Here’s what Uniswap [UNI] bulls can hope for after THIS breakout

- UNI’s recent bounce from the $5.5-$5.7 support range suggested that the bulls are not ready to give up just yet.

- Derivatives data on Binance reaffirmed a slight bullish edge.

Uniswap [UNI] recently broke out of its bearish pattern and tested key support levels between $5.5 and $5.7. This region is critical for buyers as the altcoin managed to bounce back from this level, indicating renewed interest from the bulls.

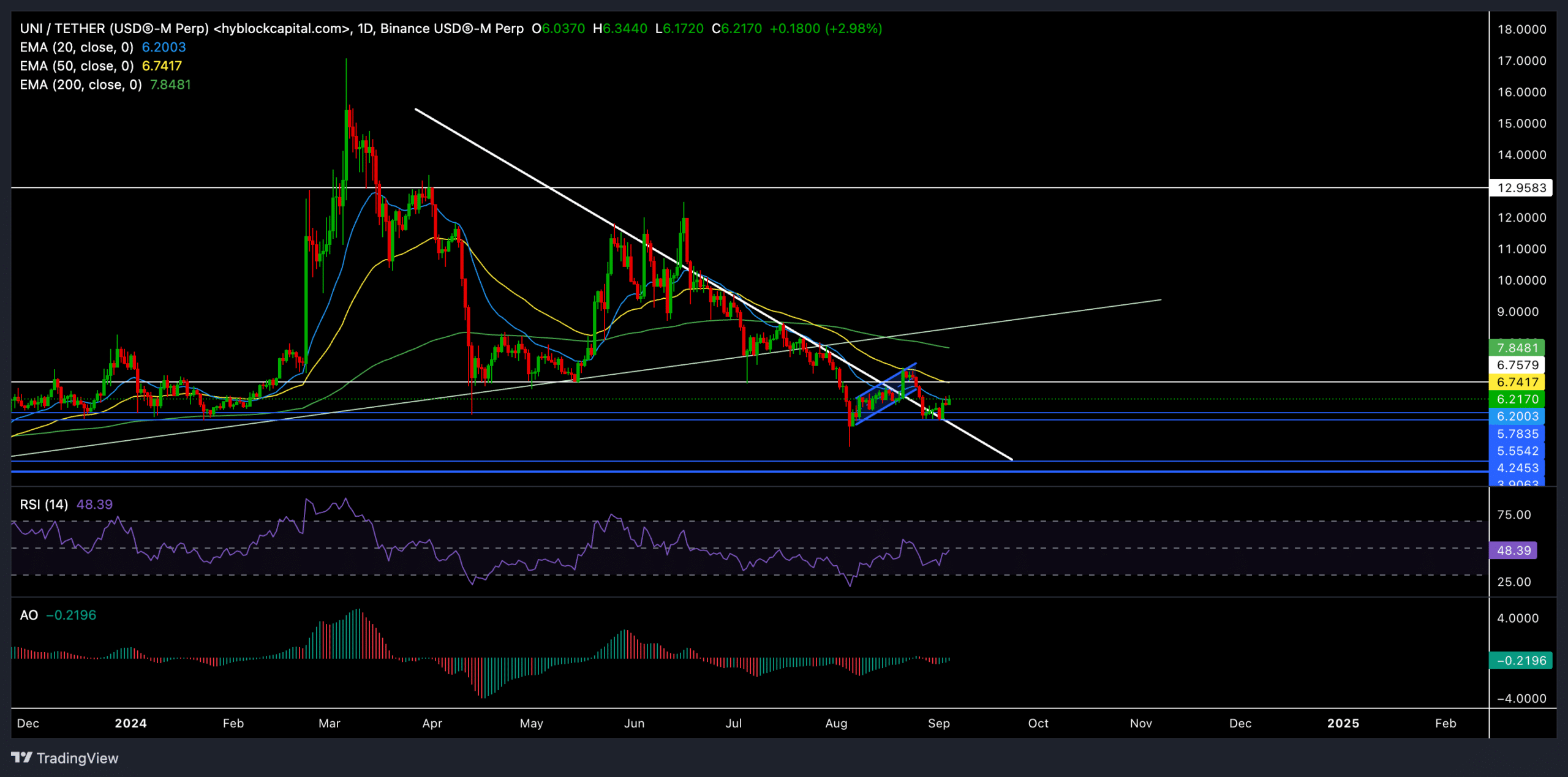

UNI traded at $6.2 at the time of writing, down by nearly 1.2% in the last 24 hours. The price action hovered just around the 20-day Exponential Moving Average (EMA) at $6.20, which could be a pivot point for the bulls in the near term.

Uniswap could see a sustained recovery, especially if UNI can close decisively above this level.

Uniswap struggles to cross above its EMAs

UNI continued its long-term downtrend after touching its 2-year high in March this year. Since its July bearish rally, the 200-day EMA has remained a critical barrier. A well-needed jump above this level could confirm a long-term bullish reversal.

However, the recent recovery has reignited some hopes for buyers. If the price breaks above the 20-day EMA, it could pave the way for a retest of the $6.75 level near the 50 EMA.

Should the bulls fail to maintain this momentum, UNI could retreat to its previous support around the $5.78-$5.55 range.

The Relative Strength Index (RSI) was at around 48.6 at the time of writing, indicating a somewhat neutral market sentiment. A sustained recovery above the 50-mark on the RSI could suggest that the bulls are gaining control.

However, the current reading implied that the market sentiment was still uncertain.

It’s worth noting that the Awesome Oscillator showed an ease in selling pressure with its recent higher peaks on the daily chart. Any jump above zero can confirm the indicator’s ‘bullish twin peaks.’

Derivates data reveals THIS

The overall long/short ratio in the derivatives market stood at 0.9654, showing a slight bearish edge among traders. On Binance, however, the long/short ratio for UNI/USDT is relatively high at 1.8257—signaling a stronger bullish sentiment from top traders.

Is your portfolio green? Check out the UNI Profit Calculator

Despite this, the open interest has decreased by 3.78%. This reflected caution among traders as some may be closing positions due to recent volatility.

Traders should monitor the RSI for signs of bullish momentum while keeping an eye on overall market conditions, particularly Bitcoin’s price movements, which could influence UNI’s trajectory.