Bitcoin

How Bitcoin’s whale action can stop BTC from falling below $60K

Bitcoin’s current market has some big positives, but there are some risks too.

- Drop in long-term holder active sales meant sellers might be exhausted

- Increase in the largest whales’ holdings while prices plummeted may be seen as a sign of confidence

Bitcoin [BTC] fell back rapidly from the $69k-$70k resistance zone. The weekly timeframe developed a bearish structure, and the FOMC meeting slashed bullish hopes of a Fed rate cut in September.

On top of this, the Sahm Rule appeared to confirm economic weakness and opened up the possibility of a recession. This sent the markets into a panic and BTC tumbled lower.

The $60k region is a significant support zone, but there are no guarantees that the bulls would successfully defend it. AMBCrypto looked closer at on-chain metrics to better understand the long-term holder sentiment.

Long-term holder sell pressure has fallen

Source: Axel Adler on X

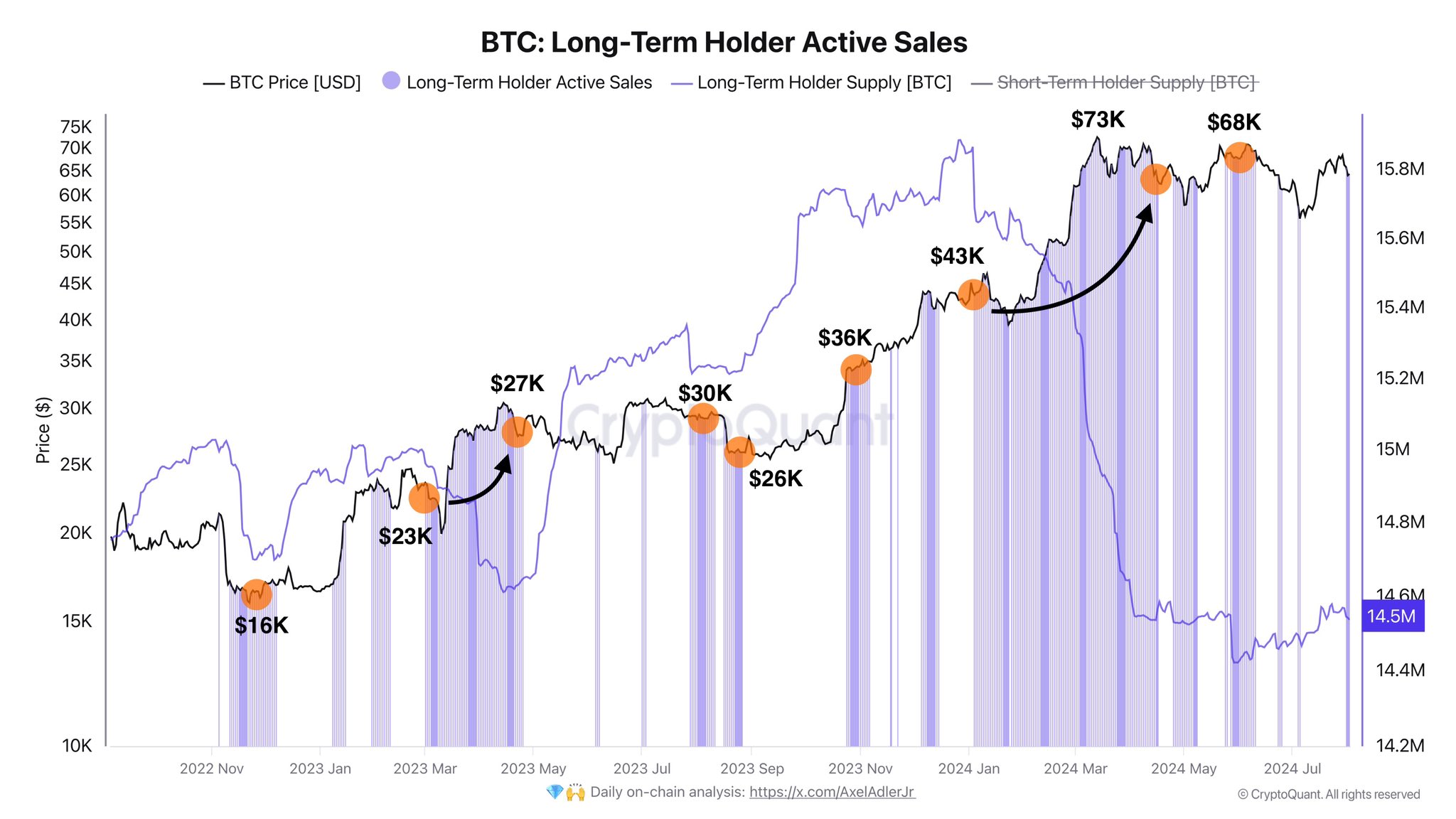

In a post on X (formerly Twitter) crypto-analyst Axel Adler observed that long-term holder active sales had reduced. Compared to early June, the selling pressure from this band of holders was “minimal.”

The long-term supply also fell dramatically. This suggested intense profit-taking activity when BTC was trading around the $68k-$70k levels. It pointed to a lack of conviction of a breakout past $70k.

On the other hand, this might also be positive news because this meant the selling pressure is likely exhausted.

Whale cohort’s behavior is exciting news

Source: Santiment

The cohort of wallets with 100k-1M BTC in their wallets climbed higher as a percentage of the total. The last time it jumped this rapidly was in May 2023, when Bitcoin began to poke its head above the $26k resistance.

While this whale accumulation is encouraging, other whale cohorts have been selling. The 1k-100k division saw a sharp drop in their holdings over the past two weeks, showing selling pressure from whales.

Source: CryptoQuant

Evidence for bearish sentiment over the past few months was also seen in the adjusted SOPR. The value was above 1 to show that on average, coins were sold at a profit.

Alas, the falling aSOPR trend since March has been a bearish signal.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Overall, the drop in LTH active sales, combined with accumulation from larger whales, is encouraging. Despite these positives, however, Bitcoin might struggle to recover in August due to the bearish market-wide sentiment.