Here’s why Bitcoin’s 15% spike in Open Interest signals caution

- Bitcoin’s OI made a remarkable 15.8% jump as the weekly CME futures closed at $84K.

- BTC sliced through the 50-day SMA, with the next key hurdle being the 200-day SMA at $87K.

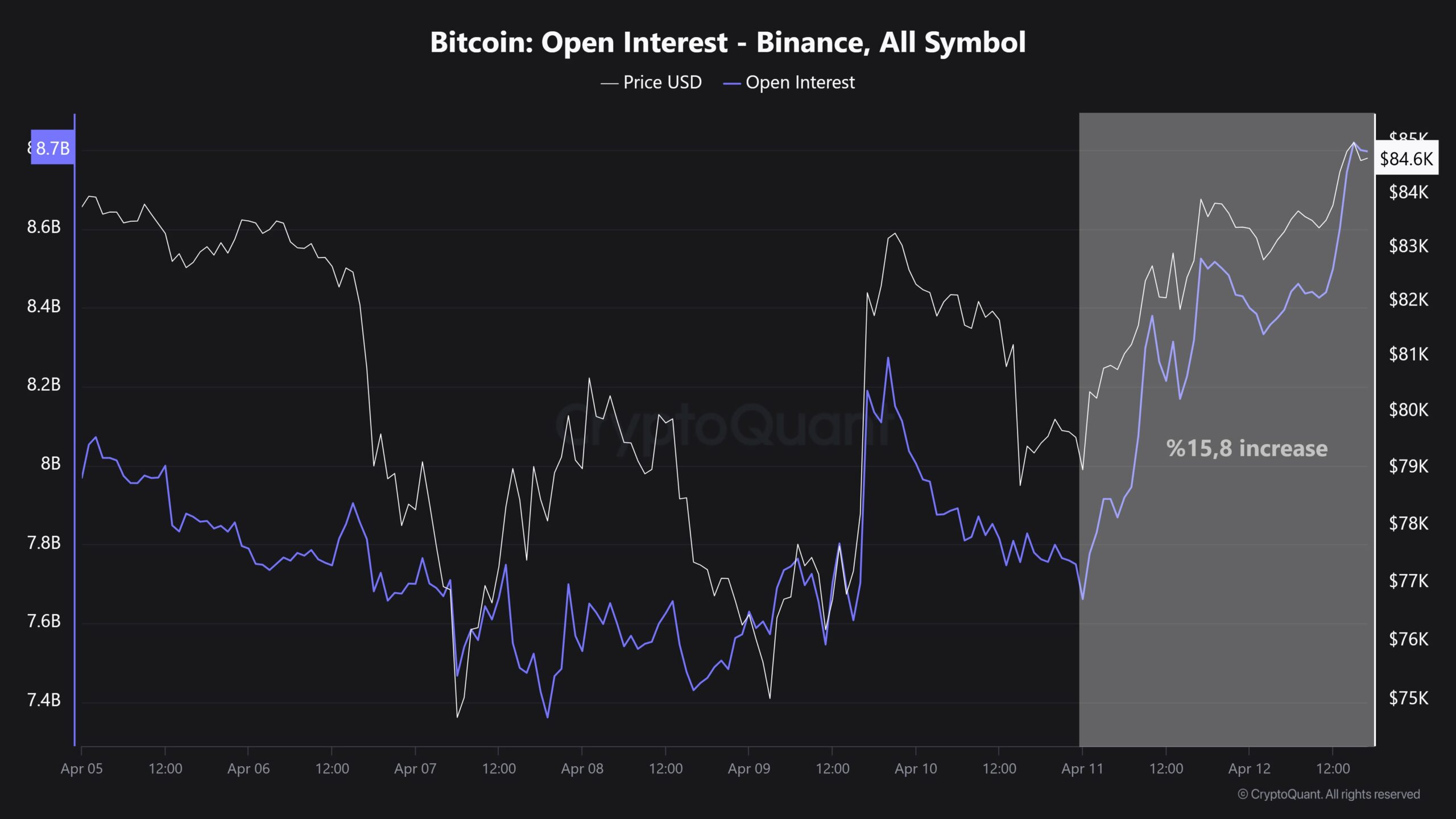

Binance’s Bitcoin [BTC] Open Interest (OI) saw a 15.8% growth in a day, elevating it from $7.6 billion to $8.8 billion, at press time. The market and trader engagement increased significantly because of this rapid $1.2 billion increase.

