Ethereum

Here’s why it’s Ethereum vs Bitcoin in the macro capital markets now

If you wonder why Ethereum’s latest bounceback has not been as strong as that of Bitcoin, here’s an explanation why.

- Ethereum lags behind Bitcoin in terms of demand from institutional investors

- Ethereum maintains strong lead against Bitcoin in one key area though

Spot Ethereum ETFs may have brought some excitement into the market, but the hype has not been anywhere near what we have seen with Bitcoin. This is an outcome that aligns with a push for Bitcoin from political elites.

While the observation underscores how Bitcoin overshadows Ethereum, could the latter also have a disadvantage in terms of liquidity? In fact, a recent QCP analysis suggested that Ethereum may be sidelined from the macro capital markets while the market continues to favor Bitcoin.

Since both Bitcoin and Ethereum are available as Spot ETF assets, a performance comparison may provide a clearer picture of performance differences.

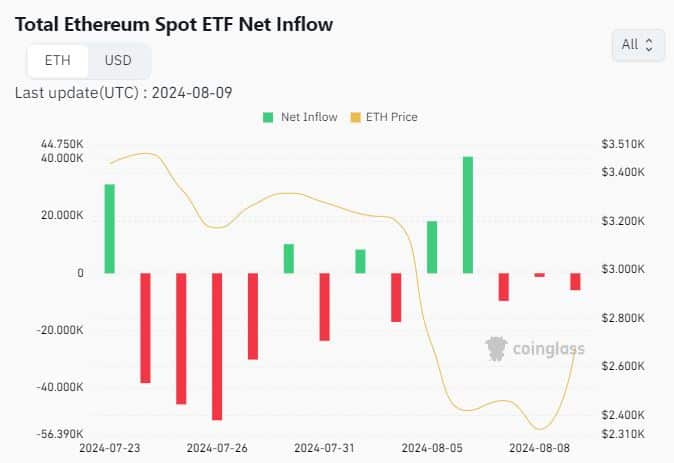

Bitcoin ETFs netflows averaged almost 300,000 BTC in the last 2 weeks, according to Coinglass. Meanwhile, Ethereum had a total spot ETF netflow of -114,350 ETH.

The data disclosed stronger demand for Bitcoin, compared to ETH in the spot ETF segment.

Our assessment also revealed the same for fund holdings. According to CryptoQuant, ETH fund holdings amounted to 2,026,328.5 ETH, worth $5.32 billion at ETH’s press time price.

Here, it is also worth noting that ETH fund holdings were still on a downward trajectory at the time of writing, despite the market’s recovery.

Meanwhile, Bitcoin fund holdings amounted to 280,951.35 BTC, which at press time value were worth $17.07 billion – A little over 3 times more than ETH. This, despite BTC fund holdings also declining over the last 4 weeks.

A fair comparison?

The aforementioned data confirmed that Bitcoin is more preferable in the capital markets, compared to Ethereum.

This may explain why funds hold more in Bitcoin than Ethereum. However, Ethereum also wins in other key areas too. For example, it has a much higher total address count with balance at 116.97 million.

In comparison, Bitcoin had a total of “just” 52.67 million total addresses with balance – Less than half of the total Ethereum addresses.

This highlighted one of Ethereum’s strengths as an expanding ecosystem. Perhaps one of the biggest reasons why Ethereum recently received Spot ETF approvals.

There’s no doubt that Bitcoin’s early lead against Ethereum offers a clear advantage. However, Ethereum also presents an opportunity that the institutional class of investors are starting to embrace. Besides, Ethereum ETFs are only a few weeks old, while Bitcoin ETFs have been around for months.

The remaining months of 2024 should provide a clearer picture of how Ethereum will fare in the macro capital market. Nevertheless, the findings confirm that Ethereum is at a bit of a disadvantage against Bitcoin in terms of securing institutional liquidity.

It may explain the differences between BTC and ETH’s price action too.