Bitcoin

How does Bitcoin’s surge over the S&P 500 impact BTC prices?

Bitcoin surges past $100K, breaking free from S&P 500—analysts hint at a new bull market!

- Bitcoin outpaced the S&P 500 with a 3.7% gain, showing signs of reduced stock market correlation.

- Strong support at $95K-$98K and minimal resistance above $ 104K positioned BTC for potential new highs.

Bitcoin [BTC] showed early signs of decoupling from equities, surging ahead of the S&P 500. As of press time, Bitcoin was priced at $100,839, with a 1.39% increase over the past 24 hours and a 7.16% rise in the last seven days.

This marks an important shift, as analysts suggest that reduced correlation to traditional markets could signal the start of a new bull market.

Bitcoin decouples from S&P 500

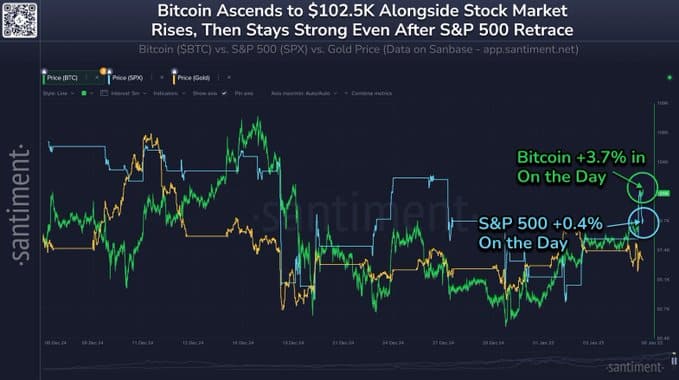

According to Santiment, Bitcoin has begun to outperform the S&P 500 in January 2025. While Bitcoin posted a 3.7% gain in a single day, the S&P 500 recorded a modest 0.4% increase, signaling divergence. Santiment on X (formerly Twitter) stated,

“For most of the past three years, cryptocurrency has been perceived as a ‘high-leveraged tech stock,’ but current data suggests that BTC may break away from stock market fluctuations.”

Historically, crypto markets have experienced their strongest bull runs when they have a low correlation with equities. Analysts believe that if Bitcoin can sustain its momentum and operate independently of macroeconomic factors, it could pave the way for new all-time highs in 2025.

Strong support and minimal resistance levels

Crypto analyst Ali noted that Bitcoin is well above a critical support zone between $95,400 and $98,400, where 1.77 million addresses purchased 1.53 million BTC. This cluster of buyers represents a strong demand zone that could prevent significant price declines.

On the upside, Bitcoin faces minimal resistance, with only 107,000 BTC held by 102,168 addresses between $104,700 and $105,770. Analysts expect further upward movement if BTC breaks through this light resistance zone, as selling pressure remains limited at higher levels.

This positive ratio reflects strong market sentiment, as most holders are confident in Bitcoin’s trajectory.

Rising Open Interest and market activity

Data from Coinglass shows an increase in Bitcoin Futures Open Interest, now at $64.96 billion, up 2.20% daily. Open Interest(OI) has been steadily climbing since mid-2024, aligning with Bitcoin’s price rally and reflecting heightened speculative activity.

Additionally, trading volume surged by 49.82% to $86.96 billion, and options volume jumped 76.78% to $3.54 billion, indicating growing trader engagement.

However, rising OI and leveraged positions can increase the risk of volatility. The BTC Total Liquidations Chart recorded $17.87 million in long liquidations and $2.95 million in short liquidations in the past session.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

This imbalance suggests that overleveraged longs were wiped out during minor price corrections.

With a strong support base and minimal resistance ahead, analysts believe Bitcoin is well-positioned to test new all-time highs if it continues to decouple from traditional markets.