How Bitcoin can help Solana rise to a new ATH

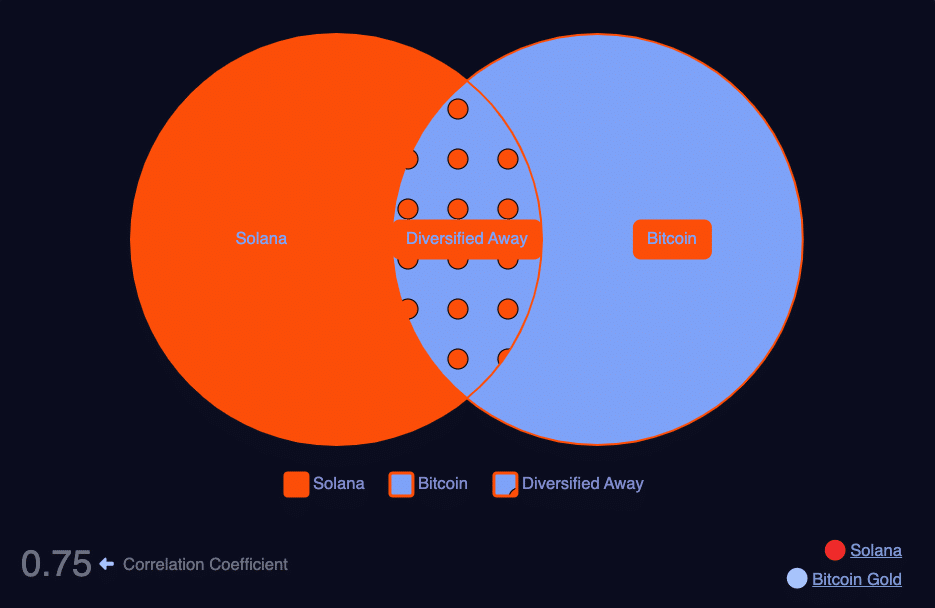

- A 0.75 correlation coefficient showed Solana’s movements closely align with Bitcoin’s price.

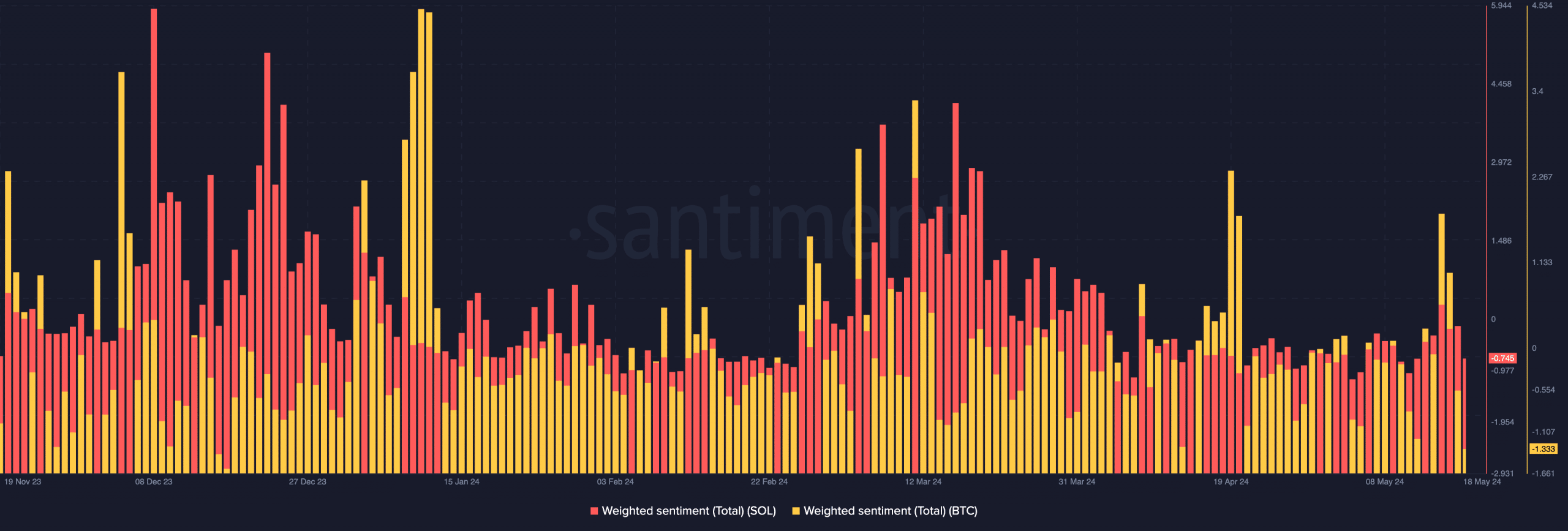

- Negative sentiment around BTC and SOL could hinder immediate price gains.

Solana’s [SOL] price could be set for a new All-Time High (ATH) according to Daniel Cheung, the co-founder of Syncracy Capital. Cheung posted this on X (formerly Twitter).

According to him, Bitcoin’s [BTC] return to bullish territory was the major reason SOL might make the move. Explaining his bias, he noted that,

“Dispersion of returns to continue but we should start to see many new and older alts make new ATHs as well (I.e. $SOL, $AKT, $MKR, $TAO etc…)”

At press time, Bitcoin’s price was $67,164. This was a 10.17% increase in the last seven days. Solana’s price, as of this writing, was $173.35, representing a 19.76% increase within the same period.

In March, BTC hit a new ATH before the halving. But before that, SOL outperformed the number one cryptocurrency. Despite that, SOL failed to hit a new ATH.

Solana’s all-time high was $260.06. This happened during the bull market of 2021. This cycle, the price of the token climbed past $200. But bears ensured that the SOL failed to tap its previous high.

Solana joins forces with the king

If SOL will hit a new high with Bitcoin backing it, the correlation between the two has to be solid. AMBCrypto evaluated this by looking at data obtained from Macroaxis.

As of this writing, the correlation coefficient between Solana and Bitcoin was 0.75. Values of the metric range from -1 to +1.

If the reading is close to the negative region, it means that the price does not move in the same direction.

However, a close positive reading and close to +1 indicates a strong correlation. As such, both Solana and Bitcoin seem to move together on most occasions.

Red days ahead still

Going into the week, there are predictions that BTC might revisit $70,000. If achieved, then it means SOL’s price might rise past $200 too.

But to hit a new ATH, the price of SOL has to increase by more than 55%. In terms of the perception around both cryptocurrencies, AMBCrypto observed that the Weighted Sentiment was negative.

According to data from Santiment, Bitcoin’s Weighted Sentiment was -1.333.

For Solana, it was -0.745, meaning that the broader market was not convinced that the prices of SOL and BTC would continue to increase.

If the sentiment remains negative, demand for SOL and BTC might drop. However, a change in the sentiment could validate a price increase.

Realistic or not, here’s SOL’s market cap in BTC terms

But from the look of things, Bitcoin might need to surpass $73,750 for Solana to rise past $260.

While this might not happen in a few weeks, SOL’s price might surpass its previous high before the end of the next quarter.