Here’s how Bitcoin reacted to the latest Fed rate hike

- The FOMC has increased its rates to the highest level since 2001.

- BTC price slightly increased as its social dominance spiked to the FOMC report.

Amidst a whirlwind of speculations, the long-awaited FOMC report has finally been released. Leading up to its release, this report has been the talk of the town in the crypto space, with everyone eagerly awaiting its impact on Bitcoin’s social dominance. But the question remains: how did the latest FOMC report affect BTC?

Read Bitcoin (BTC) Price Prediction 2023-24

FOMC report shows hike resumption

In an eagerly awaited decision, the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve wrapped up its two-day policy meeting on 26 July. After a brief pause, the committee resumed rate hikes. It pushed the benchmark fed funds rate by 25 basis points, setting the targeted range at 5.25%–5.50%. This marked the most significant rate increase since 2001, sparking a flurry of social reactions, according to Santiment data.

Interestingly, this surge in social interactions hinted at an initial positive response from the crypto market, with Bitcoin also reaping some benefits from the situation. As the dust settled, the rate hike’s impact on the cryptocurrency landscape became evident, leaving enthusiasts and investors eager to see how this unfolding event would shape the future of digital assets.

Bitcoin’s social dominance rises

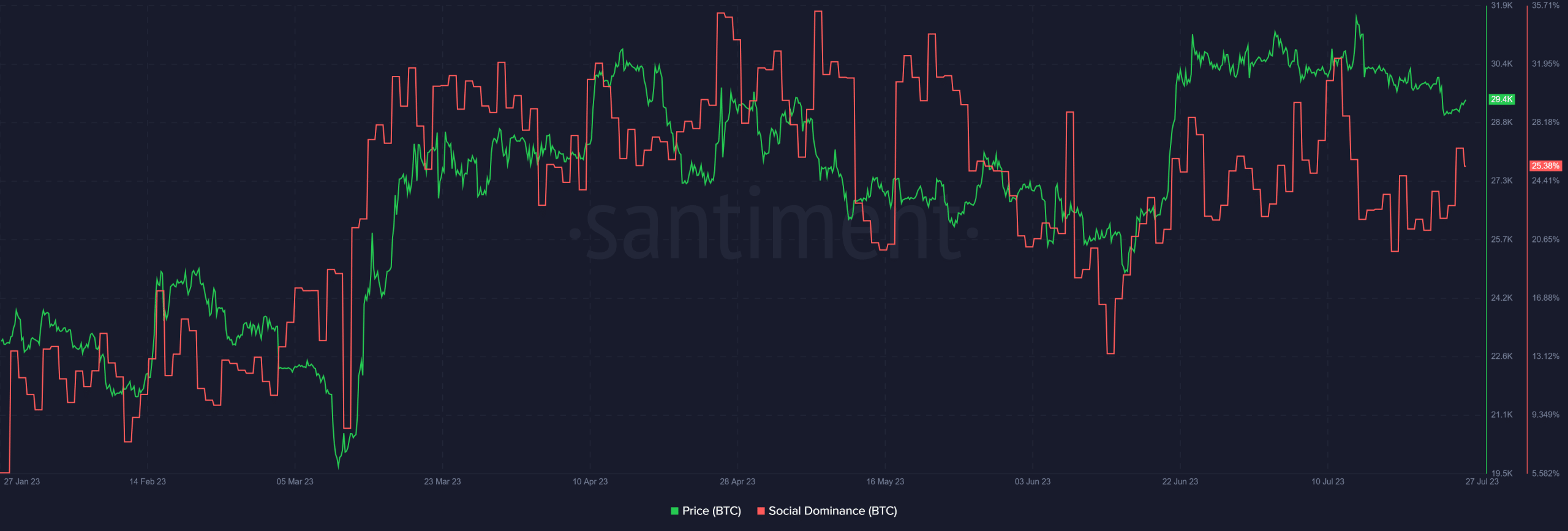

In the wake of the FOMC’s rate hike decision on 26 July, Bitcoin assumed a more prominent position in the crypto discourse, evident from the social dominance metric. Before the FOMC announcement, BTC’s social dominance had experienced a dip of approximately 22%.

However, the scenario quickly changed after the announcement, with social dominance skyrocketing to over 26%. Though currently at around 25%, it remains higher than its pre-FOMC level.

This notable increase in social dominance is often associated with a sense of fear among market participants, which interestingly tends to heighten the likelihood of a price surge.

