Hong Kong regulator SFC to launch new crypto guidelines in May

According to a Bloomberg report, the Hong Kong Securities Futures Commission (SFC) is scheduled to announce cryptocurrency exchange licensing guidelines next month.

Julia Leung, the chief executive of Hong Kong’s SFC, is said to have released guidelines for crypto exchanges.

The details

The new rules will allow retail investors to trade major tokens like Bitcoin and Ether in a new licensing regime for crypto platforms due on June 1. According to Leung, the licensing regime consultation process got over 150 answers from interested parties.

While most prospective Virtual Asset Service Provider (VASP) licensees await confirmation, several trading platforms such as Hashkey and OSL have already begun delivering crypto-related services to investors under SFC supervision.

As Hong Kong’s support for crypto businesses grows, more crypto exchanges are expected to follow suit. Following the U.S. banking crisis, several crypto companies are scrambling to find new banking partners.

Bitget, a cryptocurrency exchange, announced that it would no longer provide services to Hong Kong users due to new legal requirements. Instead, Hong Kong consumers must use its affiliate, BitGetX HK. Other offshore exchanges have begun to limit Hong Kong consumers due to these legal requirements.

Hong Kong takes the crown for crypto adoption

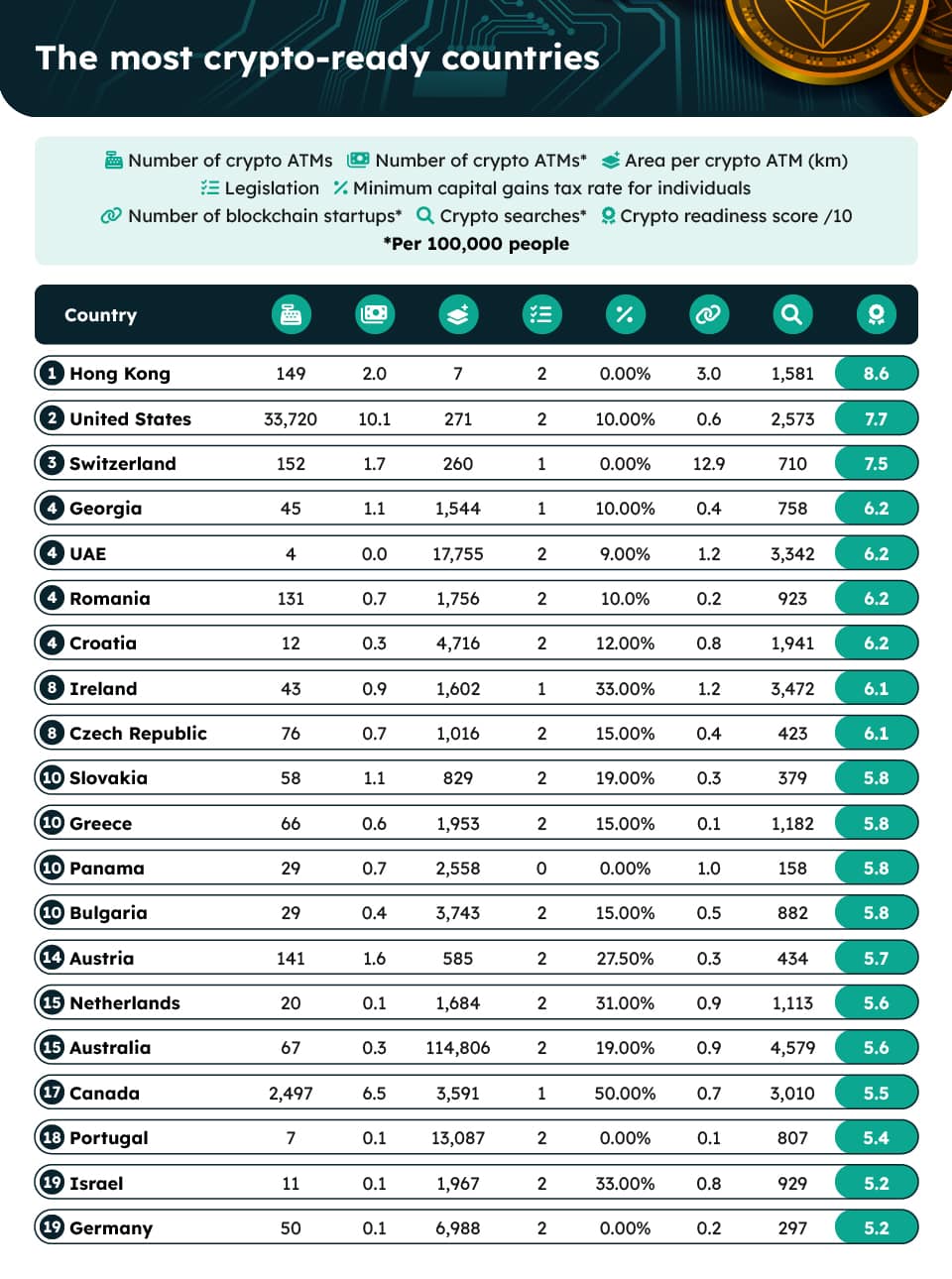

According to a Forex Suggest study published in July 2022, Hong Kong is the best-prepared country for widespread cryptocurrency adoption, with a crypto-readiness score of 8.6.

Despite having a bigger crypto infrastructure than the island nation, the U.S. and Switzerland had lower crypto-readiness scores of 7.7 and 7.5, respectively.

Source: Forex Suggest

The study took several factors into consideration to calculate a country’s crypto readiness. They include the number of crypto ATM installations proportional to the population and geographical size of the jurisdiction. And also, the number of blockchain startups per 100,000 people.

As a result, Hong Kong’s smaller land mass helped the country top the list. Hong Kong installed a network of 146 crypto ATMs, representing just 0.4% of crypto ATMs worldwide. Owing to the smaller area, Hong Kong residents are never more than 4.3 miles away from a crypto ATM.