Altcoin

Helium’s 59% rally – More gains to come for HNT?

Helium’s Open Interest rises as Funding Rates flip negative, suggesting that traders are opening short positions.

- HNT has formed a bullish crossover after the 50-day SMA crossed above the 100-day SMA.

- Open Interest has increased to multi-month highs, but the negative Funding Rates showed a spike in short positions.

Helium [HNT] continued to rally at press time, with seven-day gains of over 50%. Volumes in the spot and futures markets showed rising investor interest as prices push to multi-month highs.

HNT was trading at $7.28 at the time of writing after a nearly 10% rise in 24 hours. Open Interest has also soared to the highest level in months.

Bulls are showing strength

The HNT rally was not showing signs of weakening as bullish signals dominate.

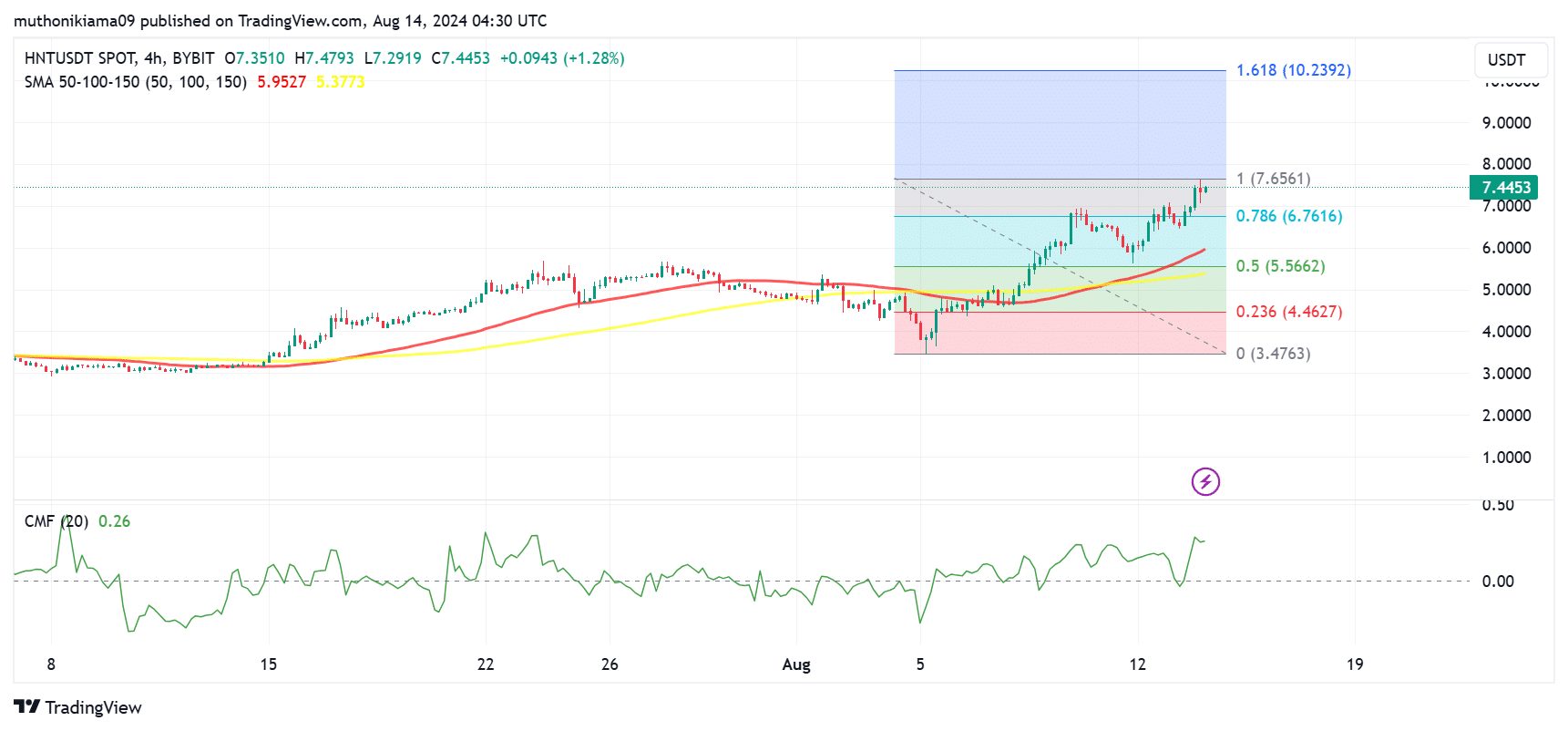

The four-hour chart showed the formation of a shorter-term bullish crossover as the 50-day Simple Moving Average (SMA) moved above the 100-day SMA. This trend indicated the likelihood of a sustained uptrend.

Data from CoinMarketCap showed a 30% rise in HNT trading volumes. These volumes are likely coming from buyers, as the Chaikin Money Flow (CMF) showed a positive value of 0.26.

This metric indicated that the buying pressure was outweighing selling pressure.

Currently, the 1.0 Fibonacci level ($7.65) acts as the immediate resistance. Buying pressure coupled with solid fundamentals could see HNT rally to a longer term target of 1.61 Fib level ($10.23).

One such fundamental is Helium’s involvement in the fast-growing decentralized physical infrastructure (DePIN). The network’s usage has also increased significantly over the past year.

HNT Open Interest hits multi-month highs

Data from Coinglass showed that the HNT Open Interest (OI) has jumped 19% to $6.85 million, its highest level since May 2024.

This metric indicated a rise in market participation as Futures traders increased their positions.

A rising OI, coupled with a price increase, is usually bullish. However, a further look at the Futures market paints a bearish picture.

The OI rose as Funding Rates flipped negative, suggesting that traders were opening short positions.

Short traders anticipate that HNT has peaked after the recent rally and the uptrend will weaken.

However, if buying activity in the spot market continues, it will create the possibility of a short squeeze that will force short traders to close their positions, taking HNT even higher.

The HNT long/short ratio at 0.97 showed that long positions were still significant. The metric indicated that a significant number of HNT futures traders were betting on further price gains.