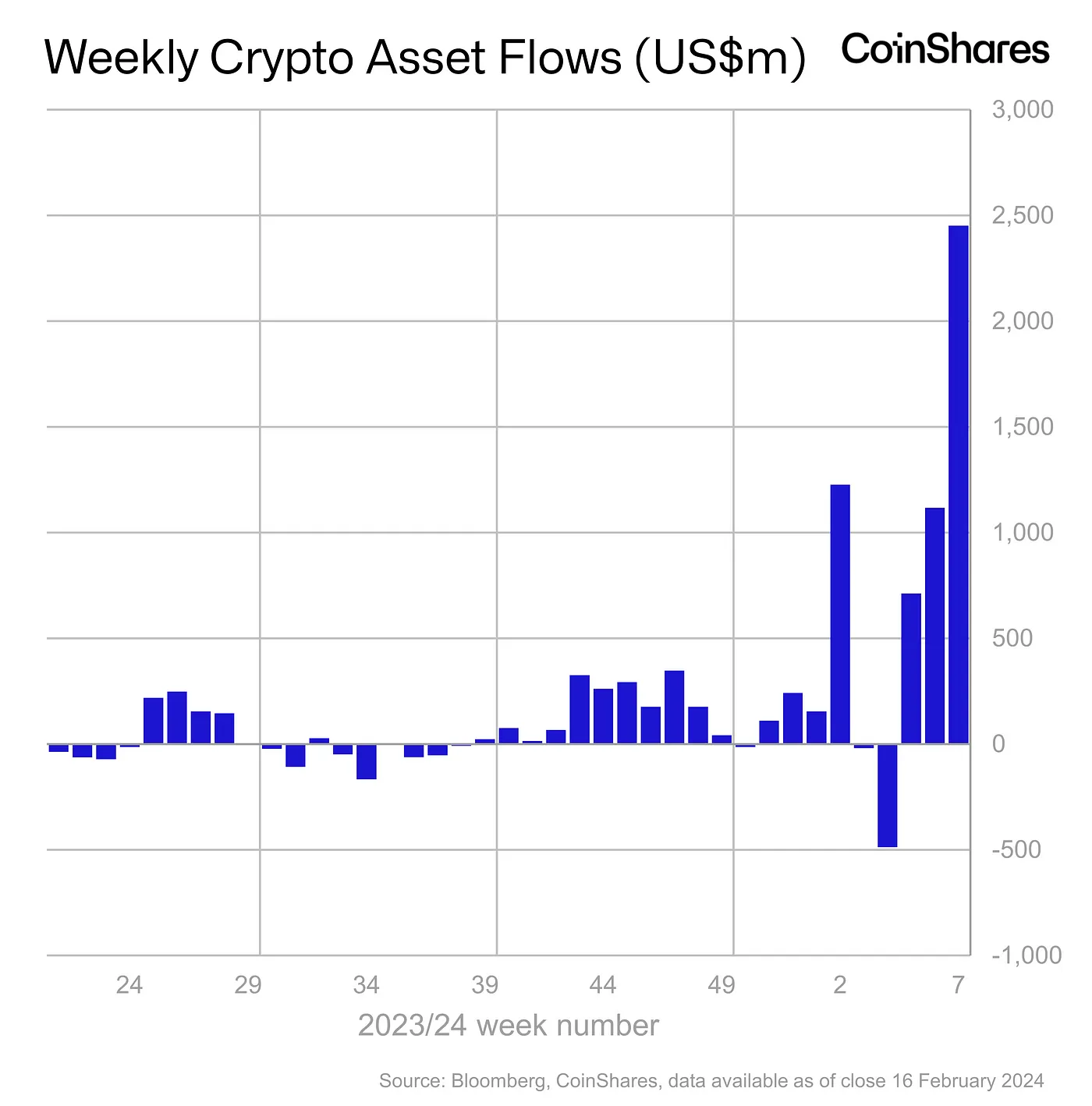

How Bitcoin helped crypto inflows reach a 26-week high

- Net inflows more than doubled from the previous week.

- Funds tied to Bitcoin accounted for over 99% of the total inflows.

Digital asset funds attracted record inflows totaling $2.45 billion last week, spurred by soaring institutional interest in spot Bitcoin [BTC] ETFs.

Net inflows more than doubled from the previous week, according to the latest report by crypto asset management firm CoinShares.

This also marked the third consecutive week of net capital infusion into institutional crypto products.

AuM highest since December 2021

With the latest figures, the total inflows since the beginning of 2024 have surged past $5 billion. Moreover, the total assets under management (AuM) spiked to a 26-month high of $67 billion.

Recall that the AuM, apart from depending on the flow of investor money in and out of a fund, is also based on the price performance of the underlying asset.

Recent price moves, which elevated leading assets like Bitcoin and Ethereum [ETH] to cyclical highs, were a key driver behind increasing AuM.

Bitcoin spot ETFs hog the limelight

Funds tied to Bitcoin cornered more than 99% of the total inflows last week, taking year-to-date (YTD) inflows to $5.02 billion.

Much of the action revolved around the newly-launched spot ETFs in the U.S. market. In fact, the U.S. accounted for 99% of the total inflows last week, the report stated.

Outflows from the Grayscale Bitcoin Trust (GBTC), which were one of the major bearish triggers for Bitcoin initially, have ebbed significantly in recent weeks, leading to the turnaround.

According to AMBCrypto’s examination of SoSo Value data, GBTC outflows have plunged by 73% since the peak on the 22nd of January.

Ethereum-linked funds on the move

Meanwhile, funds linked to other major cryptos like Ethereum also saw impressive inflows, totaling over $21 million.

The sentiment was likely bolstered by an 18% weekly increase in ETH’s market value, as seen from CoinMarketCap.

On the other hand, Solana [SOL] saw a capital exit worth $1.6 million, which the report attributed to negative sentiment following the recent network outage.

One of the other main sources of outflows was profit-taking by investors in blockchain equity ETFs.

![Kaspa [KAS] on a long-term downtrend? Here's why it should worry investors!](https://ambcrypto.com/wp-content/uploads/2025/06/Kaspa-Featured-400x240.webp)