Binance remained dominant in crypto derivatives trading, as its OI position occupies 31.4% of the $28 billion total OI capital.

Fast-rising OI signaled the risk of market volatility, as these wide-ranging liquidations could impact both extended long and short positions with high leverage.

An increase in OI often indicates growing bullish sentiment; however, it can also trigger opposing market movements or prompt aggressive position unwinding.

A sharp rise in OI may result in brief price fluctuations, primarily driven by shifts in market sentiment or failed attempts to maintain critical resistance levels.

Leverage driven pump and activity

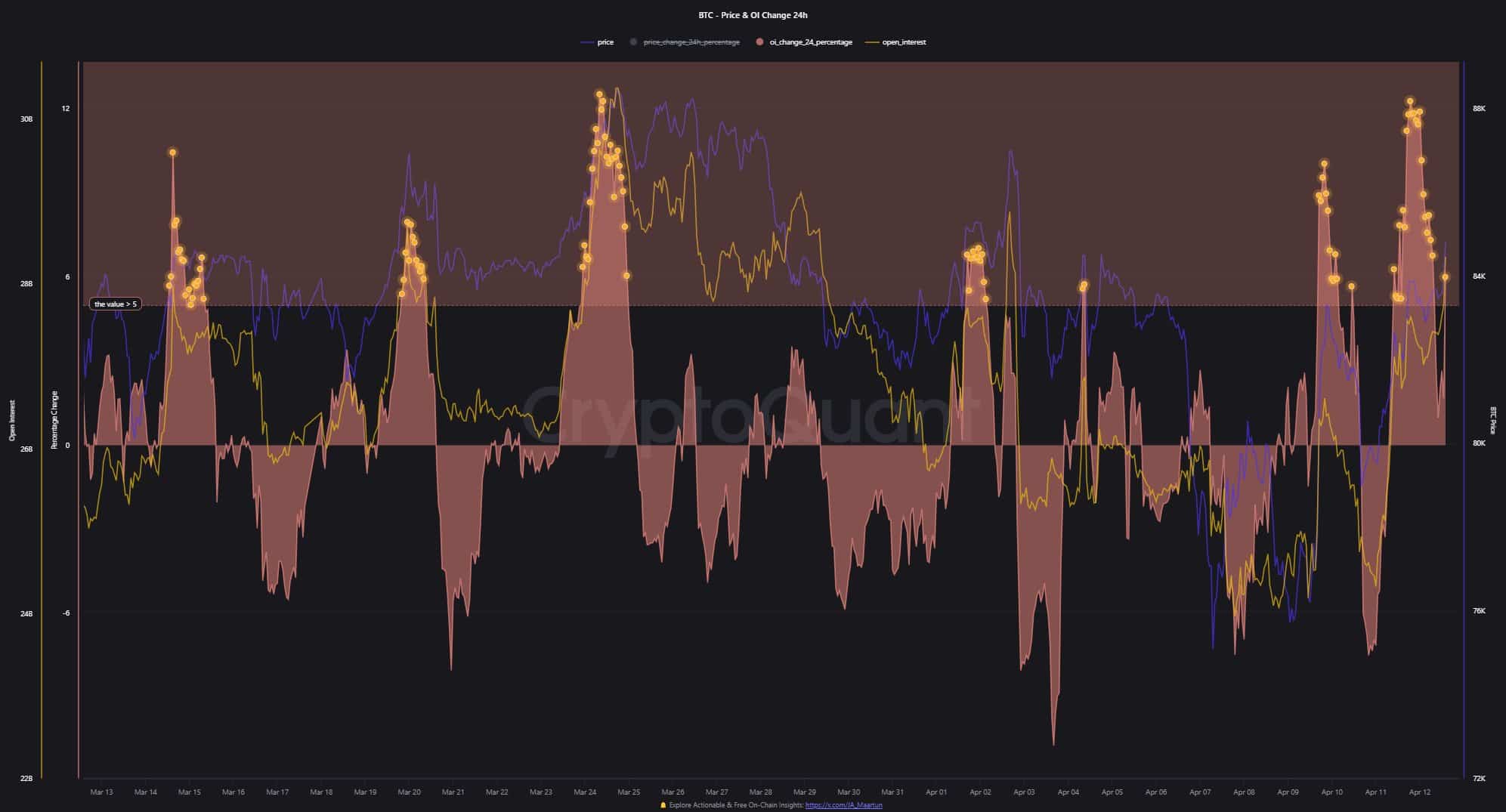

Following this, BTC spot prices closed at the $84K level, as recorded in the weekly CME futures. The pump was due to increases in excessive leverage, although this movement caused risks for short-term market traders.

