Here’s how Avalanche fared in Q2

- Avalanche user activity and revenue experienced growth in Q2.

- Its DeFi and NFT verticals suffered a decline.

House to over 350 decentralized applications (dApps), a new report from Messari revealed that Proof-of-Stake (PoS) smart contract platform Avalanche [AVAX] saw growth in its key ecosystem metrics and some corresponding minor declines in Q2 2023.

Read Avalanche’s [AVAX] Price Prediction 2023-24

Titled “State of Avalanche Q2 2023,” the on-chain analytics firm found that the 90-day period under review was marked by an uptick in Avalanche’s user activity and revenue, the launch of new products, and a few key partnerships secured.

Avalanche and its many tales of growth

The Avalanche network consists of several chains, including the Primary Network, which includes the P-Chain, X-Chain, and C-Chain. The P-Chain is responsible for all validator and Subnet-level operations. This chain serves as the primary chain in the network and is responsible for coordinating and managing the other chains. The C-Chain is an implementation of the Ethereum Virtual Machine (EVM), while the X-Chain is responsible for operations on digital smart assets known as Avalanche Native Tokens.

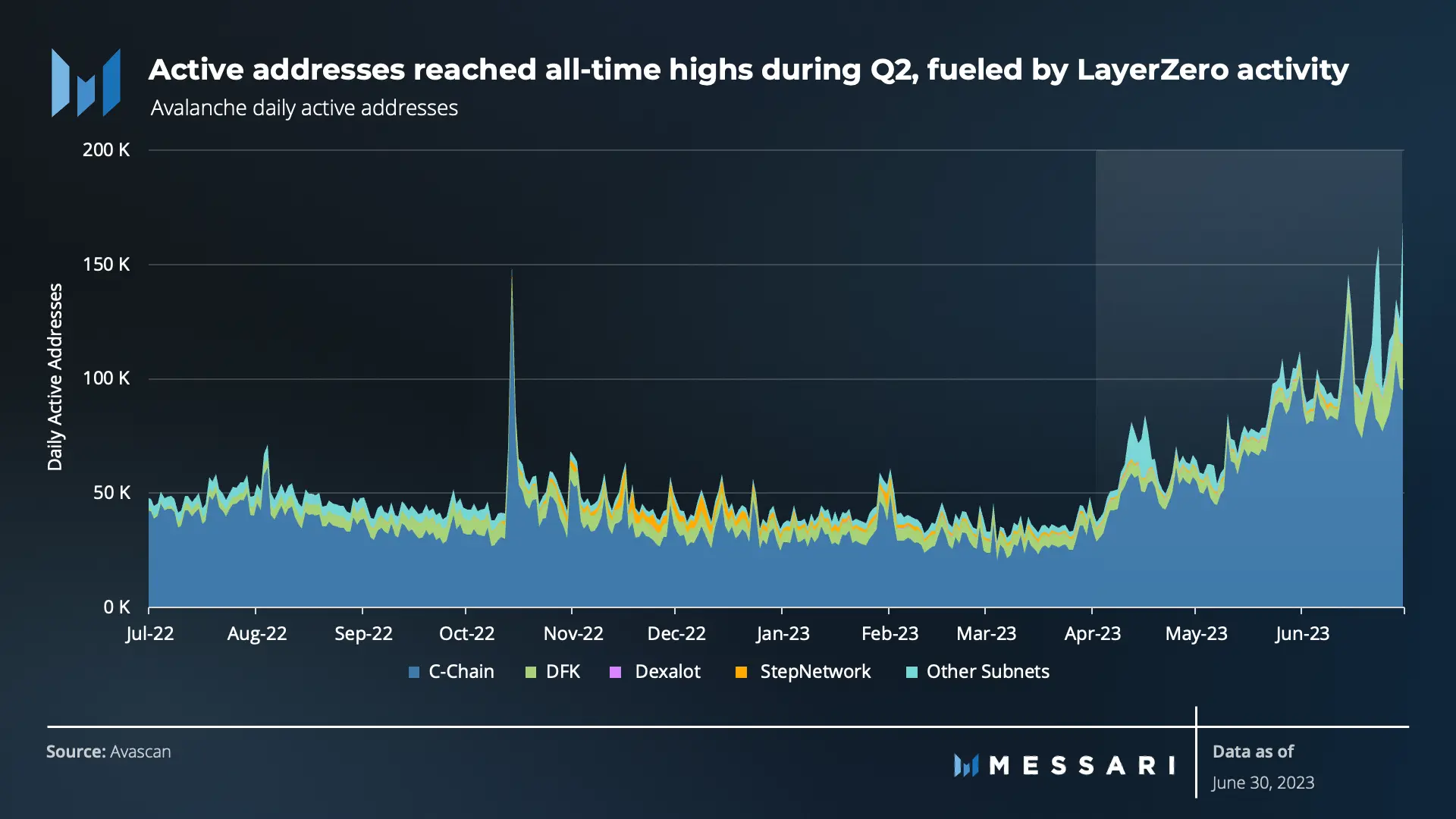

Messari considered user activity across the C-Chain and 15 Avalanche Subnets and found the count of daily average active addresses increased by 107.8% quarter-over-quarter (QoQ). By the end of Q1, Avalanche recorded 30,097 as its daily average active addresses count. By the end of Q2, this surged to an all-time high of 79,167.

