Here’s everything you need to know about Bitcoin’s new all-time-highs

The last few days have been pretty slippery for Bitcoin. Bulls were, however, able to prevent massive losses and fairly maintain their dominating position in the market. In fact, Bitcoin’s price recently re-visited the $48k region after nearly 3 months.

The record-setting spree

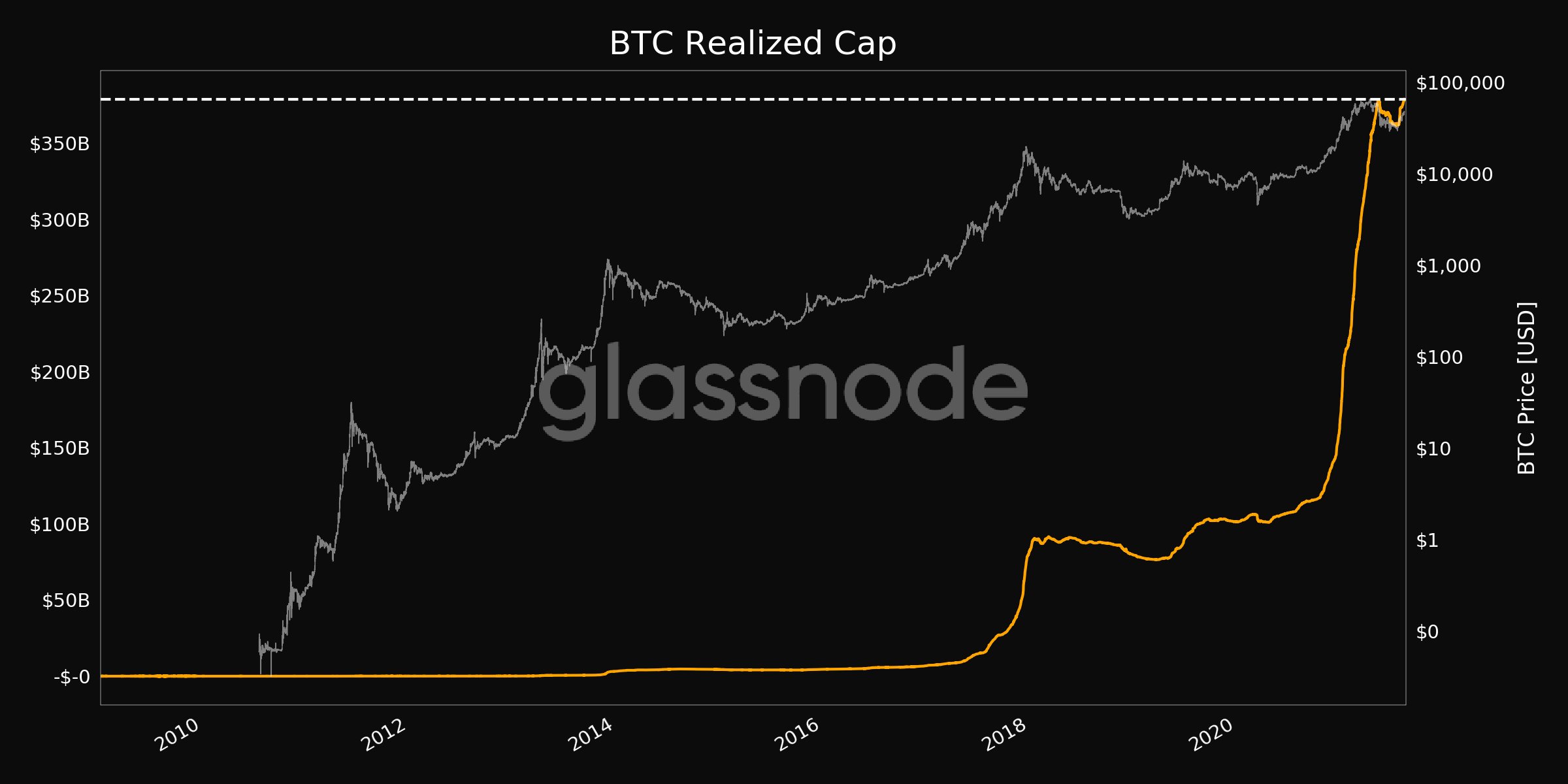

Bitcoin has been overshadowing its previously created benchmarks. For starters, Total Realized Market Cap surpassed its April highs and stood at its peak at the time of writing. As seen from the chart attached, Realized Cap was now worth over $378.76 billion.