This strong uptrend in the 24-hour percentage changes in OI showed multiple points exceeding +5, indicating extreme long sentiment.

The recent price surge, driven by high-leverage positions, highlighted risks of rapid forced sales, similar to trends observed in the past. This level of market leverage underscored the importance of caution for traders.

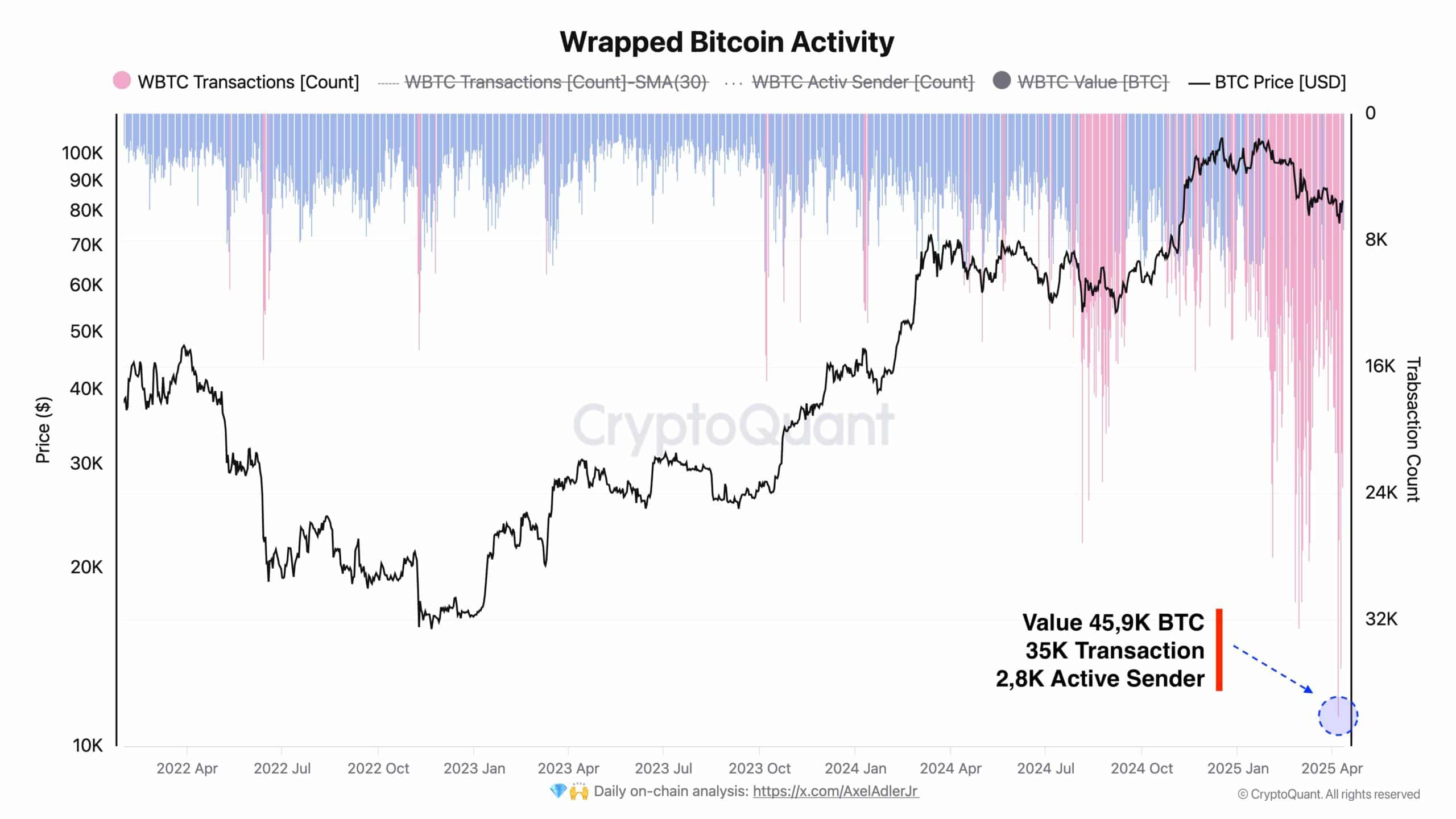

At the same time, Wrapped BTC [WBTC] activity reached an all-time high, with 35,000 transactions executed across 2,800 active wallets, and a total movement of 45.9K BTC.

These developments occurred amidst heightened market volatility caused by geopolitical crises and trade conflicts between nations. Despite these macroeconomic pressures, WBTC users showed resilience, continuing to drive a notable increase in transactions.

Despite the two oppositional evaluations where leveraged positions seemed to cause short-term price fluctuations, WBTC activity signaled enduring functionality in the BTC space.

BTC potential price moves

