Is Bitcoin likely to see a 12% drop soon?

Bitcoin price seems ready for a drop leading to increased volatility and a revisit of $30,000 or a drop of 10% to 12% cannot be ruled out. Not just one but many indicators point to the bearish drop for bitcoin in the near term.

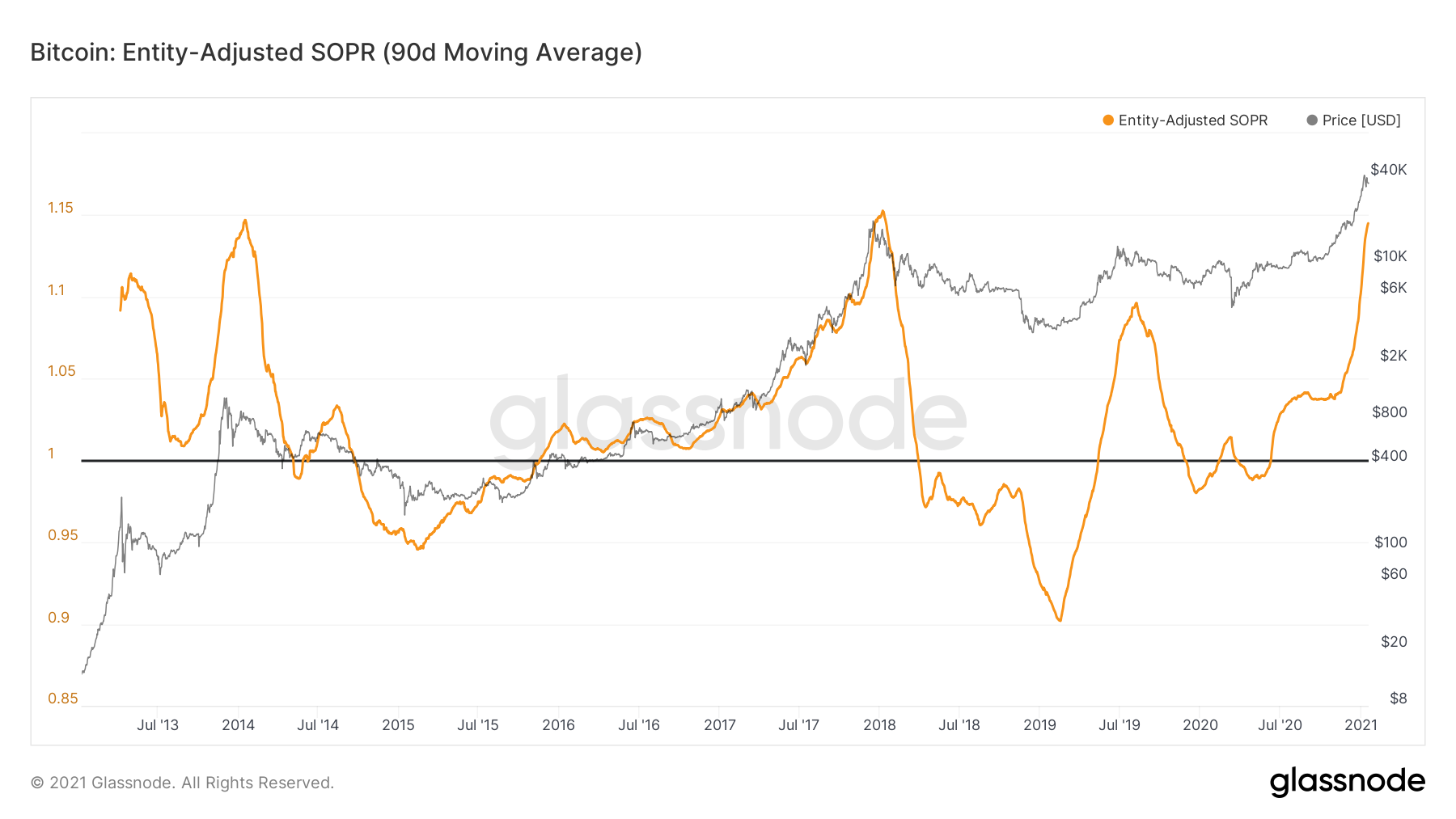

Bitcoin on-chain indicator

The SOPR indicator is a classic on-chain indicator that highlights the sentiment of hodlers ie. if the holders want to sell or hold. This indicator achieves this by taking into account the purchased price of bitcoin and compares it to the current bitcoin price.

Adjusted SOPR is a derivative of SOPR and does exactly the same as SOPR but ignores transactions/addresses/outputs with a lifespan of less than 1 hour. Similarly, Entity-based SOPR ignores the addresses/outputs originating from a single entity.

According to Glassnode,

“Entity-adjusted SOPR is an improved variant of SOPR discards transactions between addresses of the same entity (“in-house” transactions). Entity-adjusted SOPR therefore accounts for real economic activity only, and provides an improved market signal compared to its raw UTXO-based counterpart. For detailed information read this article article.”

