Here’s why Aptos might dip before surging to $10.44

- APT’s current pattern could set the stage for a significant price increase.

- Should this classic bullish pattern persist, APT is projected to reach at least $10.44.

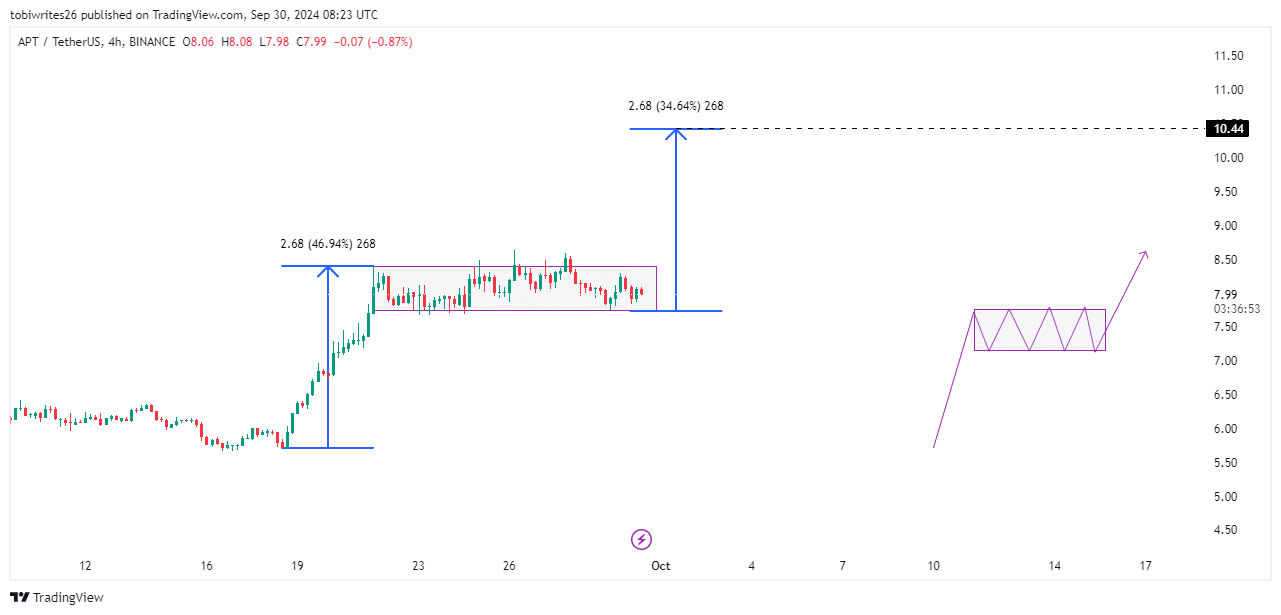

Aptos [APT] prices surged by 17.84% before the prices went into a consolidation at press time. In the last seven days, APT saw a modest increase of 0.33% and a decline of 0.53% in the last 24 hours.

Despite these mixed signals, AMBCrypto reports that the current pattern bears similarities to previous bullish trends that have catalyzed market rallies.

Ongoing accumulation signals a potential rally for APT

APT is currently in a consolidation phase, a common precursor to a rally as historically indicated on the chart. During this phase, traders often accumulate positions, buying more APT in anticipation of an upward move.

Typically, the ensuing rally will match or exceed the duration of the previous rally before consolidation. In this scenario, APT is expected to rise to $10.44, marking a 34.64% gain.

However, a shift in market direction could see APT’s price fall. Such a change would be confirmed if APT drops or spikes below the current consolidation channel.

