Here’s how SOL reacted to the Visa-Solana partnership

- Solana will now be used to settle USDC stablecoin payment for Visa.

- SOL’s weighted funding rate turned positive after the Visa announcement.

Solana [SOL] received a significant boost following a major announcement by Visa. Did this development result in any unexpected reactions from SOL, and what is the current status of transactions on the Solana network?

How much are 1,10,100 SOLs worth today

Solana tapped for Visa settlement

On 5 September, Solana announced that Visa extended its stablecoin settlement pilot program to include Solana. Visa began experimenting with blockchain technology and utilizing USDC for payment settlements using Ethereum. This expansion to the chain was a significant victory for the network, which had faced scrutiny due to its association with FTX and past downtime issues.

1/?Breaking: Visa Expands Stablecoin Settlement Pilot to Solana@Visa is scaling their USDC settlement pilot to include the Solana blockchain, enabling enterprise-grade throughput at virtually no cost for Visa issuers and merchant acquirers on Solana. https://t.co/rF5ouZaISM

— Solana (@solana) September 5, 2023

Furthermore, in addition to the Visa integration, it recently introduced Solana Pay to Shopify. Additionally, there were discussions about Solana becoming the blockchain platform for the Maker New chain. How did SOL respond to these developments?

SOL on a daily timeframe

By the conclusion of trading on 5 September, SOL had recorded a modest increase of approximately 3.7%, closing at approximately $20.2. This indicated a generally positive reaction to the news, albeit less significant than expected. However, it’s worth noting that some of these gains have been eroded since then.

As of this writing, on a daily timeframe chart, SOL was trading at approximately $19.7, reflecting a decline in value of over 2%.

Additionally, its Relative Strength Index (RSI) line displayed bearish signals. The RSI line was positioned at 40, signifying a bearish trend in the market.

Impact on other Solana metrics?

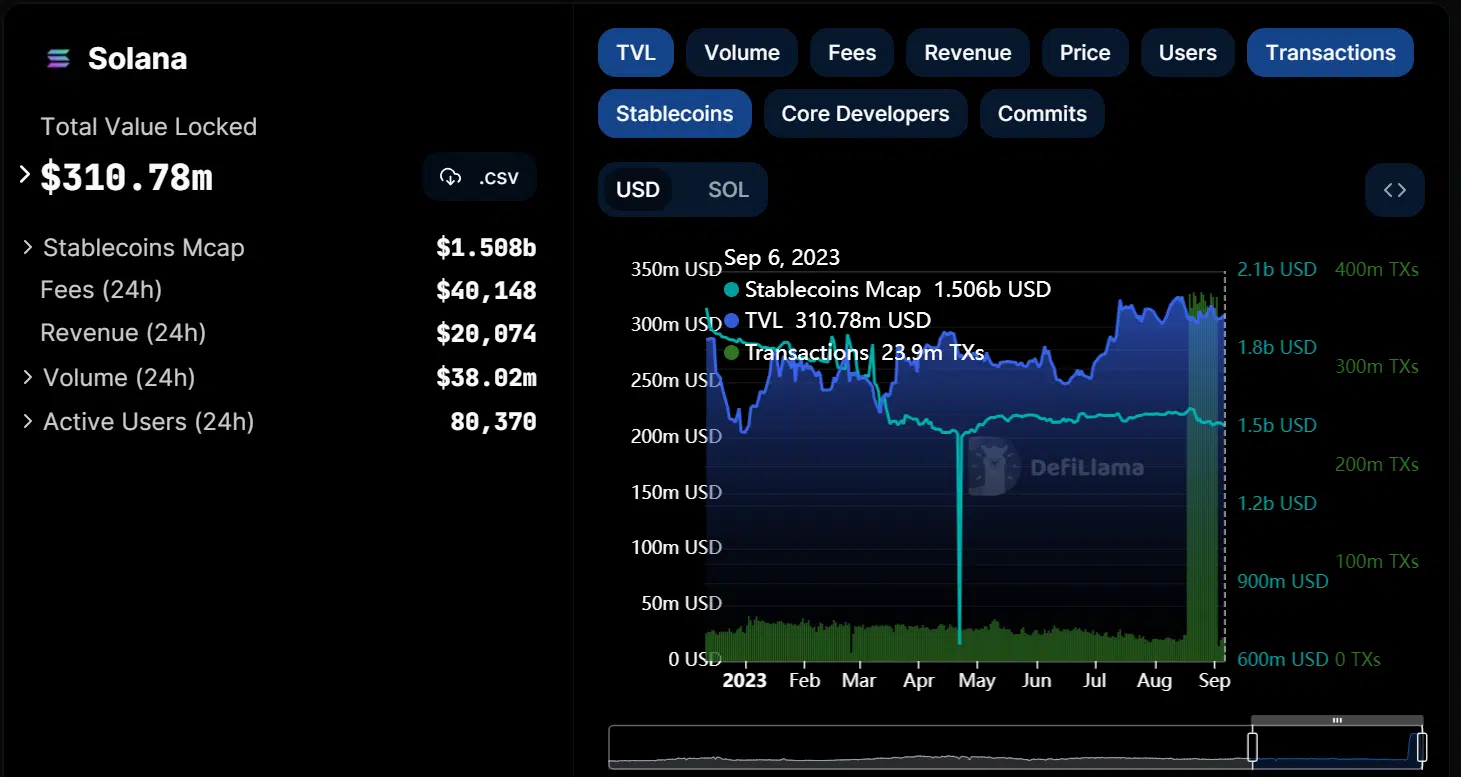

According to data from DefiLlama, there appeared to be no significant reaction in Solana’s Total Value Locked (TVL) and stablecoins market capitalization.

The TVL remained at approximately $310 million, and there were no apparent signs of a major uptrend on the chart. Similarly, there was no notable uptrend in the stablecoins market capitalization, which was approximately $1.5 billion as of this writing.

However, an increased activity could be observed in transactions. The chart indicated a spike in transactions on the network towards the end of August, continuing until 2 September.

Transaction volumes surged from around the $20 million range to over $300 million. Nevertheless, as of this writing, transaction volumes have returned to similar levels as before the spike.

Realistic or not, here’s SOL’s market cap in BTC terms

Bet on a Solana price rise

Despite the price retracement observed in the previous trading session, traders displayed confidence in Solana’s potential for an upward movement. As per the funding rate on Coinglass, Solana had a positive funding rate.

This marked a notable shift from the negative funding rate it registered on 5 September. The positive funding rate indicated that traders were optimistic about a price increase, likely influenced by the recent developments and announcements in the Solana ecosystem.