How BlackRock’s Bitcoin ETF surged amid a BTC price drop

- IBIT saw record volume while BTC’s price declined.

- BTC, however, saw a record volume of over $100 billion.

The cryptocurrency market, including Bitcoin [BTC], has experienced a significant downturn recently, culminating in a sharp decline on 5th August.

Despite this widespread market pullback, there was an intriguing contrast in the activity observed with the Blackrock Bitcoin ETF, which recorded one of its highest daily trading volumes on the same day.

Blackrock logs record volume

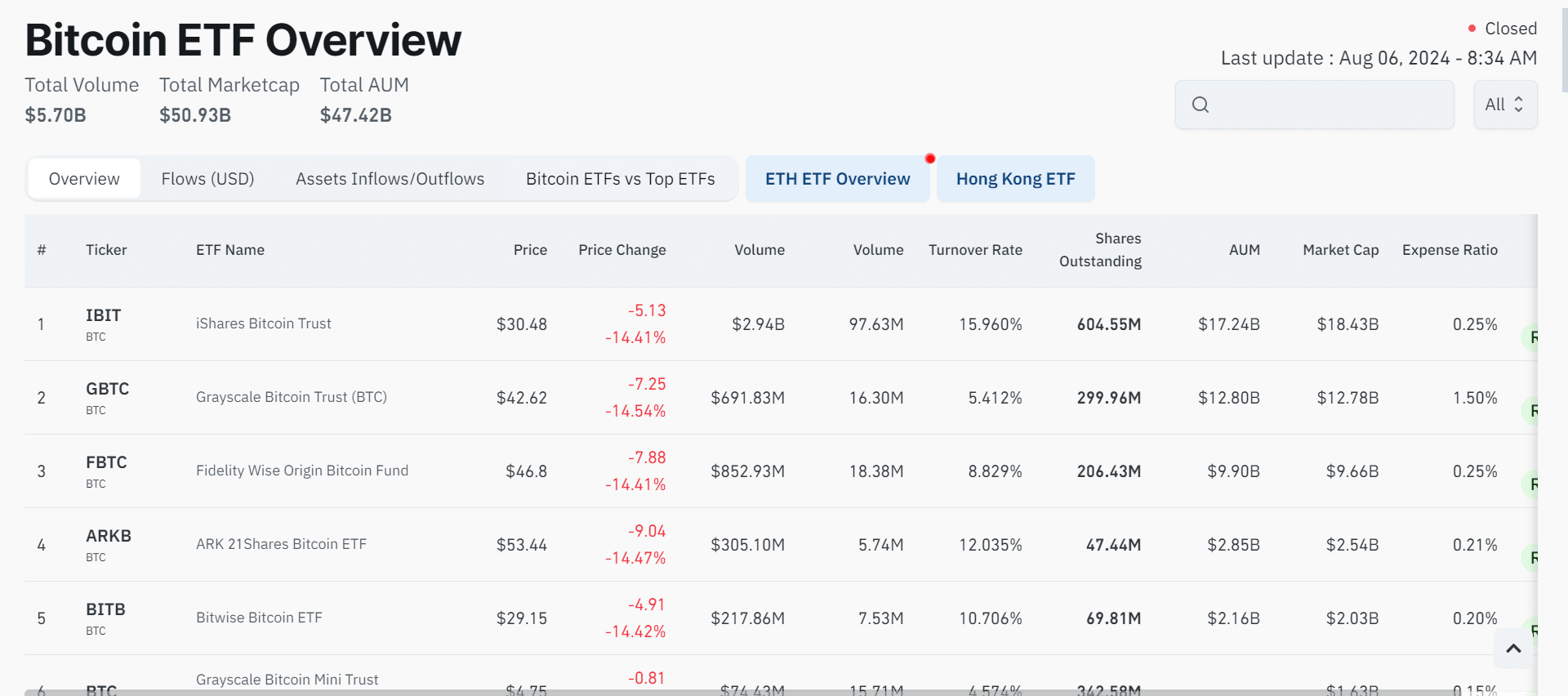

The recent trading data from Coinglass highlights a remarkable surge in volume activity.

The BlackRock Bitcoin ETF (IBIT) recorded the highest volume on 5th August. Analysis showed that this ETF’s trading volume soared throughout the day.

