How are Bitcoin’s whales trying to make BTC more volatile?

- Are Bitcoin whales really accumulating? We explore on-chain data to find some answers.

- Bitcoin longs could be at risk of liquidations if the bears assume dominance.

Bitcoin [BTC] bounced back by over 3% during the trading session on the 2nd of September. Part of this performance was excitement triggered by reports that whales were accumulating BTC.

However, its inability to maintain strong momentum calls into question those reports.

According to Lookonchain, whales have also been moving Bitcoin onto exchanges despite healthy outflows. This may suggest that whales have been trying to trigger more volatility in the market.

Despite these reports, AMBCrypto also observed negative netflows from Bitcoin ETFs, which did not exactly inspire confidence.

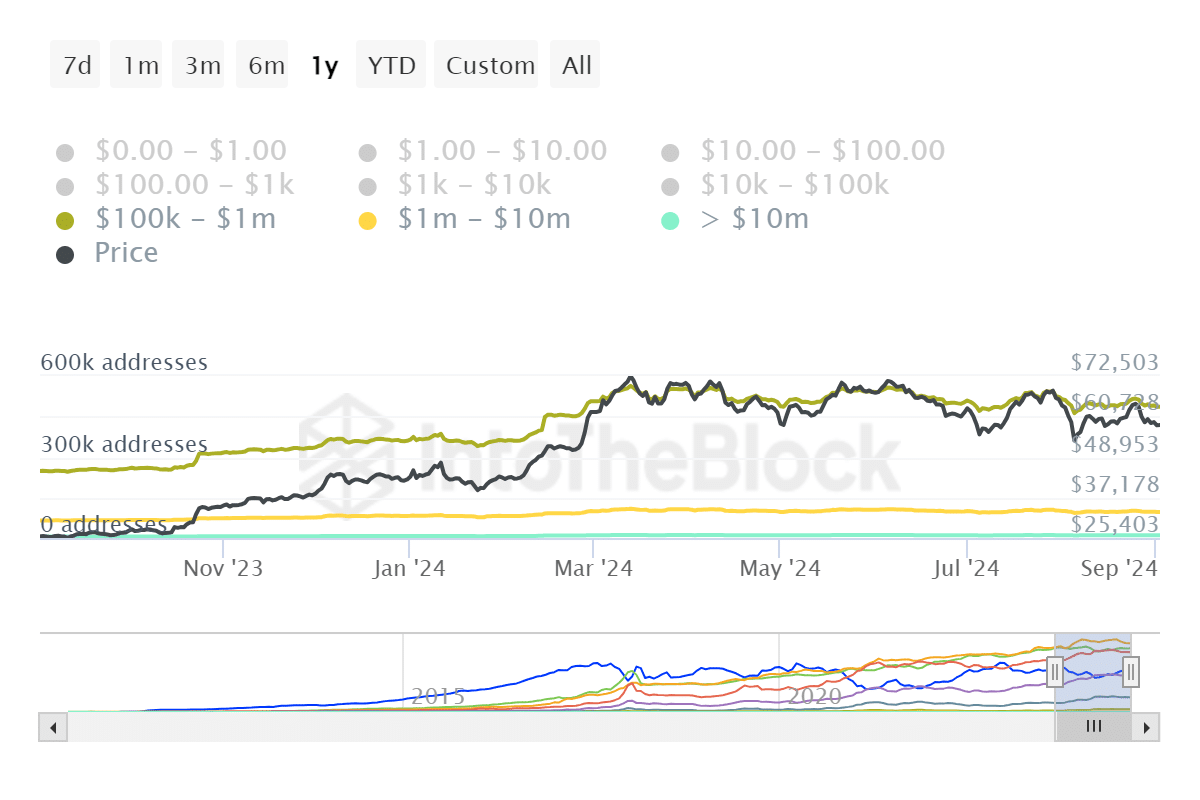

These findings warranted an assessment of Bitcoin addresses to establish the level of accumulation.

IntoTheBlock data revealed that addresses holding between $100,000 and $1 million worth of BTC dropped from just over 516,000 addresses on the 25th of August to over 486,500 addresses by the 2nd of September.

Addresses in the $1 million to $10 million worth of BTC range also dropped from 100,540 addresses to 96,150 addresses during the same period.

Addresses holding more than $10 million worth of Bitcoin dropped from 100,440 addresses to 100,000 addresses.

A Bitcoin price inducement set-up?

The data confirmed that a significant number of whales contributed to sell pressure. So, the hype may have been a classic inducement attempt, where the market gets hyped up and provides exit liquidity for the sellers.

This would explain Bitcoin’s limited upside and its struggle to sustain recovery above $60,000.

