How Binance became the ‘talk of the town’ thanks to this tittle tattle

- Binance sees large outflows of BUSD linked to the Cobie’s hash prediction.

- The crypto exchange stood at the receiving end of some FUD-inducing false prediction.

Cryptocurrency exchange Binance reportedly experienced a large exodus of BUSD on 3 April, 2023. This outflow was linked to FUD after the content of a Sha256 hash prediction by Twitter user @Cobie was published.

According to Arkham Intelligence, multiple Paxos addresses received large amounts of BUSD from the Binance exchange right after the Cobie hash was decoded. The BUSD exodus reflects a response to the FUD related to the hash prediction, and especially regarding Binance.

gm

BUSD saw heavy outflows from Binance last night, after the solution to Cobie's hash was posted on Twitter.

Most BUSD redemptions to Paxos were made through two deposits:

– 0x4F4 with heavy interaction with a number of on-chain addresses

– 0x72b only receiving from Binance. pic.twitter.com/PTsp94OIsb— Arkham (@ArkhamIntel) April 4, 2023

Understanding SHA256 hash predictions may provide clearer insights as to what happened. They represent coded messages that a party encodes onto a block as proof of knowledge at a specific time without necessarily spoofing the market.

The coded information can then be revealed at a later date, thus the proof of knowledge aspect.

Planned FUD or prediction gone wrong?

An analysis of the situation by pseudonymous analyst @FatManTerra revealed that the code was cracked. The hidden message was about an Interpol red notice for Binance CEO CZ. This explains why the market reacted by aggressively pulling liquidity from the exchange.

?An explanation of what happened with the Cobie tweet, in simple terms so everyone can understand.

What are hash predictions, and why did this one go wrong? How did a single tweet cause $50m+ in liquidations? What exactly happened? (1/9)

— FatMan (@FatManTerra) April 3, 2023

Also, it turns out that Cobie made the hash prediction based on a rumor, rather than a fact. There was no red notice for CZ, hence the hash prediction turned out to be incorrect.