It began with an impressive $1.5 billion in the early trading hours and closed the day at nearly $3 billion. This level of activity was significantly higher than any other ETF in the same category for the day.

This surge in trading volume during a broader market downturn is particularly notable. It suggests that while the general cryptocurrency market was declining, many investors actively engaged with the BlackRock Bitcoin ETF.

This could indicate a range of strategic behaviors among investors. Some may have viewed the downturn as a buying opportunity, purchasing more shares at a lower price in anticipation of future gains.

Conversely, others might have been selling their holdings to minimize losses amidst falling prices.

Moreover, the exceptional volume in the ETF could reflect a broader shift in investor sentiment or strategy. Particularly during heightened market volatility and uncertainty, investors often seek out what they perceive as safer or more stable investment options.

Bitcoin regains consciousness amidst BlackRock’s volume

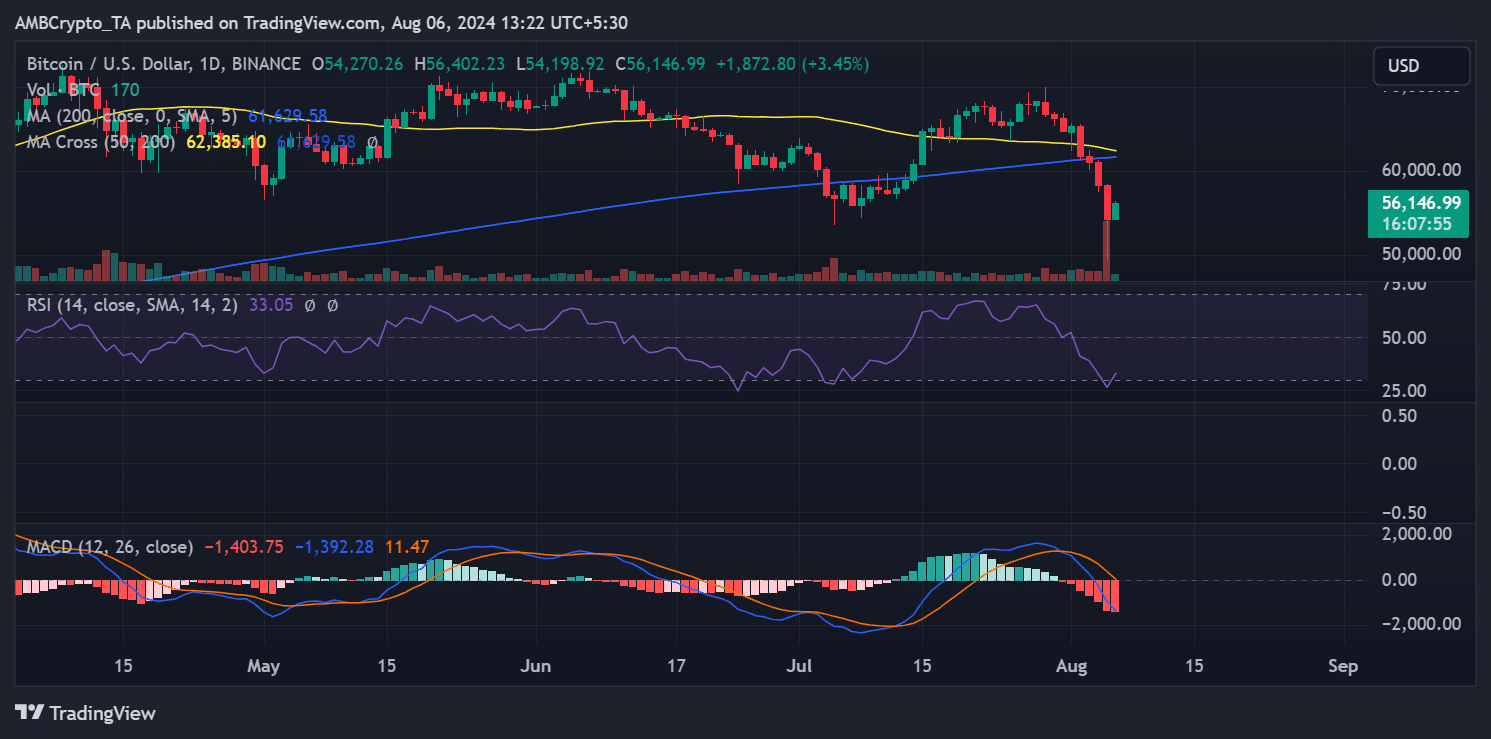

The recent analysis of Bitcoin’s price movements highlighted a contrasting scenario. Despite a spike in trading volumes for the BlackRock Bitcoin ETF, BTC faced significant price struggles.