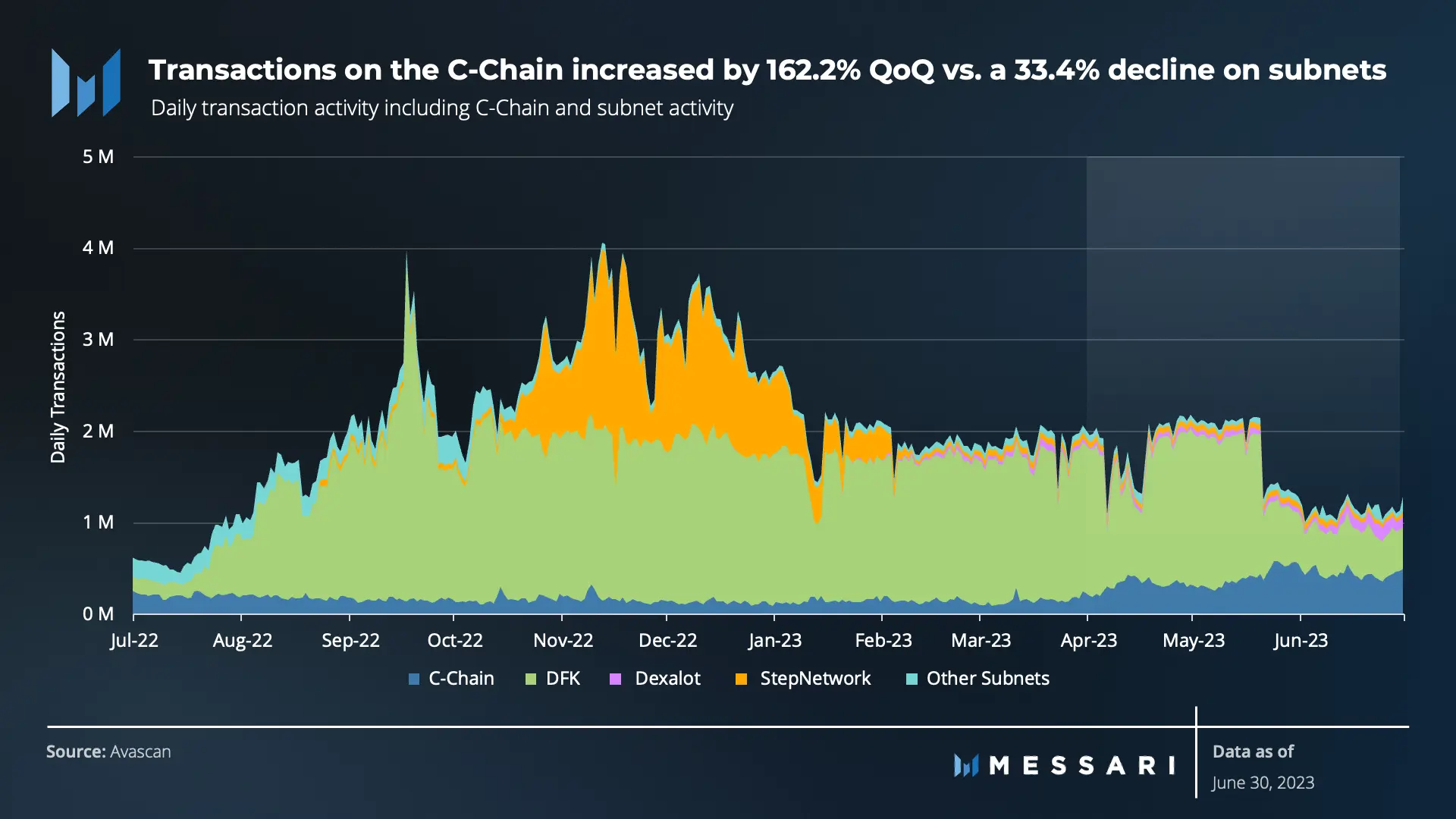

As for the count of transactions executed daily on Avalanche in Q2, Messari noted that the C-Chain saw a substantial increase of 162.2% QoQ. The C-Chain closed the 3-month period with a daily average transactions count of 1.58 million. This was “largely due to a rise in stablecoin liquidity and LayerZero,” Messari stated.

On the other hand, transactions across subnets declined by 33.4%. This decline was primarily driven by a significant decrease of 31.7% in transactions on the DFK (DeFi Kingdoms) subnet.

Regarding network financials, Avalanche recorded revenue growth of 173.1% QoQ. This was due to an uptick in the chain’s user activity during that period. Likewise, the average transaction fee on the chain also jumped by 5.9%, contributing to the astronomical growth in revenue.

“The increase in revenue was partly due to a 5.9% increase in transaction fees, but it was primarily due to the activity stemming from LayerZero. Additionally, the spike in revenue in late April was driven by XEN Crypto, a free-to-mint token known for clogging networks. Given that Avalanche burns 100% of revenue (gas fees), the greater activity contributed to the burn of AVAX and token value accrual,” Messari found.

Is your portfolio green? Check the Avalanche Profit Calculator

As for its DeFi vertical, Avalanche recorded a 19.4% decline in its total value locked (TVL) denominated in the US dollar. In contrast, its TVL denominated in AVAX rose by 9.7%. According to Messari, this suggested that “new capital inflow drove TVL versus asset price increases in USD.”

Lastly, as for its NFT ecosystem, there was a 38.3% shortfall in secondary sales volume and a 50% decline in unique NFT buyers on the chain in Q2.