How can Ethereum benefit from Blur’s NFT lending protocol?

- Blur’s NFT lending protocol witnesses a massive spike in activity.

- Ethereum NFTs such as CryptoPunks, Azuki and Milady Makers take the spotlight.

The NFT market has been seeing lots of volatility, as interest in the space hasn’t been as consistent. However, the performance of Blur Blend could indicate a turn in tides.

Is your portfolio green? Check out the Ethereum Profit Calculator

It’s all a BLUR

DappRadar’s data revealed a notable surge in total loan amount within 22 days since the launch of Blur Blend. Specifically, the loans have escalated from 4,200 Ether [ETH] to 169,900 ETH, representing a remarkable 82% share of NFT lending activity.

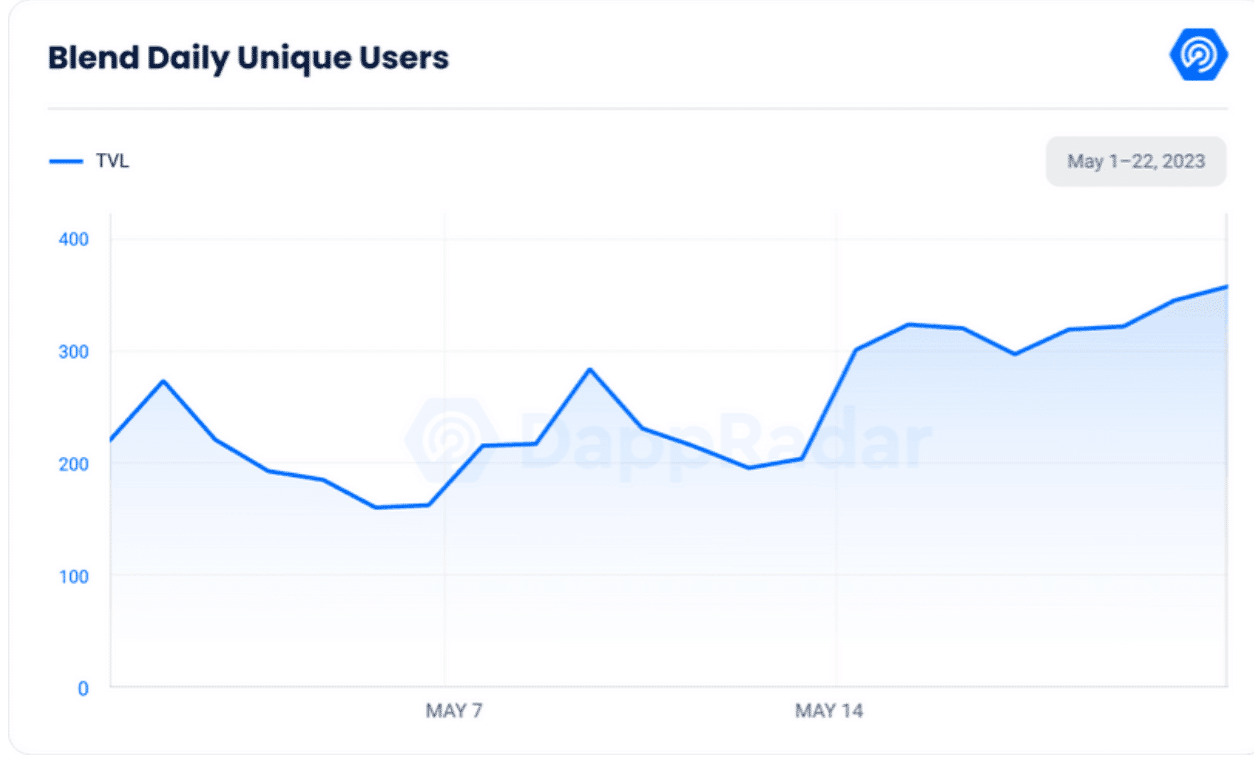

At press time, the daily average user count on Blur [BLUR] stood at 306 individuals, representing a 64% increase since the inception of the protocol.

The surge in loans occurring on the platform has been contributed mainly by NFT collections such as CryptoPunks, Azuki, and Milady Maker.

