How Bitcoin’s [BTC] consolidation phase can yield profits for traders

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

The cryptocurrency market crash over the past few weeks has been brutal. In fact, none of the asset classes have survived the onslaught from the central bank interest rate hikes happening across the globe. And the correlation between traditional assets like equities and newer assets like cryptocurrencies has been increasing thanks to increasing institutional interest – which has doubled the pain for all investors.

However, there is still a way for you to make money out of this. But you’ll have to understand why first.

Boring price action

Broadly speaking, Bitcoin has been consolidating since 10 May, right after the major crash that pulled down prices from $47k to sub-$30k levels. But since 10 May, things have been more peaceful, so to speak. And it can be expected to remain so for a while now too.

Bitcoin can be expected to stay in the narrow horizontal channel (white) for a while very simply because sentiments are weak and fresh buying or selling from these levels is going to be hard.

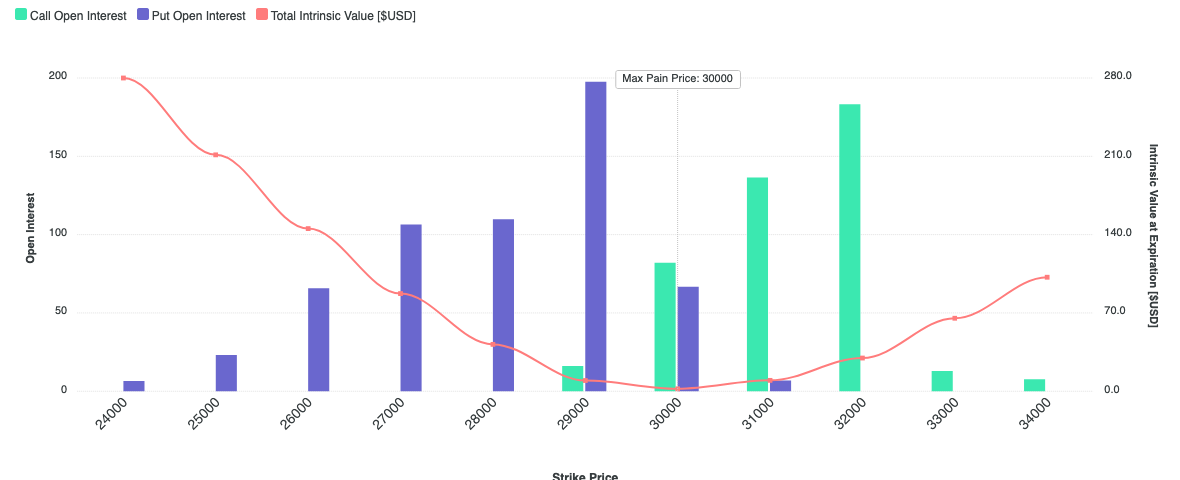

Options data for Bitcoin also points in a similar direction. According to data from Coinoptiontrack.com, Bitcoin is currently trading right on the point of max pain – typically the point where options tend to expire at.

Max Pain | Source: Coinoptiontrack.com

This data also shows there’s huge put open interest at the $29,000 strike with negligible call open interest, suggesting good support at those levels. While at the same time, the $31,000 strike has a decently high call open interest, while negligible put open interest – suggesting a resistance at that level. Why? Put and call option writers are betting big on the market to remain in a range-bound manner.

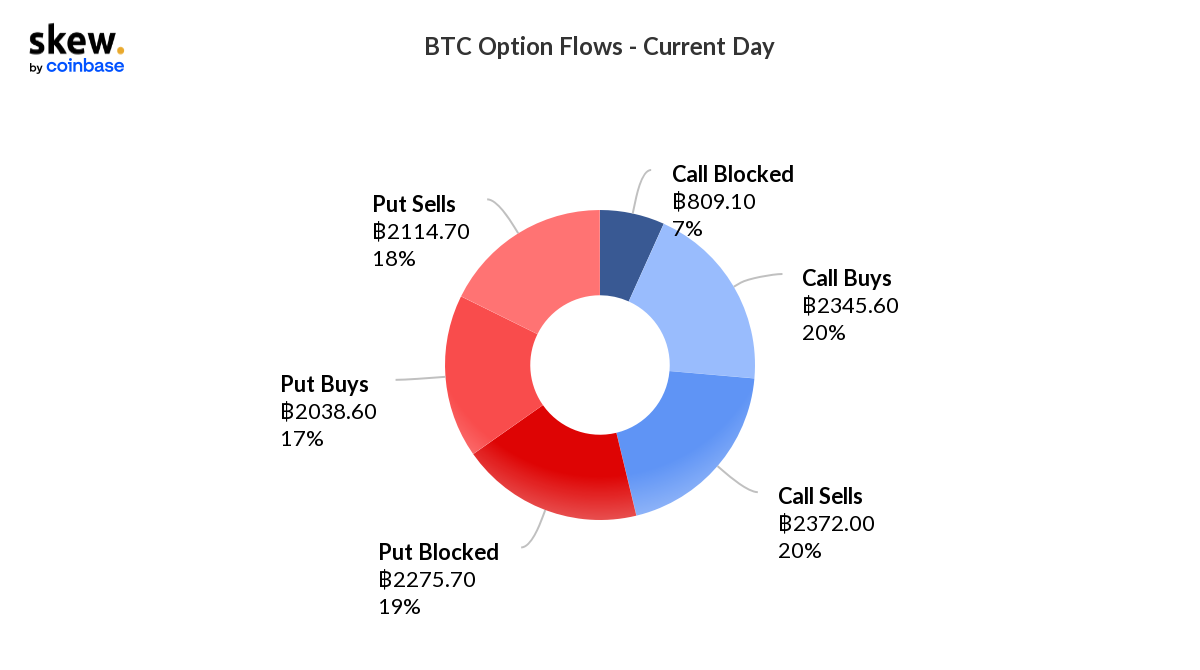

According to data from Skew, Bitcoin option flows also seem to point to a very balanced outlook. Nearly 38% of the open interest is on bullish bets (put sells and call buys) while 37% are in bearish bets (call sells and put buys).

Bitcoin Options Flow | Source: Skew

Even the options data for the major expiry on 27 May suggests that bulls and bears in the market are equally matched on the field and may tend to hold on to that for a while.

Bitcoin Options OI by Expiry | Source: Skew

Here’s how to profit from it!

How do you profit from this, you may ask? Well here’s how.

Options give traders the benefit of executing hedged strategies to profit from a sideways moving market. Depending on the risk profiles of the trader, one can choose between naked strangles (if you have nerves of steel) or an iron condor (if you want to protect your capital).

All you need to do is choose the right expiry, execute the trades and wait for the expiry, and et voilà! If everything goes according to plan, as an option writer your options will expire worthless leaving you with the entirety of the options premium you collected.

In either of these option spreads, depending on the risk/reward ratio chosen by the trader – one has a high probability of making a profit out of a consolidating market while other direction traders are waiting for a trigger.

However, DYOR before you try out anything such as this. Options trading requires reasonable experience and understanding so jumping right in without understanding can be financially fatal.

![3 catalysts that could send Ethereum [ETH] to $5,000 in 2025](https://ambcrypto.com/wp-content/uploads/2025/05/Abdul_20250515_122605_0000-400x240.webp)