-Critic-Says-XRP-Is-Not-a-Security-400x240.webp)