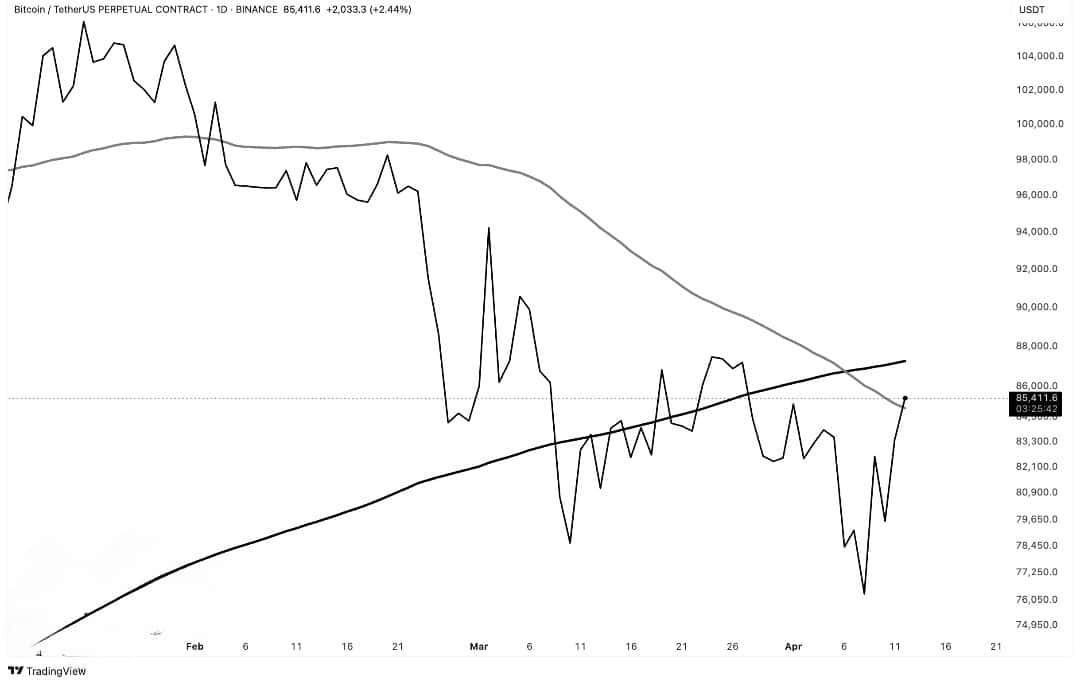

BTC also sliced the 50-day Simple Moving Average (SMA) as it approached the resistance at the 200-day SMA.

This breakout showed an increasing bullish trend and a move above $87K could likely validate ongoing growth toward $94K, while seller intervention is possible near that level.

If the price stays below $87K, it could confirm the warnings connected to recent leverage-based pump actions.

This could mean reaching as low as $79K or $76K if prices drop below $84K, which would suggest further bearish momentum.

The market’s indecision was confirmed by its stationary movement, which stayed between two fundamental moving averages.

Investors needed to observe strong price movements on either side to get BTC’s future direction.

Market sentiment may flip bullish if prices exceed $87,000, but continuous bearish performance below that level will probably sustain a consolidation phase or extend the existing correction period.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/08/Bitcoin-BTC-400x240.webp)