How AVAX reacted to Avalanche’s rising network activity

- Avalanche C-chain’s weekly transactions only changed marginally in the last week.

- AVAX’s on-chain metrics were robust, and the token’s demand in the Futures market was high.

Avalanche [AVAX] managed to maintain its network activity last week, as its stats remained somewhat comparable to the numbers at the end of October. These bullish market conditions caused the token’s price to surge by double digits.

Avalanche’s network activity remains stable

AVAX Daily, a popular X (formerly Twitter) handle that posts updates related to the Avalanche ecosystem, recently posted a tweet highlighting Avalanche C-chain’s weekly network status.

As per the tweet, the blockchain observed a maximum transaction speed last week of 210. Moreover, Avalanche’s total gas usage reached 6.98 trillion during the last seven days.

?#Avalanche C-chain weekly on-chain status?

?Network Status

Transactions: 6.65M -0.93%

Max TPS Observed: 210 +1.43%

Gas Used: 6.98T +1.95%?Staking:

Staking ratio: 59.69%

Staking rewards: 7.84%

Total validators: 1,534

Total delegations: 86,214#AVAX $AVAX pic.twitter.com/kZno2x66At— AVAX Daily ? (@AVAXDaily) November 9, 2023

Not only that, but when AMBCrypto checked Artemis’ data, it was revealed that the blockchain’s daily active addresses also surged over the past few weeks. A similar trend of increment was also noted in terms of AVAX’s captured value, as evident from the rise in its fees and revenue.

While checking AVAX’s network status, a look at its stalking ecosystem is a must. AVAX Daily tweet also mentioned that last week AVAX’s staking ratio stood at 59.69% while its staking rewards stood at 7.84%.

As per Staking Rewards, at the time of writing, Avalanche had a total of over 85,000 staking wallets and a total of over 248 million AVAX tokens staked. The blockchain had a staking market capitalization of $3.3 billion.

A look at AVAX’s state

The blockchain’s network stats definitely bode well for AVAX’s price. According to CoinMarketCap, the token was up by more than 11% in the last seven days. It traded at $13.39 at press time, with a market cap of over $4.7 billion.

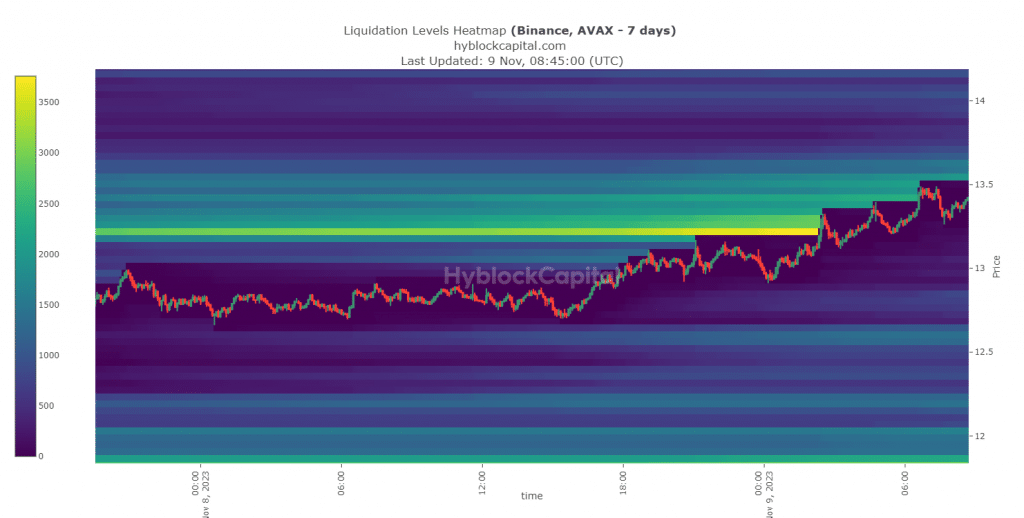

AMBCrypto’s analysis revealed that over the last week, AVAX’s liquidation increased substantially, when the token’s price touched the $13.2 mark. However, this did not stop prices from rising over the next few days.

Read Avalanche’s [AVAX] Price Prediction 2023-24

Upon further inspection, AMBCrypto found that AVAX’s development activity increased over the last week, reflecting developers’ efforts in improving the network. Thanks to the price uptick, both the token’s Price Volatility 1w and Social Volume remained high.

AVAX’s demand in the derivatives market also remained high at the time of writing, as evident from its green Binance Funding Rate.