How Aave faces $300M liquidation amid Ethereum’s drop

- AAVE ended the past week as one of the biggest losers.

- The protocol’s TVL is around $11.7 billion without an apparent increase

The Aave protocol recently experienced a record-high spike in liquidations. Despite benefiting from this event, its token, AAVE, ended the week on a declining note.

Aave sees record liquidation volume

Data from IntoTheBlock revealed that the Aave protocol underwent its largest liquidation event to date, with nearly $300 million in liquidations.

The liquidation was due to stablecoin loans backed by wrapped staked Ethereum (wstETH) as collateral. A 25% drop in the price of Ethereum triggered it, as it caused many borrowers’ collateral positions to become undercollateralized.

In response, Aave’s protocol mechanisms automatically executed these liquidations to preserve the platform’s financial stability. The move resulted in an unprecedented surge in liquidation volume.

Furthermore, despite the turbulence caused by such a large-scale liquidation, the protocol derived some financial benefit from the situation. It collected approximately $6 million in profits from the liquidation fees incurred during these events.

Aave ends the week in red

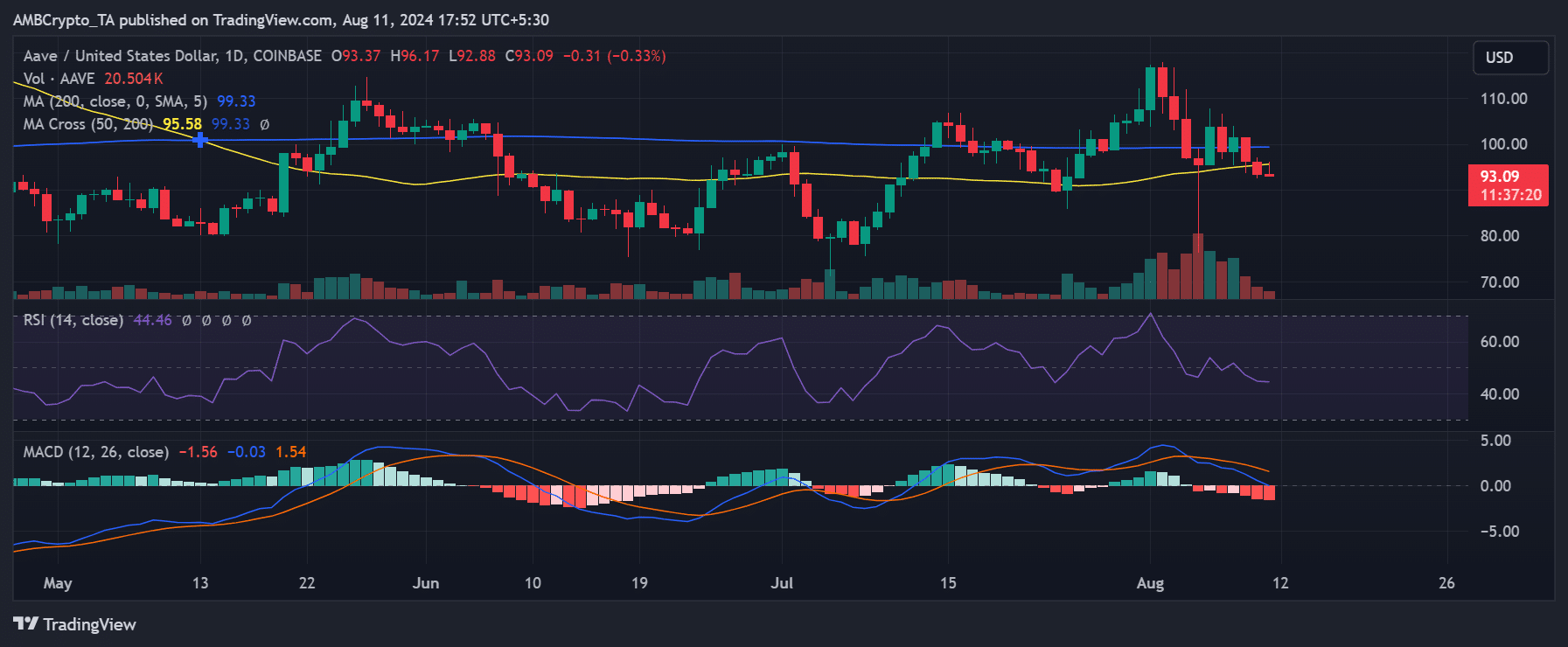

AMBCrypto’s recent analysis of Aave (AAVE) showed notable declines at the end of the previous week. On 9th August, it experienced a 5.17% drop, bringing its price down from approximately $101 to $96.

The following day, the price fell further by 2.97%, closing at around $93. As of this writing, it continued to trade around $93, showing a marginal decline.

Additionally, these consecutive drops have resulted in a shift toward a bearish trend for Aave, as evidenced by its Relative Strength Index (RSI).

The RSI, currently at around 45, suggests that the asset is under some selling pressure.

The price trend showed the divergence between protocol performance and token valuation.

Aave Futures throws up mixed signals

The funding rate for Aave has displayed significant volatility recently, oscillating between negative and positive values. The switch reflects changes in market sentiment and trader behavior.

At the close of trading on 10th August, the funding rate was positive, at approximately 0.0021%. This suggests that traders were willing to pay to hold long positions, indicating a bullish sentiment at that time.

However, by the start of trading on 11th August, the funding rate dipped into negative territory, falling to around -0.009%.

A negative funding rate indicates that shorts are paying longs, typically a sign that bearish sentiment is prevailing as more traders are betting on a price decline.

Is your portfolio green? Check out the Aave Profit Calculator

As of the latest update, the funding rate has recovered to a positive 0.004%.

This fluctuation from negative to positive within such a short period suggests an uncertain market, with traders rapidly shifting between bullish and bearish positions based on immediate market conditions and sentiment.