Polygon’s zkEVM vs zkSync – The ‘how’ of it all

- zkEVM’s number of transactions reached a new all-time high on 25 May.

- zkSync was still ahead of zkEVM in terms of active addresses and transactions.

Polygon [MATIC] published a new blog highlighting its much-talked-about zkEVM’s performance in the month of May.

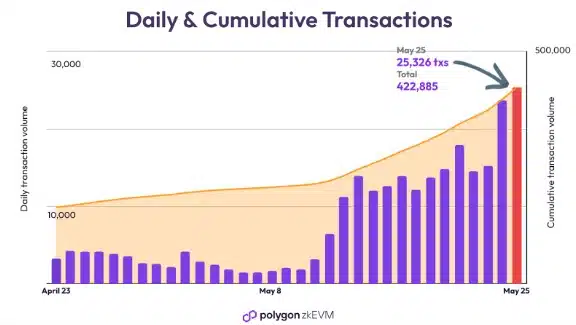

As per Polygon’s latest tweet posted on 31 May, single-day transaction volume on Polygon zkEVM reached a new all-time high. The ATH was noted on 25 May 2023 as the number of transactions exceeded 25,000.

In May, single-day transaction volume on Polygon #zkEVM reached all-time highs ⬆️

?? Steady TVL growth

?? Lower feesMay metrics for Polygon zkEVM show that activity followed liquidity. pic.twitter.com/s0XIm4EZZZ

— Polygon (Labs) (@0xPolygonLabs) May 30, 2023

A month of Polygon zkEVM setting new records

The month of May turned out to be generous for zkEVM, as the roll-up performance looked promising. One of the achievements was that over the last two weeks, gas optimizations drastically reduced the cost of transacting on the network.

For reference, unlike Ethereum, rollups become cheaper as activity increases. This was due to the amortization of the cost of producing proofs across all transactions in a batch.

Over the past few weeks, there were more transactions due to a decrease in the gas fee. An increase in the number of transactions directly means that more users share the cost of proof generation.

Not only that, zkEVM’s adoption also witnessed a surge, as evident from its number of unique wallets. As per the blog, unique active wallets increased by 54% from 25 April to 25 May, with the biggest rise occurring when the new assets were linked on 15 May.

Rollups’ TVL reaches new heights

DeFi-related assets surpassed the $10 million milestone, bringing the overall value of the network’s assets to almost $18 million. This resulted in a considerable surge in zkEVM’s TVL.

It was also interesting to note that not only zkEVM, but zkSync, and Starnet also hit records in TVL this month.

ZK-Rollups are rapidly attracting liquidity and attention.

zkSync Era, Polygon zkEVM, and Starknet all hit an all-time high in TVL today.

— Patrick | Dynamo DeFi (@Dynamo_Patrick) May 29, 2023

Polygon zkEVM vs zkSync Era

Though last month’s figures looked encouraging for zkEVM, was it enough to outperform its competitor, zkSync Era?

A look at Artemis’ data provided the much-needed answer. zkSync was ahead of zkEVM in terms of almost every metric onboard.

For instance, though zkEVM’s daily active addresses and transactions spiked last month, they were still lower compared to zkSync. The same remained true for TVL, as zkSync’s chart was higher.

A look at MATIC’s performance

While zkEVM’s performance was commendable, the same can’t be said for MATIC. According to CoinMarketCap, MATIC’s price declined by more than 1% in the last 24 hours.

At press time, it was trading at $0.893 with a market capitalization of over $8.2 billion.

Is your portfolio green? Check the Polygon Profit Calculator

As per CryptoQuant, a reason behind the price decline could be MATIC’s increasing exchange reserve. An uptick in the metric suggests that a token is under selling pressure.

Bullish sentiment around MATIC also registered a decline of 15% in the last 24 hours, which was worrying.