How did Bitcoin react to Mt. Gox-linked wallet making a $2B test transaction?

- Mt. Gox’s BTC distribution raises concerns about potential market volatility

- Bitcoin showed some resilience, despite ongoing Mt. Gox asset distributions

In a recent development related to the long-defunct Mt. Gox exchange, blockchain analytics firm Arkham Intelligence reported that a crypto wallet associated with Mt. Gox’s trustee initiated a test transaction involving $2 billion worth of Bitcoin [BTC].

What happened?

This move follows the recent transfer of $3.1 billion in BTC to BitGo, signaling potential preparations for the long-awaited distribution of funds to creditors.

According to Arkham analysts,

“This wallet bc1q26 is likely Bitgo, the 5th and final exchange working with Mt. Gox Trustee to distribute funds to Mt. Gox creditors.”

For those unaware, BitGo is one of the last remaining distribution partners for Mt. Gox. It plays a crucial role as one of the five service providers tasked with distributing tokens to creditors.

This recent test transaction, initiated after the transfer of 33,100 BTC valued at $2.2 billion two weeks ago, underscores the ongoing efforts to prepare for the long-awaited distribution of funds from a Mt. Gox cold wallet holding creditors’ assets.

Why BitGo?

According to Arkham Intelligence, BitGo is likely the recipient of these transactions due to its role as one of the key distribution partners responsible for handling the complex process of returning funds to Mt. Gox creditors.

“The address was clustered with a large input cluster which we were able to identify as BitGo due to custody structure and wallet types used.”

In fact, some users on Reddit have also confirmed suspicions by claiming that they have already received funds in their BitGo accounts.

The story around Mt. Gox

For context, the ongoing distribution of Mt. Gox’s remaining 140,000 BTC and Bitcoin Cash (BCH) to creditors has sparked concerns in the cryptocurrency market, particularly around potential sell-offs by long-waiting creditors.

This event has already affected Bitcoin prices, causing them to dip below $54,000 when distributions began in early July.

With 46,000 BTC still held in Mt. Gox addresses, the sustained release of these funds through authorized exchanges like Bitbank, BitGo, and Kraken could lead to further market volatility. This will depend on how creditors choose to manage their assets.

Impact on Bitcoin

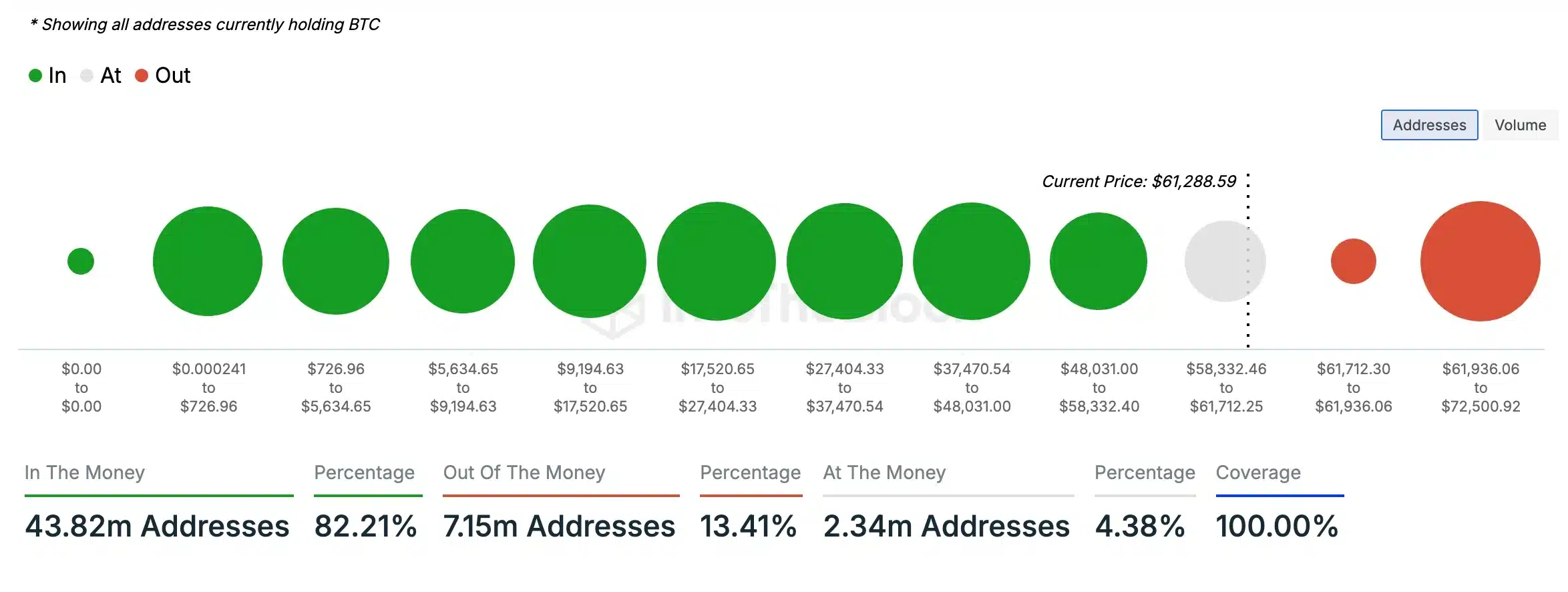

Despite concerns about potential selling pressure, Bitcoin remained resilient on the charts. It was trading at $61,284 at press time, following a 4.61% hike in the last 24 hours.

This price stability can be seen as a sign of strong market sentiment. Especially as 82.21% of BTC addresses are currently “in the money,” with their holdings valued above the purchase price.

On the contrary, only 13.41% of addresses are “out of the money,” indicating limited downside pressure in the market.