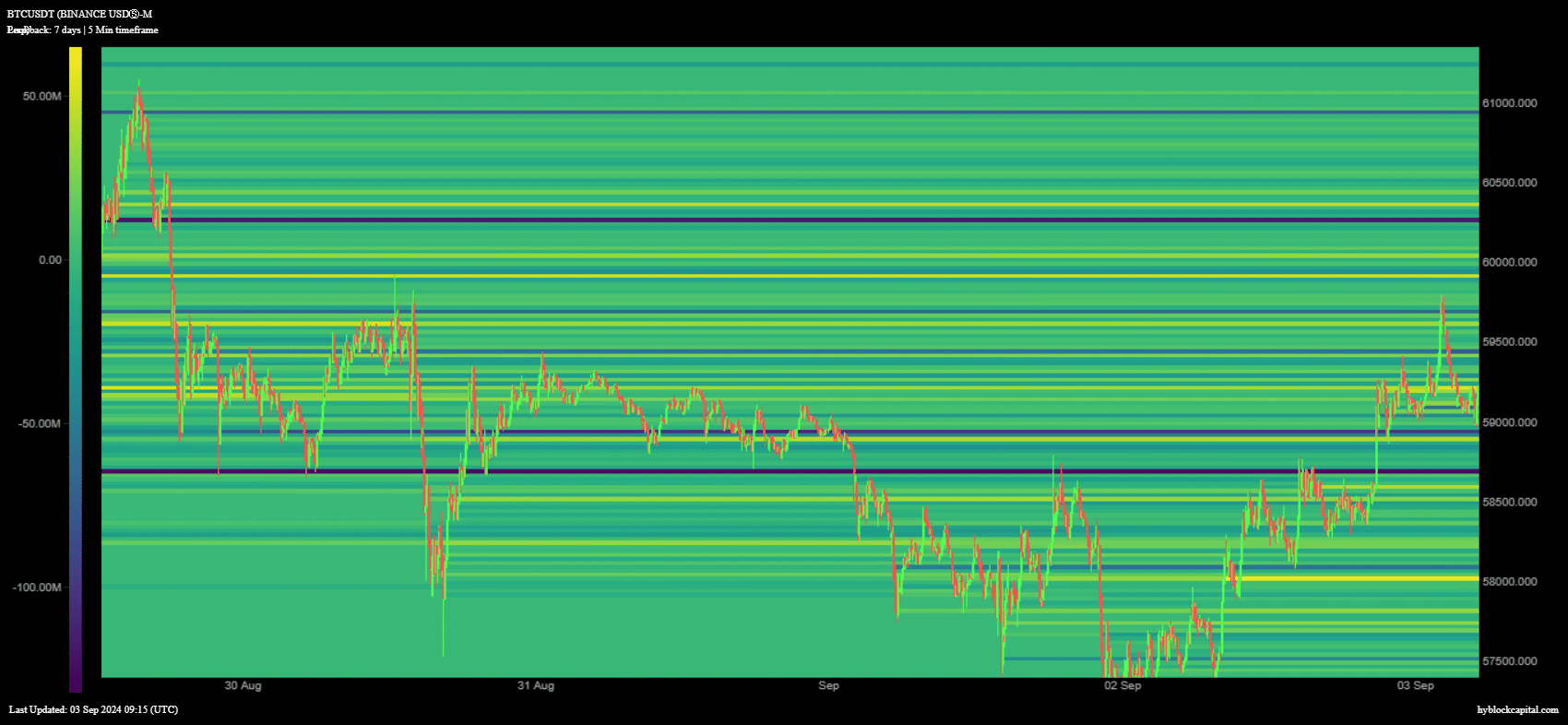

Inducement levels are usually characterized by a surge in appetite for leveraged positions. We observed a pile up of 25.582 million net longs near the bottom on the 2nd of August.

The figure was higher at 52.82 million net longs at the $58,000 price level.

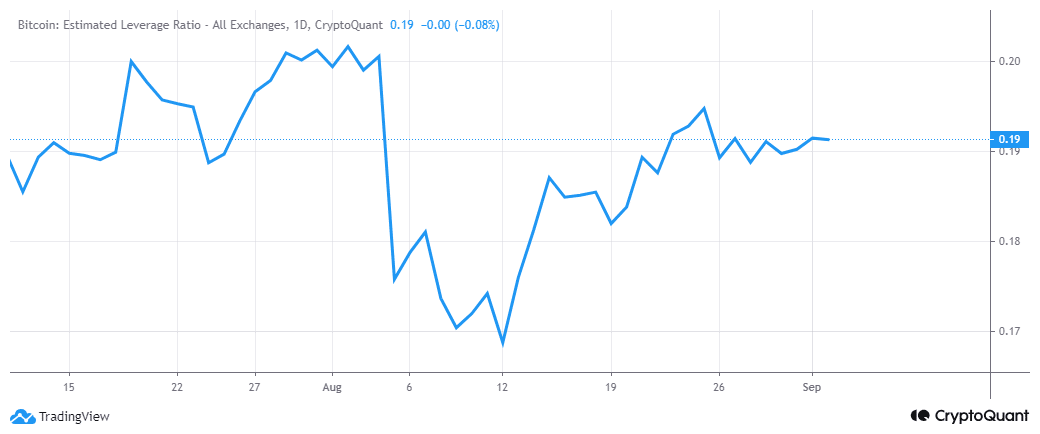

The surge in long positions indicated growing expectations of more upside. This also coincided with the resurgence of appetite for leverage.

Bitcoin’s estimated leverage ratio bottomed out on the 12th of August, followed by a pivot.

This signaled that the market has been embracing more leverage and could potentially be building towards heavy liquidations in case of another crash.

Bitcoin exchanged hands at $58,861 at press time, after a 0.47% discount in the last 24 hours.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This signaled that the market has been struggling to maintain the momentum, and it aligned with the sell pressure coming from whales as observed earlier. It also highlighted the possibility of liquidations if the price dips lower.

The next 24 hours will be critical for Bitcoin as the market awaits the next FED decision regarding interest rates. This may result in a volatile second half of the week.