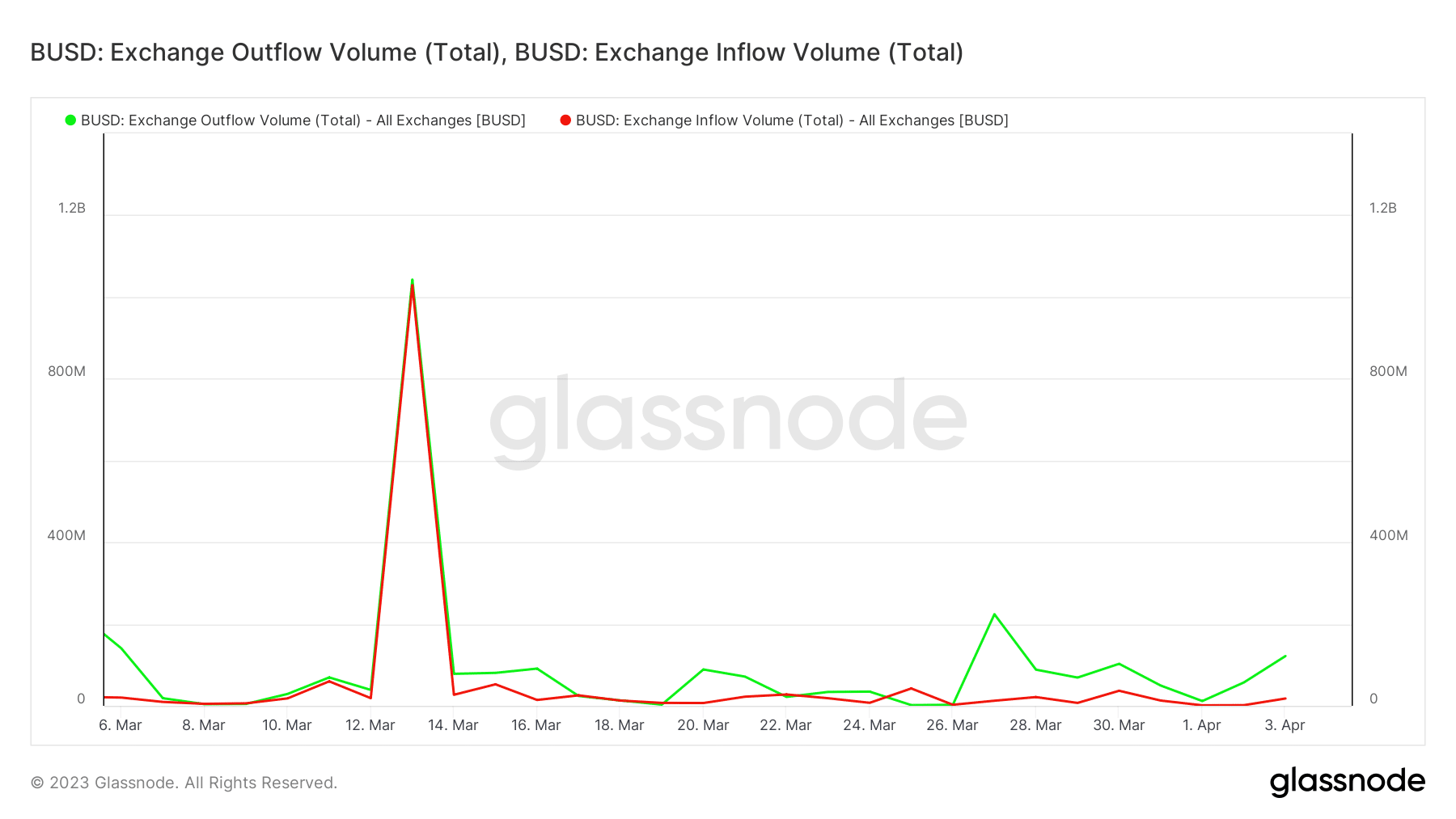

Nevertheless, the damage was already done. A look at exchange flows revealed that BUSD exchange flows far outweighed exchange inflows.

The exchange flows rode on the waves of FUD that has been hammering against Binance for the last few weeks. However, the exchange demonstrated resilience with barely any impact on its performance.

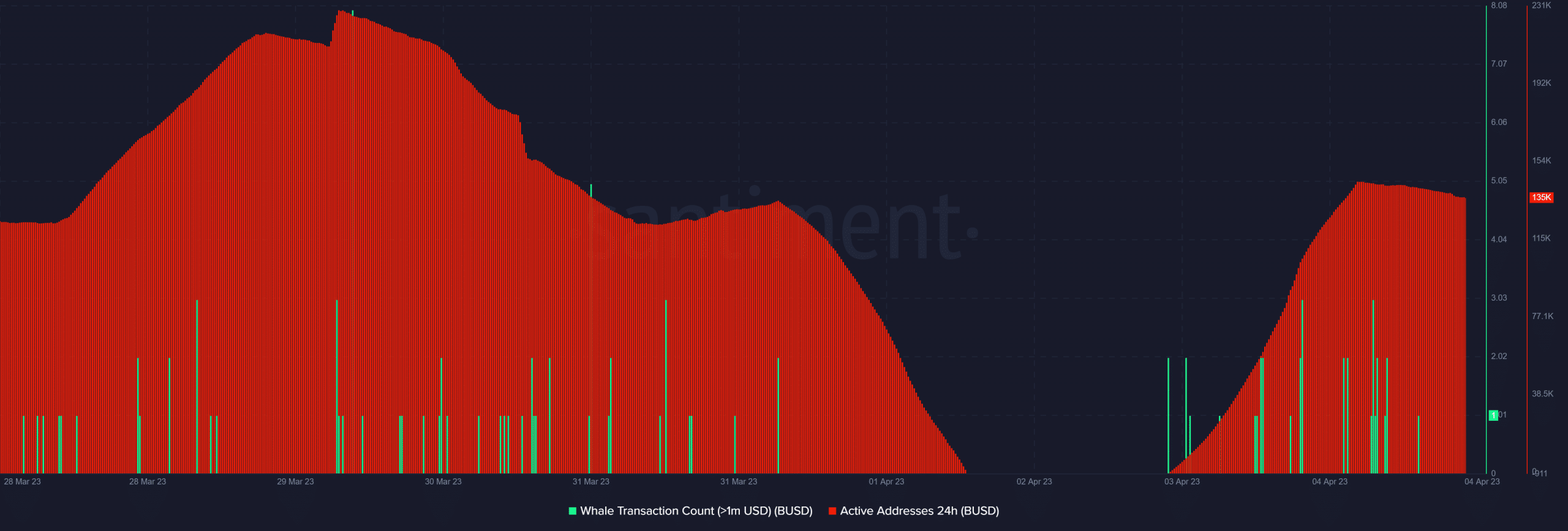

Despite this, the FUD did have an impact on users and daily active addresses on the network witnessed a spike over the last 48 hours.

Whale transaction count also showed a surge in activity after previously being dormant for the first two days of April. This may indicate two potential outcomes. Either investors were moving their funds out of the exchange, or they were taking advantage of the anticipated price movements.

Is hesitation for the weak?

Cobie’s hash has been quite enlightening for those that have been following the incident. Many people got to learn a few things about Sha256 hash predictions through this particular incident.

It also brought to light how such features can be useful especially if the prediction is based on accurate information. The flip side is that false information may trigger FUD or even be used to manipulate the markets.