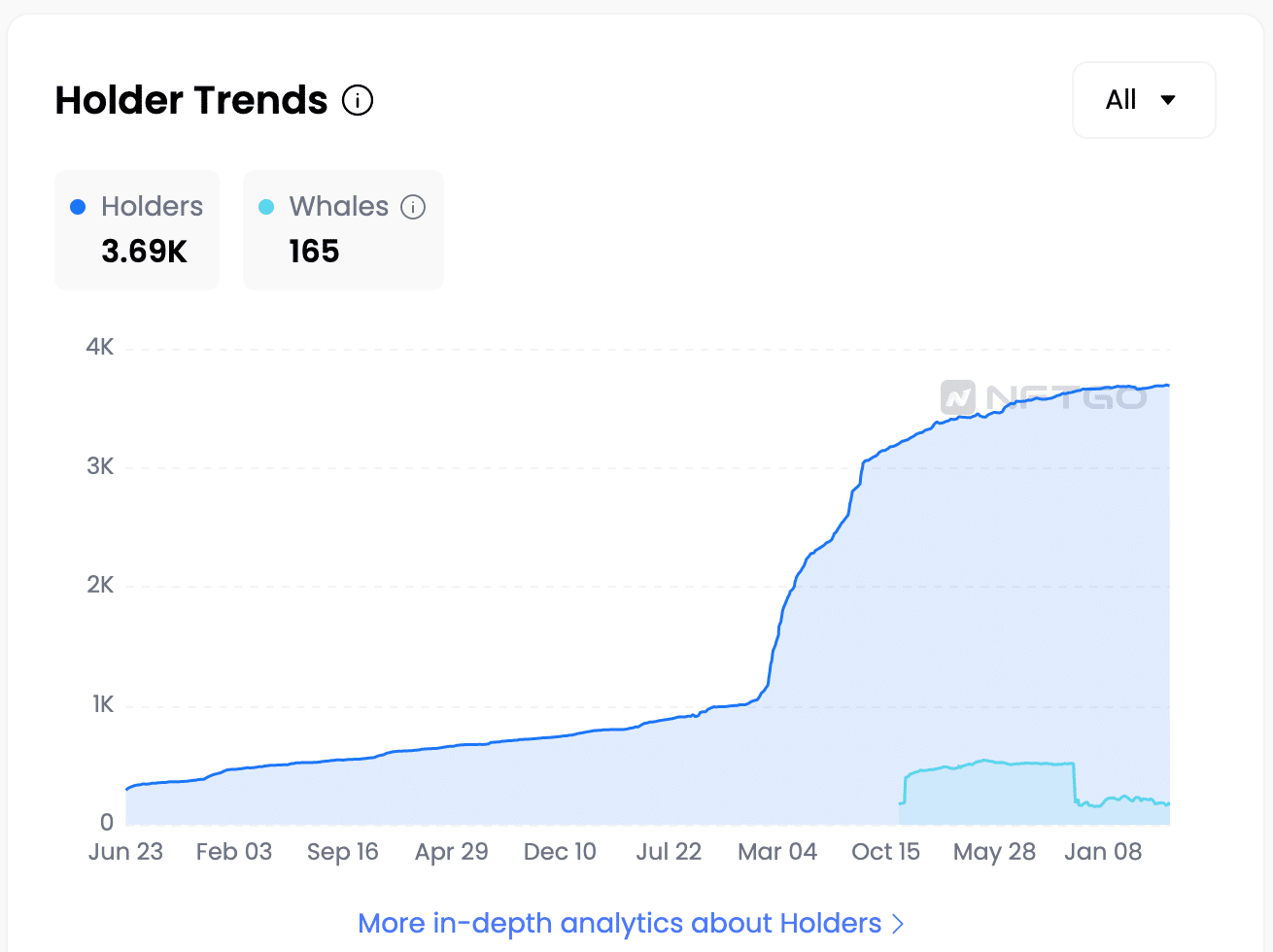

According to data provided by NFTGO, the number of addresses holding CryptoPunks surged over the last few weeks. Coupled with that, the volume of transactions surged by 71.25% in the last 24 hours.

