Here’s why Bitcoin could be heading towards $45,000

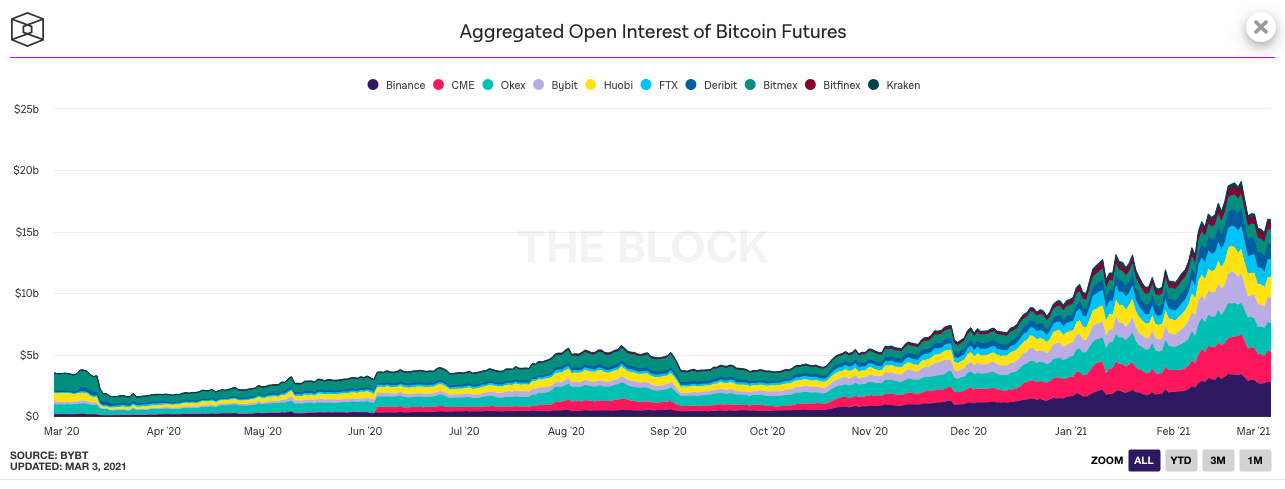

With Bitcoin‘s price breaching the $50,000-mark over the last 24-36 hours, many believe the world’s largest cryptocurrency has fully recovered from the depreciation that saw BTC drop from over $56,000 to under $47,000. However, it’s worth noting that the dip in Bitcoin’s price also coincided with a surge in Bitcoin’s Open Interest, something that has emerged as somewhat of a trend over the last few market cycles.

With the Open Interest in Bitcoin Futures above $15 million, there is a distinct possibility that this is a bearish signal for Bitcoin’s price. In fact, with the cryptocurrency dropping below $50k at the time of writing, this just seemed all the more likely.

Source: The Block

Based on the chart representing Aggregate Open Interest in Bitcoin Futures, the last time Open Interest hit a high, it was reflected in the price drop, including a drop of nearly 10% in a single day. If something similar happens again, then the price may drop below $45,000, based on the cryptocurrency’s press time price action.

Here, a valuation of $45,000 would be an important psychological level for Bitcoin’s price. Coupled with the fact that BTC’s price has historically dropped in March, nearly every year since 2013, it is likely that the two may have a negative impact on the cryptocurrency’s valuation, recovery from which might even take a month.

It’s also worth noting that Plan B’s S2F and its target for Bitcoin’s price do not have a clear prediction for the number of corrections or dips it will see, before hitting $100,000.

On the contrary, according to a recent tweet by Upstream Data Inc’s Steve, Bitcoin reverses the Cantillon Effect and therefore, we can expect central banks to retreat to a gold standard, then obsolescence, governments to shrink, mass elite insolvency/write-downs, the fracturing of megacorps, and renaissance of small businesses and family wealth.

Though this may be more of a long-term impact of Bitcoin, one or more of these factors may have an impact on Bitcoin’s price in the short-term. Change in the policy of central banks, for instance, or mass elite insolvencies, may lead to a hike in Bitcoin’s price after corrections have mellowed down.

Apart from the S2F model’s predictions and lists of such factors that may positively influence Bitcoin’s price, most predictions are bearish in the short-term. In conclusion, Open Interest, among other factors like transaction volume, demand on spot exchanges, and institutional demand, suggests that the price may drop below $45,000 or lower in the short-term.