As such, Realized Cap provides an insight into the value moving on the network. By and large, current levels are indicative of an increase in network activity and the coin’s adoption. The current level surpassing the April-May highs does stir a sense of optimism.

Bitcon’s market cap, on the other hand, has been climbing higher too. The same explicitly stood at $867.5 billion at the time of writing, but was quite distant from its $1.1 trillion all-time-high.

Market Sentiment

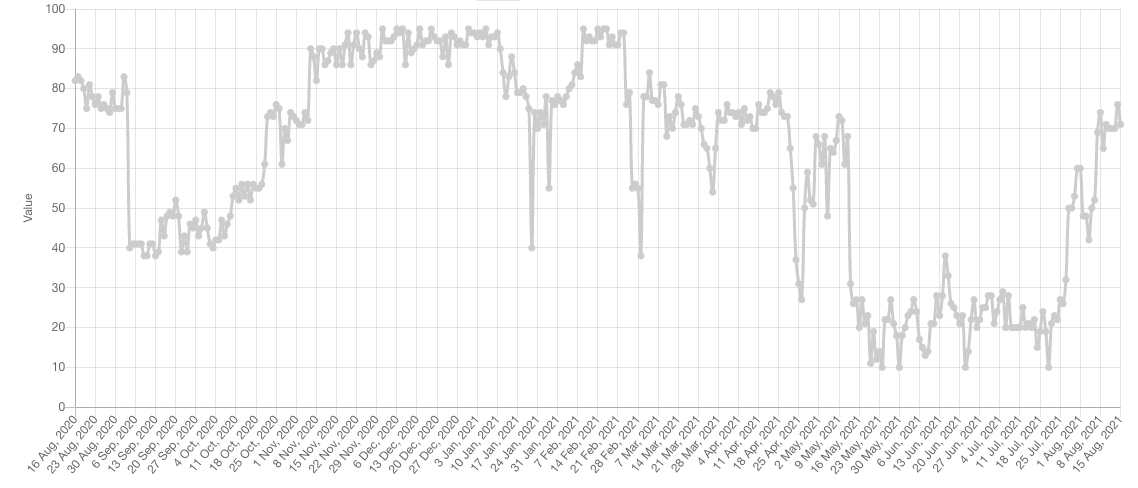

The overall market sentiment also saw an evident shift. Bitcoin’s fear and greed index stepped into the “extreme greed” domain after a period of nearly three months. In mid-May, when the coin’s price started dipping, this index was hovering around the 10 level for quite some time.

However, the change in trend gradually started becoming visible as soon as the king coin’s price started inching northwards a couple of weeks back. At press time, the index’s reading stood at 71.

Furthermore, the percentage of Bitcoin’s circulating supply reached a new 1-month high of 84.97% and conversely, the supply in loss hit its one-month low. If the landscape gets overheated in the coming days, FOMO and greed, in unison, can compel market participants to take profits by selling their HODLings during Bitcoin’s rally. If that happens, the price would witness another brief correction before heading upwards.

Are the whales in a rush

Big market participants usually have a say in the price of any given asset. Whenever whales have dumped their HODLings in the past, Bitcoin’s price has dunked and when they’ve bought more coins, the price has mostly pumped.

The number of such large transactions typically revolved around the 6k-7k range during mid July, but the same has been oscillating around the 13k-15k range of late. Coupling this with the recent price appreciation, it can be inferred that a fair share of whales are buying more Bitcoins at this stage. If they continue pumping, Bitcoin’s price would reach highs faster than expected.

Keeping the aforementioned new highs created in mind, one can expect the king-coin’s valuation to peak in the coming weeks.