Here’s how AXS is preparing for a 30% rally despite a major correction

Axie Infinity price dropped rapidly after Bitcoin price lost its footing on 6 March. This sudden downswing caught many altcoins, including AXS off guard, causing a sudden downturn. Regardless, AXS seems to be in a position to make a swift comeback.

Can bulls stage a recovery

Axie Infinity price action between 24 January to 7 February rallied from $44.34 to $71.93, setting up a range for the near future. On 23 February, AXS deviated below the range low, triggering a massive 80% upswing that ultimately deviated above the range high as well.

Regardless of this extremely bullish move, AXS failed to sustain the momentum, leading to a swing crash. After the second attempt failed to hold above the range high at $71.93 and retraced roughly 31% and is currently hovering at $55.31. Since Axie Infinity price is trading just below the 50% retracement level, a quick recovery above it could signal a resurgence of buyers.

In such a case, market participants can expect Axie Infinity price to swiftly move toward the range high at $71.93. From the current position, this run-up would amount to a 30% gain. However, if investors wait for a successful flip of the $58.13 hurdle into a support floor, then the ascent would constitute to 23% return.

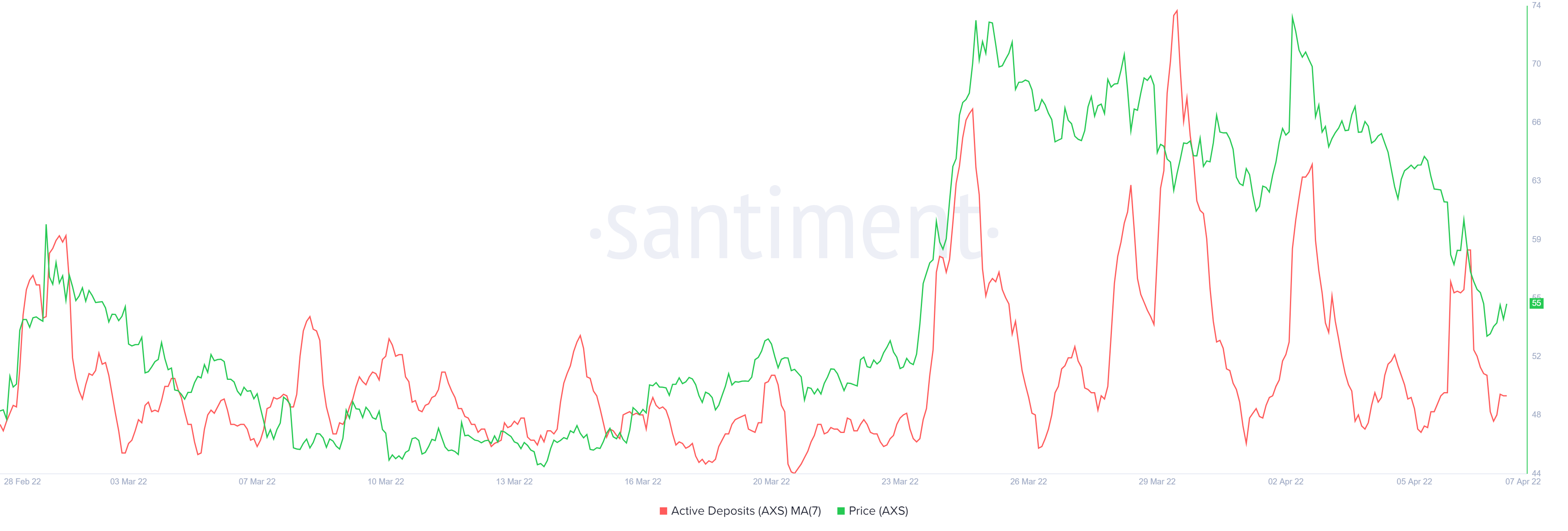

Supporting this bullish intent of Axie Infinity price is the active deposit metric. This on-chain index is used to track the inflow of AXS tokens into centralized exchanges. A spike or downtick in this indicator can allow investors to identify local tops or bottoms.

A massive inflow suggests that market participants are likely to sell their holdings to realize gains. A string of such investors could easily cause a pullback. However, for Axie Infinity, the number of active deposits hit 9.86 after spiking to 23 on 6 April.

This downtick indicates that investors looking to book profits have diminished and that the potential for a sell-off is relatively less. Hence, from a logical standpoint, a bullish outlook is more likely for AXS.

While things are looking up for Axie Infinity price, a twelve-hour candlestick close below the range low at $44.34 will invalidate the bullish thesis for AXS. In such a case, investors should be prepared for a further crash to stable support levels,