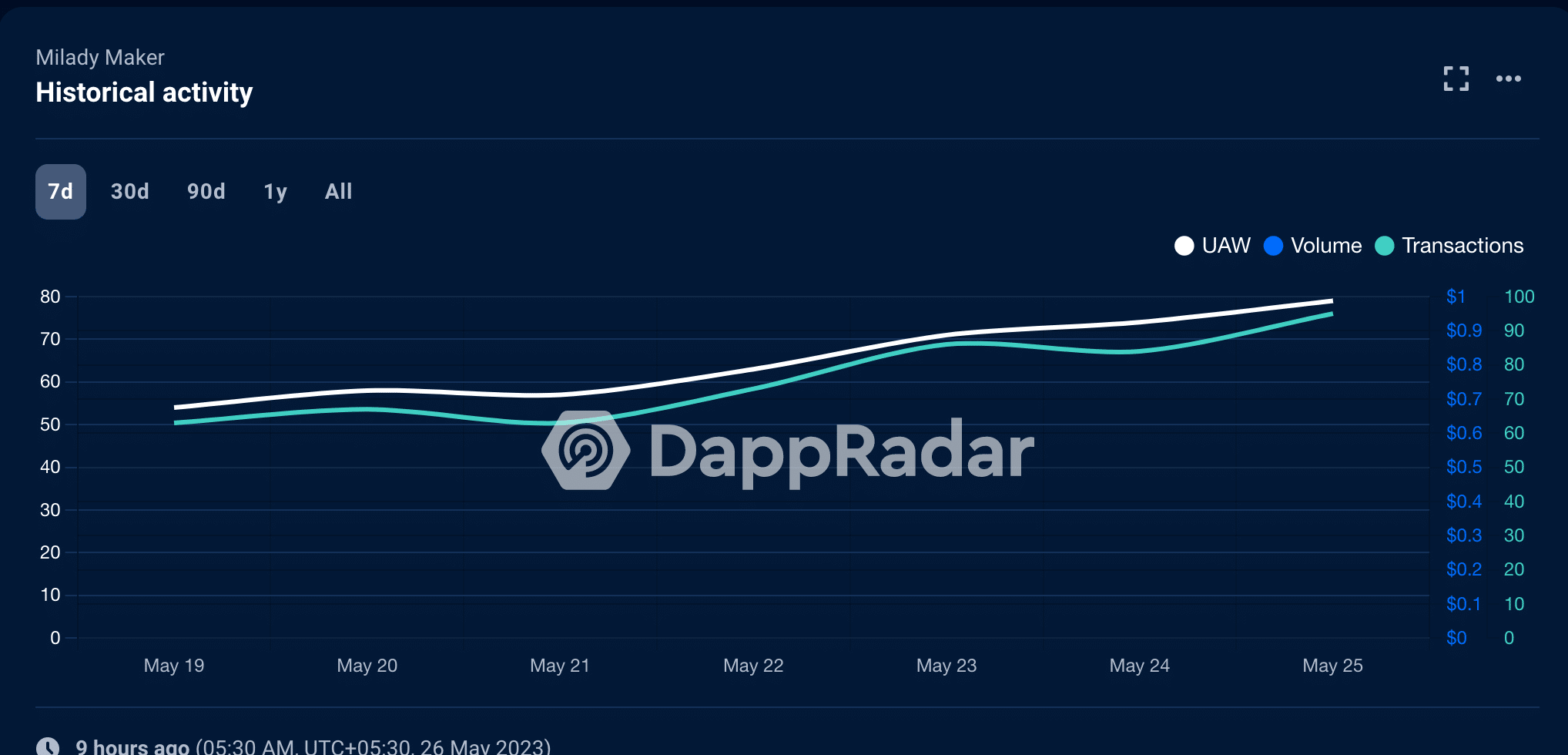

Milady Maker, an NFT collection that recently started gaining popularity, observed similar levels of growth as CryptoPunks. According to Dapp Radar, the overall number of unique active wallets holding Milady Maker increased by 34.31% in the last week.

Ethereum to benefit?

The popularity of these NFTs and their increasing use cases could have a positive impact on Ethereum [ETH]. This is because blue chip NFTs with the highest volume are majorly deployed on the network.

