Dogecoin

Here’s what Dogecoin traders can expect if bearish pressure continues

Dogecoin remained under bearish pressure, with a potential retest of the immediate support level if the momentum continues.

- After witnessing bearish pressure, Dogecoin recently saw a patterned breakout on its daily chart.

- Derivates data showed mixed sentiment with a slight edge for bulls.

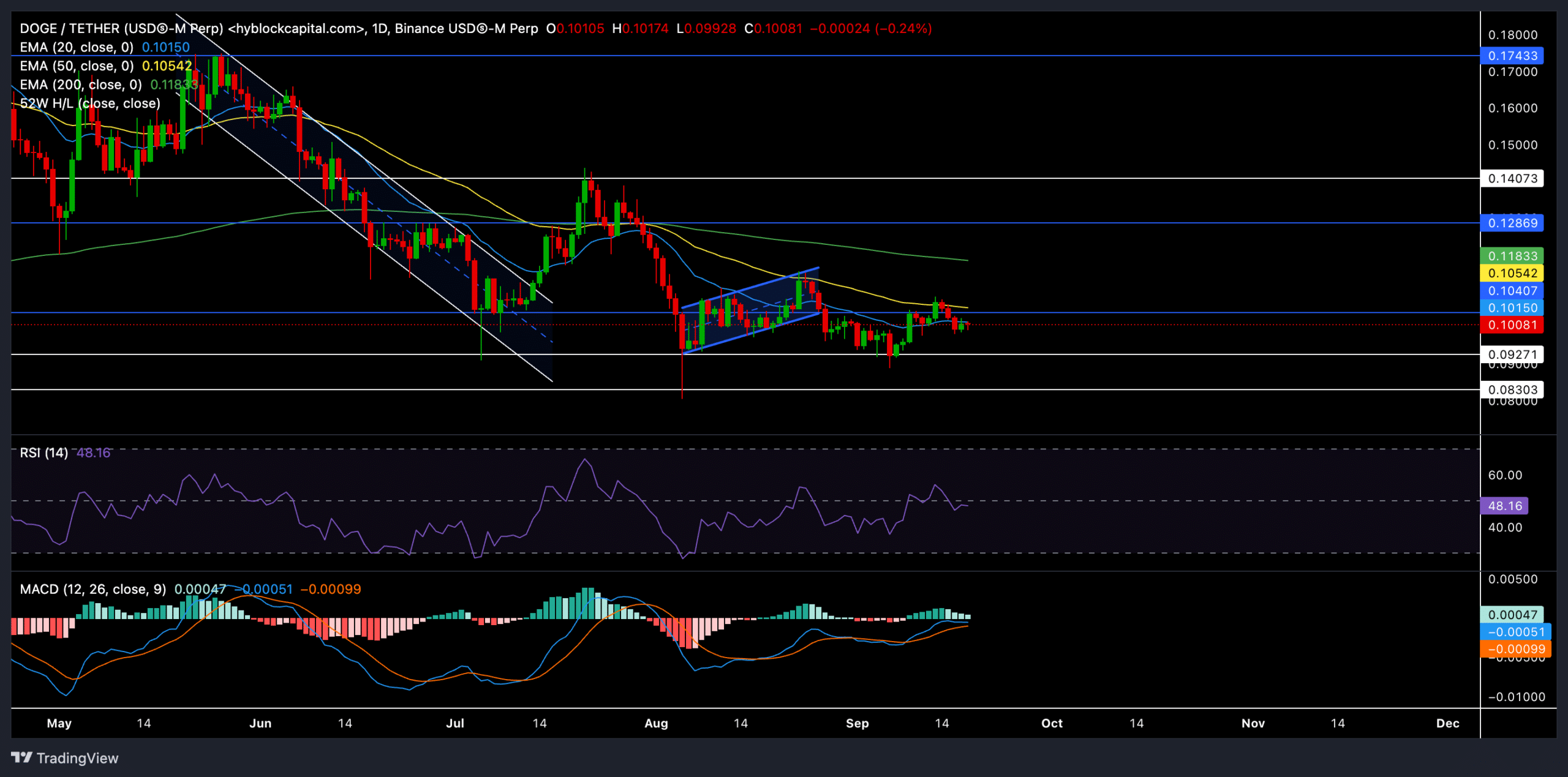

Dogecoin’s [DOGE] recent price was dominated by bearish pressure following the formation of a bearish flag pattern on the daily chart. The memecoin struggled to maintain momentum, testing the $0.092 support level while battling against the resistance posed by the 50-day EMA.

At press time, DOGE was trading at around $0.1008, facing immediate hurdles near the 20-day ($0.1015) and 50-day EMA ($0.1054). These EMAs continued to exert resistance, making it difficult for bulls to take control of the short-term trend.

Dogecoin continued to face selling pressure—will it retest crucial support levels?

If DOGE bears continue to dominate the market, traders should watch for a potential retest of the $0.092 support level. Any close below this key support could trigger a deeper decline toward the $0.083 level in the coming sessions.

This would confirm an extended bearish phase for Dogecoin, especially if the overall market sentiment remains weak.

On the flip side, a strong defense of the $0.092 support could allow bulls to push DOGE back above the $0.105 resistance, possibly targeting the $0.118 level if the momentum persists. However, the near-term outlook remains bearish unless DOGE can reclaim these critical moving averages.

The Relative Strength Index (RSI) hovered just below the neutral 50 mark. This indicated that bearish sentiment still lingered but is not yet in oversold territory, meaning there is room for further downside before a possible reversal.

It’s worth noting that the MACD lines were on the verge of a bearish crossover. Should the MACD line dip below the signal line, it would reaffirm a strong bearish edge.

Derivates data revealed THIS

DOGE’s open interest saw a slight uptick of 1.09% over the past day (with $458.70M in open contracts). This suggested that traders are keeping positions open despite the bearish price action. However, the long/short ratio was 0.967 at press time and showed a slight tilt toward short positions.

On the other hand the long/short ratios on Binance for DOGE/USDT were much more skewed in favor of long positions. It stood at over 2.5 for top traders.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Despite the increase in open interest, the sharp drop in options volume (-69.47%) to $19.76K showed decreasing interest in options trading. This may suggest that traders are uncertain about short-term volatility or are waiting for a clearer trend before making larger moves.

Buyers should also keep an eye on Bitcoin’s movements before making a decision.