As we observe the dynamics of this situation, there’s a palpable sense of anticipation in the crypto community, with many keeping a close eye on Bitcoin’s price movements to see how this fear-driven sentiment might shape its trajectory in the coming days.

Is your portfolio green? Check out the Bitcoin Profit Calculator

BTC reacts positively to the FOMC update

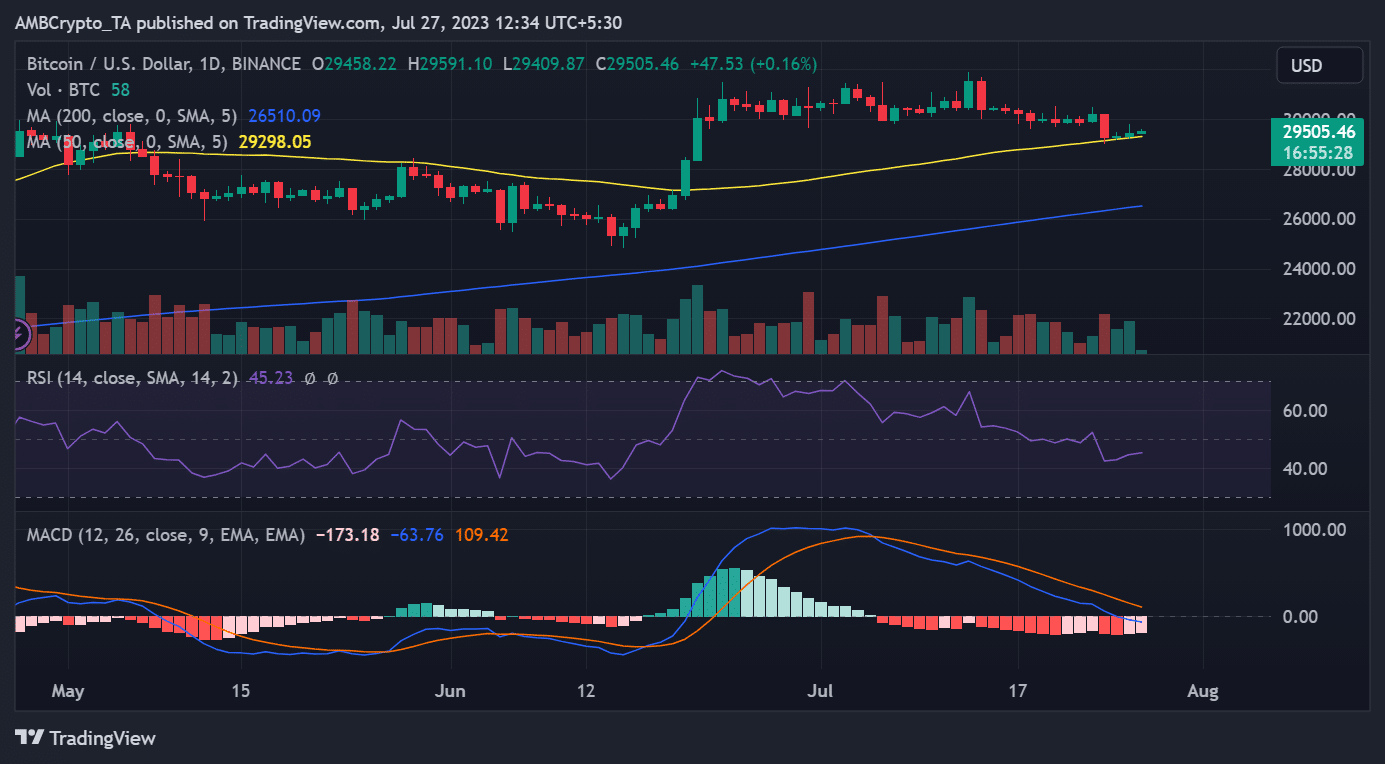

On 26 July, the daily timeframe chart of Bitcoin displayed a glimmer of hope as it witnessed a slight increase in value, managing to close with a profit. Notably, during that trading session, it came tantalizingly close to reclaiming the $30,000 price range, a level it had fallen off previously. As of this writing, it was trading at approximately $29,500, with a minor uptick in its value.

Source: TradingView

Despite this recent positive movement, the overall Relative Strength Index (RSI) indicator remained bearish. However, the consecutive rises in its value have injected a bit of optimism into the picture, giving it a hint of an uptrend.