A 90-day Entity-adjusted SOPR has now reached a 1.14 level, last seen during the peaks of previous bull runs of 2013 and 2015. This shows that bitcoin might have hit a peak at $42,000 [a new all-time high]. Hence, this is the first indicator that points towards a short term correction in the near future.

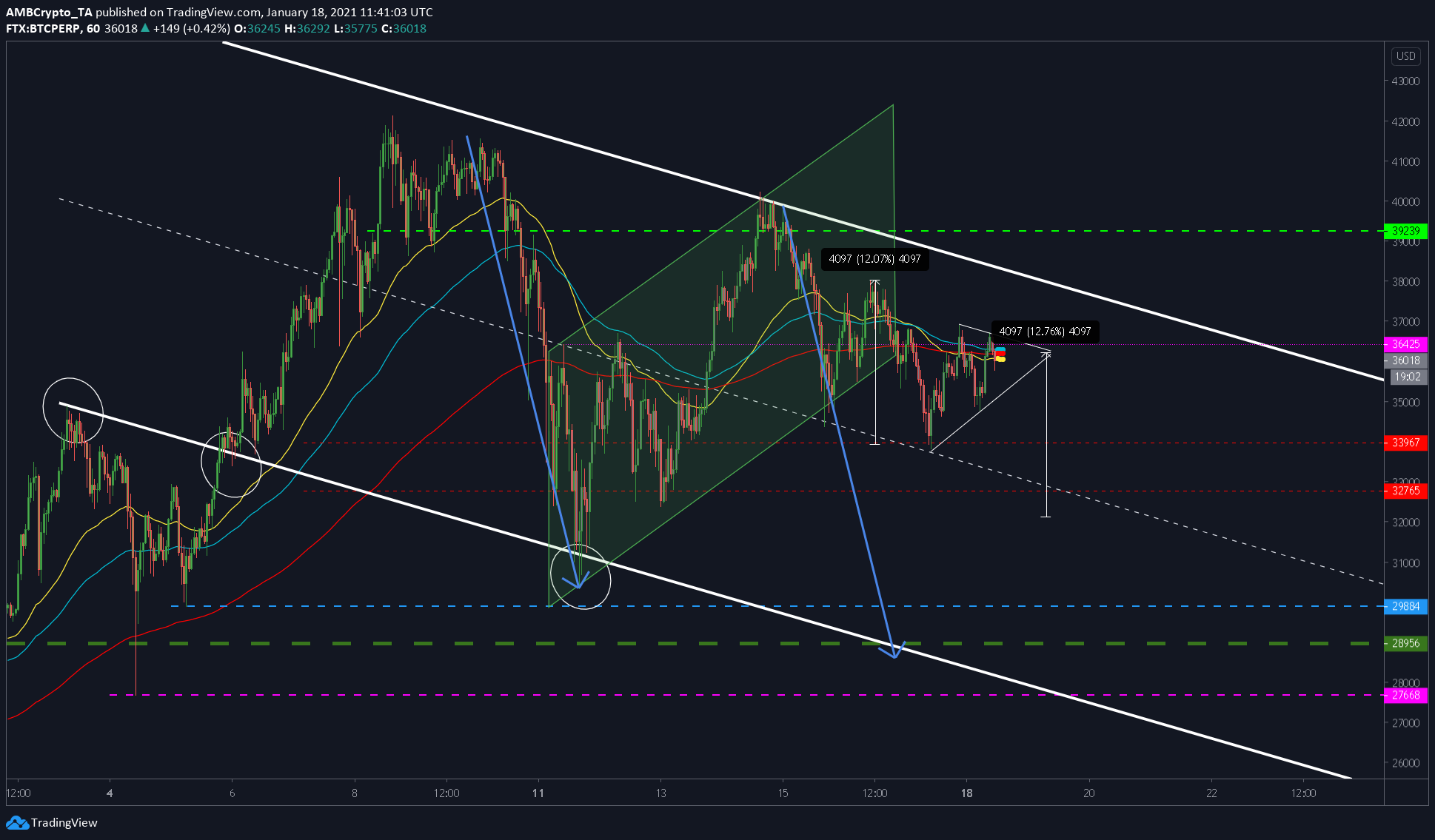

Bitcoin Technicals

There are multiple bitcoin technical indicators and patterns corroborating the on-chain metric. In fact, there are two bearish patterns – a bearish flag and a bearish pennant suggesting a 10% to 12% drop soon.

Source: BTCUSD TradingView

The bearish flag [green channel] indicates a drop of 20% on its way, however, the bearish pennant suggests a more considerate 10-12% drop. Either way, both suggest a drop is inevitable. Hence, the first target for this drop could be $34,000, a breach of this level could push bitcoin down to $32,500 perhaps even towards the yearly open at $28,956.