Analysis

Here is why Dogecoin must reclaim $0.08 to offer buyers any hope

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- The retracement below 78.6% meant Dogecoin could be trading within a range

- Long positions have been blown up en masse in December, hence bulls must remain cautious

Bitcoin had a quiet couple of days as volatility died out over the weekend. It could return with a vengeance on Monday. Stock market indices such as S&P 500 were bearish over the past week, and 19 December could set the trend for the next week.

– Read Dogecoin’s [DOGE] Price Prediction 2023-24

– Are your DOGE holdings flashing green? Check the profit calculator

Dogecoin fell back into a region of support at $0.072 and saw a 4% bounce over the last two days, but Open Interest was weak.. However, it still faced resistance at $0.08, a level that has been significant over the past month. Can bulls reclaim this level and push higher?

A bullish order block rescues Dogecoin, but this could be nothing more than a temporary respite

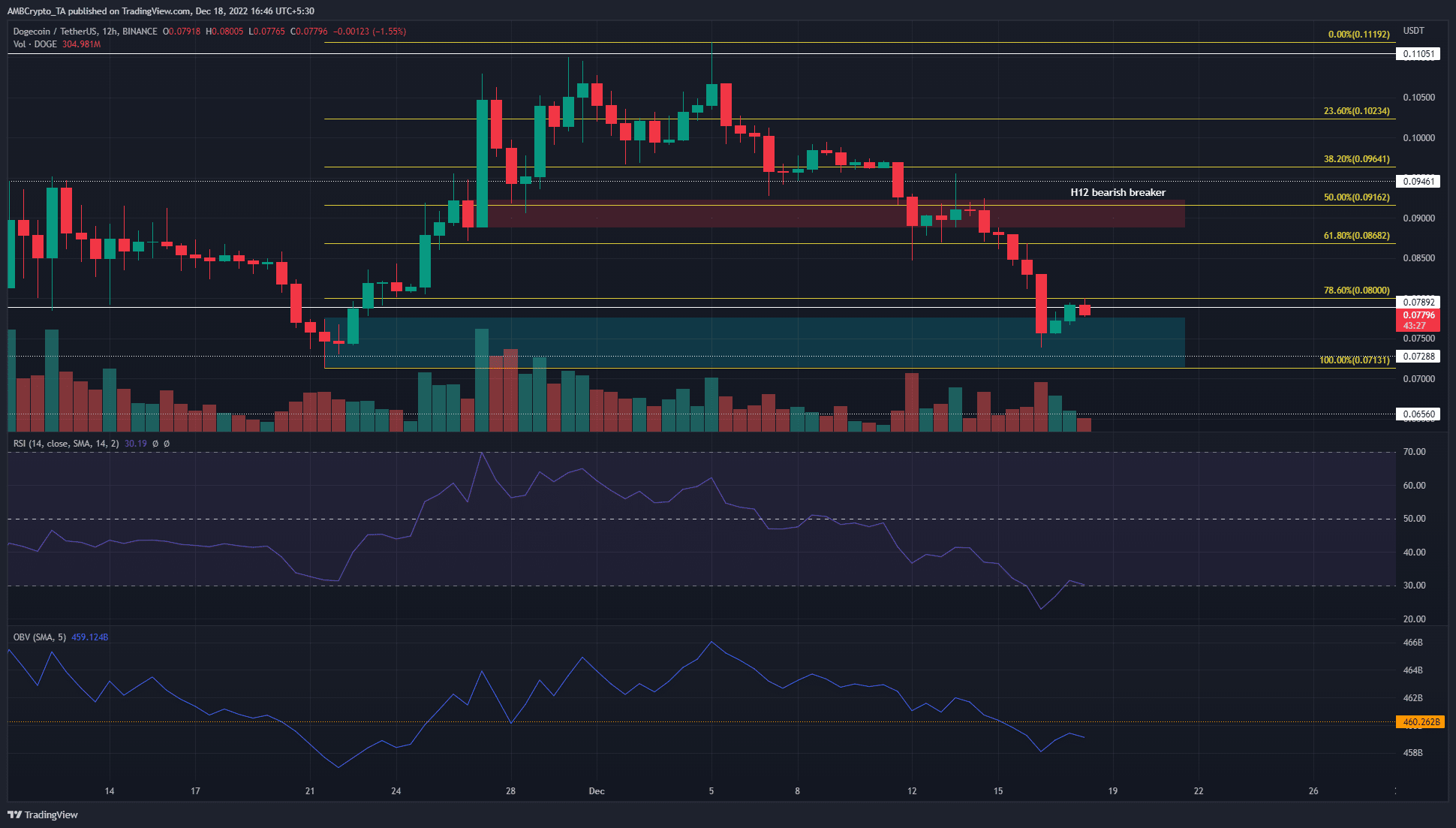

Based on the late November move from $0.071 to $0.119, a set of Fibonacci retracement levels (yellow) was drawn. At the time of writing, the price has sunk beneath the 78.6% retracement level. It encountered bullish order block, marked in cyan, above the $0.072 level of support.

The almost complete retracement meant that Dogecoin likely traded within a range and was not in a strong trend. The Relative Strength Index (RSI) oscillated from strongly bullish to strongly bearish momentum even though DOGE has not displayed a longer-term trend since mid-November. The On-Balance Volume (OBV) also sank beneath a level of support from late November.

Together, they suggested that the sellers were dominant. A daily session close beneath $0.071 would likely initiate a leg downward for DOGE. However, brave bulls can look to bid the asset within this zone.

– How many DOGE coins can you buy with $500?

– DOGE to >$2 IF its market cap goes as high as…

The $0.8 level was flipped to support before the surge to $0.119 a couple of weeks ago. As a horizontal level as well as a Fibonacci retracement level, it held significance. A retest as support in the coming days can offer a buying opportunity. Take-profit targets would be the bearish breaker at $0.091, and the $0.11 highs. Below $0.072, the next level of support lies at $0.065.

Open Interest saw a small hike over the weekend and funding rate remained positive

Source: Coinalyze

Since the beginning of December, Dogecoin has seen session with a sharp drop in prices. These were accompanied by millions of dollars worth of long positions being liquidated. Throughout the descent from $0.119 on 5 December to $0.075 on 16 December, the Open Interest also saw a decline.

This indicated long positions were discouraged. The funding rate remained in positive territory, which also showed that the majority of the market did not begin to pile into short positions.