According to AMBCrypto’s analysis on a daily timeframe chart, BTC’s price experienced a sharp fall, falling to as low as $49,360.

Although it recovered somewhat by the end of the session, it closed at approximately $54,274—down from an opening price above $58,000, marking an overall decline of over 6%.

This decline pushed Bitcoin’s Relative Strength Index (RSI) further into the oversold territory, crossing below the critical threshold of 30.

Currently, Bitcoin shows signs of a modest recovery, trading at over $56,000 with an over 3% increase. Correspondingly, its RSI has improved slightly, rising just above 30.

BTC sees a volume spike of its own

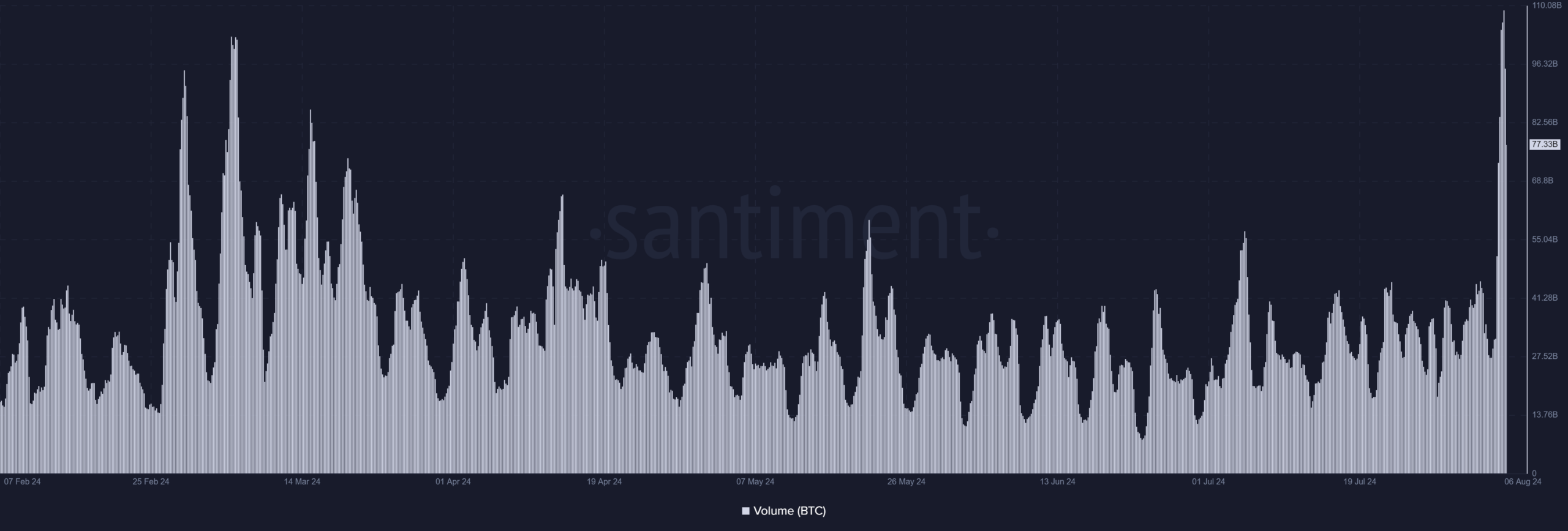

Analysis of the Bitcoin volume showed that it experienced a spike of its own, just like BlackRock. Data from Santiment revealed a significant surge, with volumes reaching over $104 billion on 5th August.

Is your portfolio green? Check the Bitcoin Profit Calculator

This spike in trading volume is particularly noteworthy as it marked the first occasion in more than five months that it surpassed the $100 billion threshold.

The last instance of such high volume was recorded on 6th March, when it briefly touched $102 billion.