Realistic or not, here’s ETH’s market cap in BTC’s terms

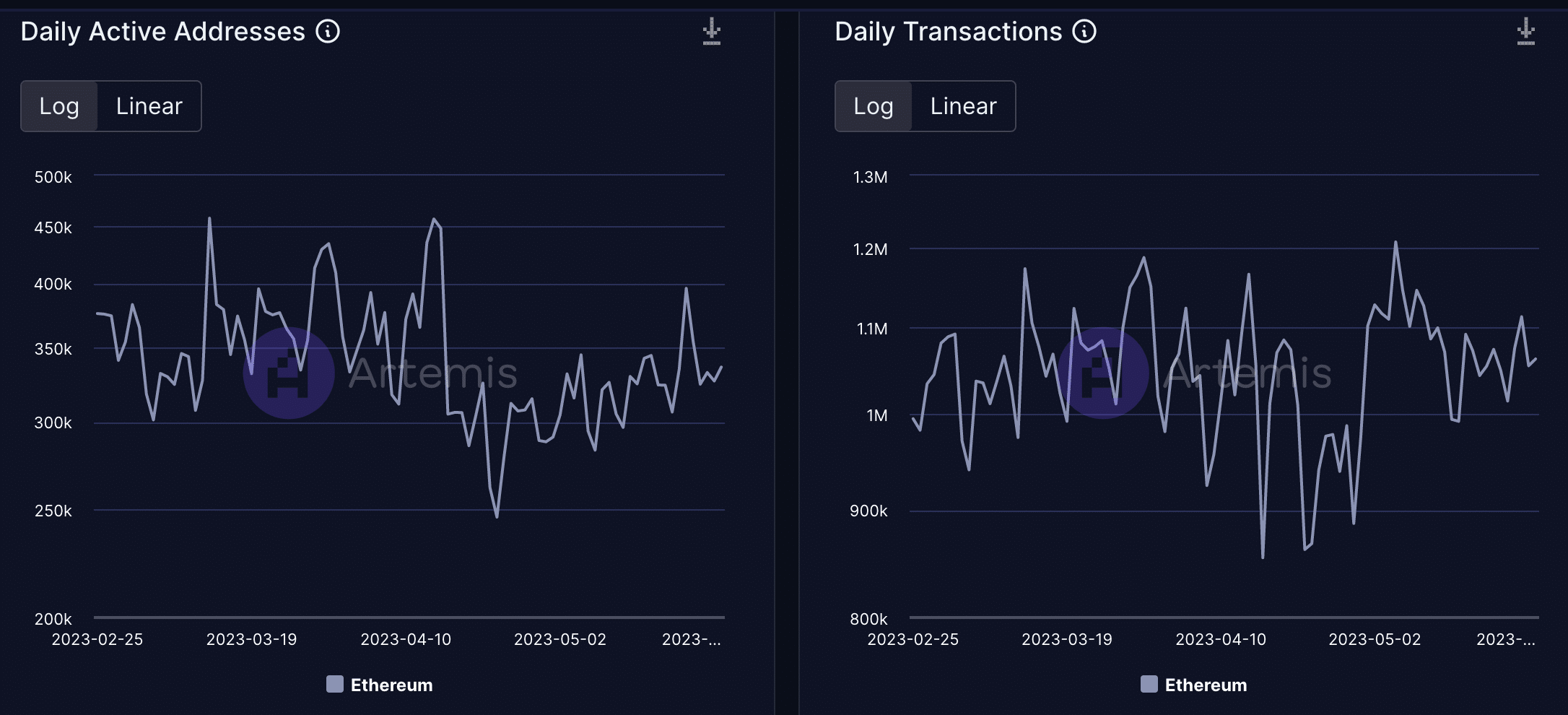

According to Artemis’ data, the number of daily active addresses on the Ethereum network increased from 246,000 to 336,110 in a few weeks. Due to this, transaction activity surged as well.

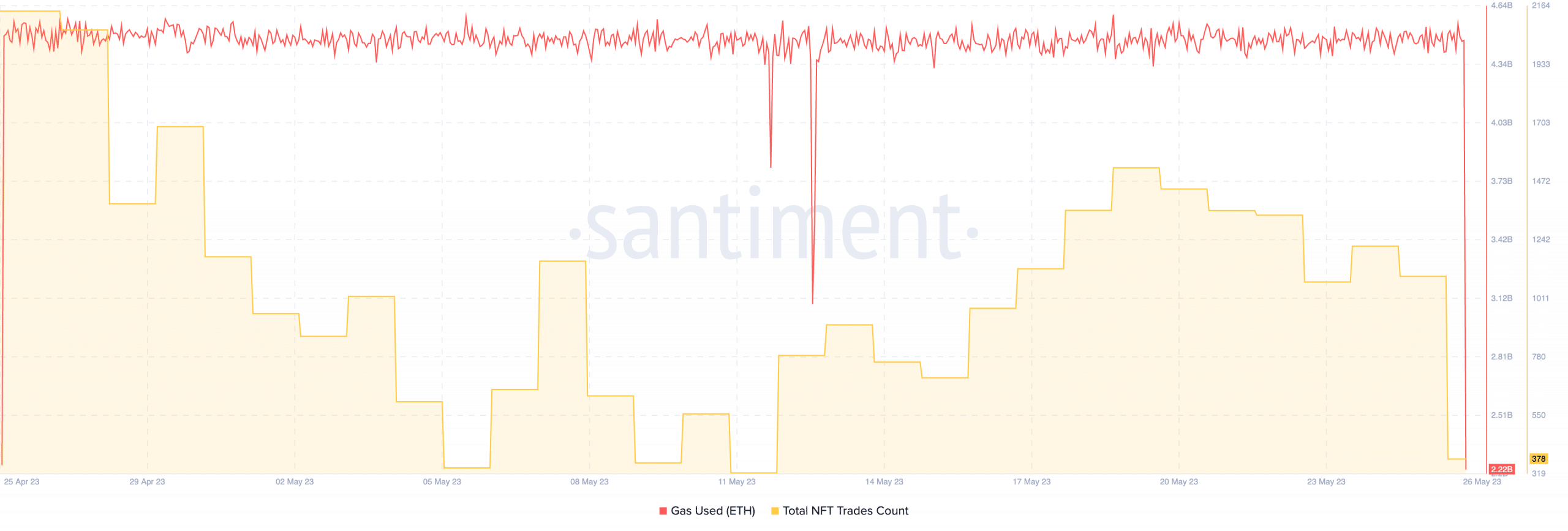

As a result of this rise, gas usage grew in tandem with overall NFT trades. Now, it remains to be seen whether the interest in Ethereum NFTs remains consistent.