APT set to decline despite bullish signals

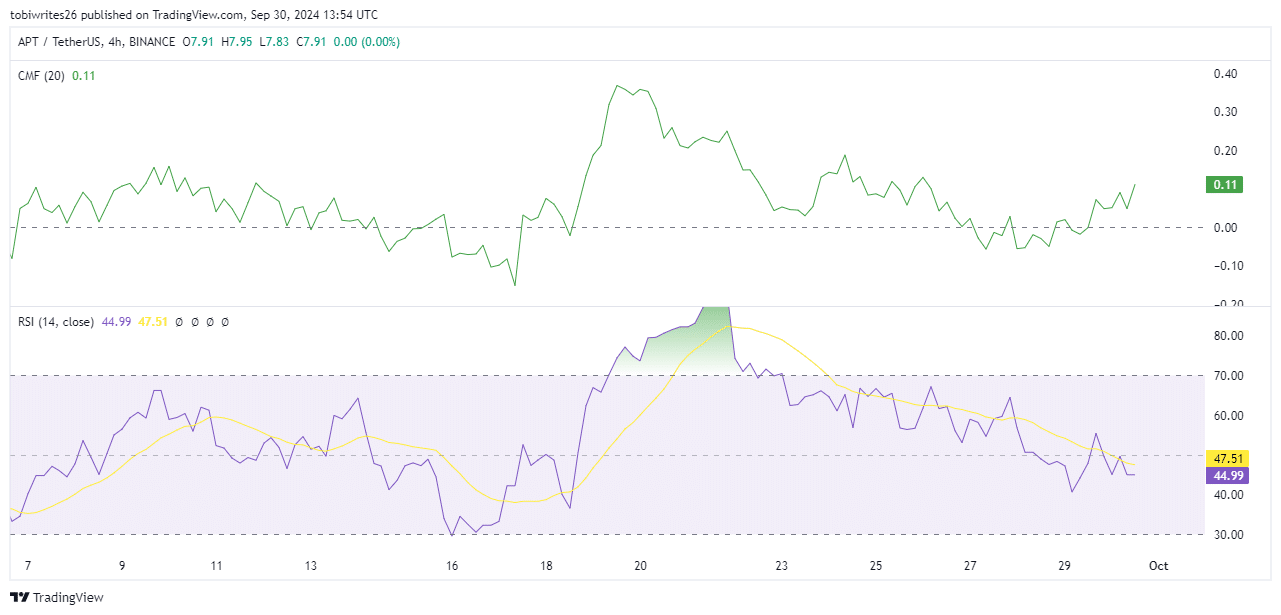

The bullish accumulation phase for APT was confirmed using the Chaikin Money Flow (CMF), which tracks the liquidity inflow and outflow of an asset.

Currently, the CMF shows a positive trend, with a reading of 0.11, indicating a significant inflow of liquidity as traders increasingly buy into APT.

However, further analysis using the Relative Strength Index (RSI) suggests that APT is likely to fall, potentially returning to the lower end of its consolidation channel or experiencing a brief spike below it in a possible stop hunt. It could then stabilize within the channel ahead of the expected rally.

APT’s decline appears imminent

AMBCrypto has identified several developments supporting a potential fall or sharp exit (as a stop hunt) from the consolidation channel for APT.

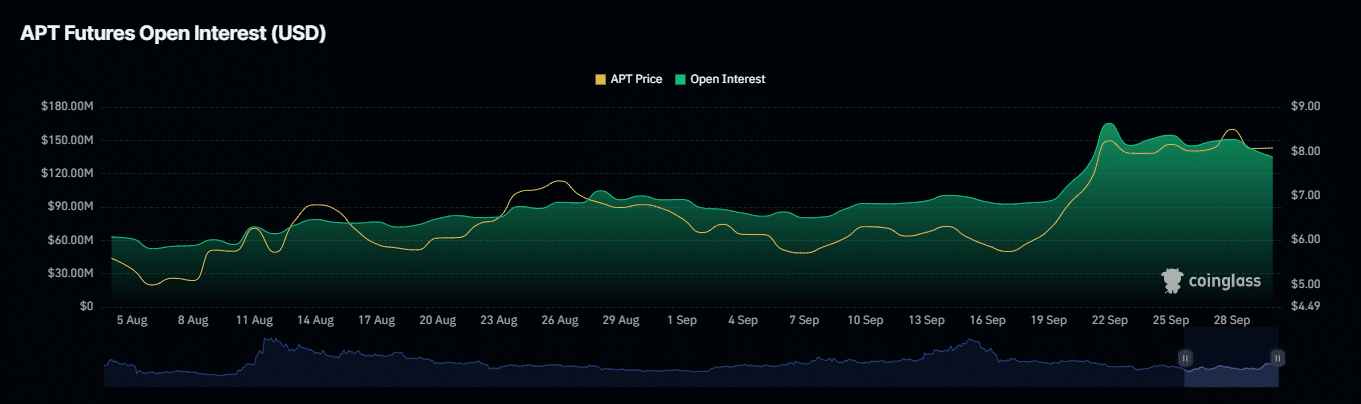

Firstly, the Open Interest has predominantly been negative, decreasing by 2.67% to a press time value of $134.83 million. This decrease suggests that fewer traders are betting on an upward move for APT.

Read Aptos’ [APT] Price Prediction 2024-25

Moreover, in the last 24 hours, numerous long traders have been forced out of the market, with $333.30 thousand worth of short positions being cleared.

However, should this metric gradually become bullish it would have a positive impact on APT’s price action.