Here’s the case for THETA going on a 37% price rally

- At press time, 69.2% of top traders on Binance held long positions in THETA

- THETA’s Relative Strength Index (RSI) stood at 43, indicating a potential for upside momentum

THETA, the native token of Theta Network, is gaining attention from crypto traders following the formation of a bullish price action pattern on its daily timeframe. At the time of writing, the larger cryptocurrency market appeared to be struggling. This included major assets like Bitcoin, Ethereum, and XRP.

In the middle of such market uncertainty, the potential factors supporting THETA’s bullish outlook include traders’ rising interest and whales’ sustained accumulation. However, all these developments are occurring after the price reached a crucial level near the breakout point.

Theta Network (THETA) technical analysis and key levels

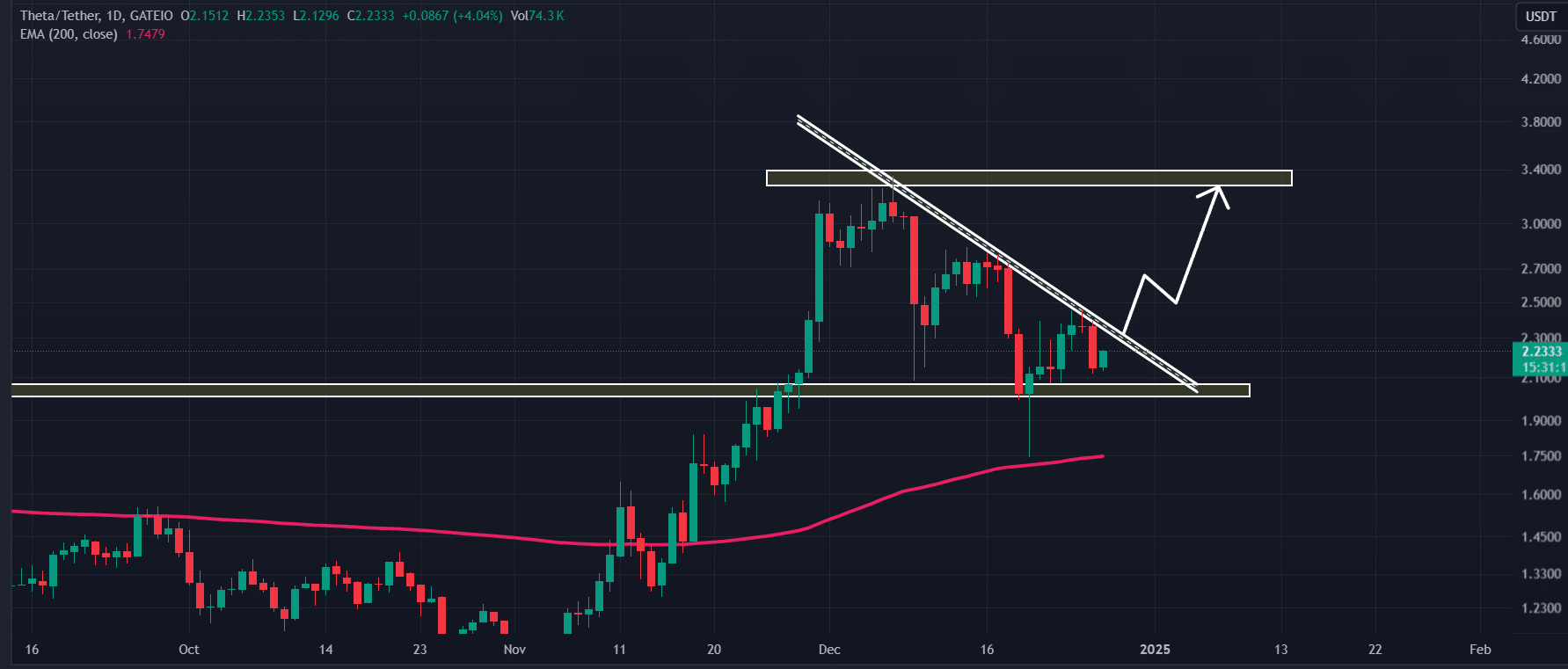

According to AMBCrypto’s technical analysis, THETA formed a descending triangle price action pattern on the daily timeframe, with the altcoin on the verge of a breakout.

However, amid the recent price correction, it successfully retested its crucial support from the 200 Exponential Moving Average (EMA) on the same timeframe.

Based on the altcoin’s recent price action and historical momentum, if the AI token breaks out from this pattern and closes a daily candle above the $2.41-mark, there is a strong possibility it could soar by 37% to hit the $3.33 mark in the future.

On the positive side, THETA’s Relative Strength Index (RSI) had a reading of 43, indicating potential for upside momentum.

Bullish on-chain metrics

The altcoin’s bullish price action has attracted traders as well as investors, as reported by the on-chain analytics firm Coinglass. Data from THETA’s spot Inflow/Outflow revealed that exchanges have seen a significant $2.02 million in THETA outflows over the last 24 hours.

The outflow is an on-chain metric that shows the number of assets moved from exchanges to long-term holders’ wallets – A sign of potential buying pressure and upside momentum.

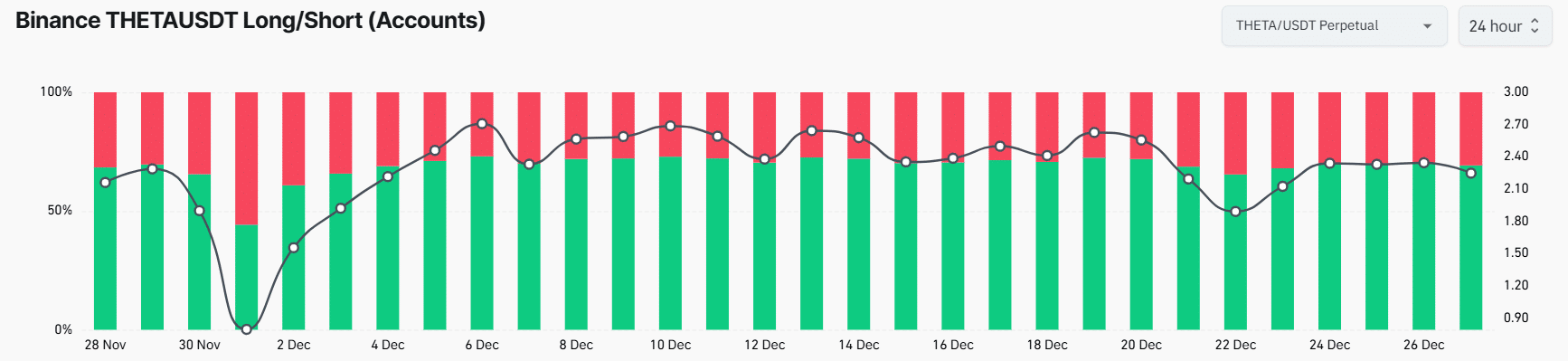

Besides the participation of long-term holders, traders on Binance have shown strong interest and confidence in the token. The Binance THETAUSDT long/short ratio stood at 2.25, at press time, indicating strong bullish sentiment among traders.

Right now, 69.2% of top traders on Binance hold long positions, while 30.8% hold short positions.

Current price momentum

At press time, THETA was trading near $2.21, having recorded a price decline of 1% in the last 24 hours. However, during the same period, its trading volume dropped by 5.75%, indicating lower participation from traders compared to the previous day.