How EigenLayer’s latest move could change BTC staking

- EigenLayer’s latest partnership has brought the liquid BTC restaking feature.

- Its TVL was over $10 billion, at press time.

EigenLayer, Ethereum’s [ETH] largest restaking platform, recently announced its latest Bitcoin[BTC] restaking options.

The option provides yield opportunities for wrapped Bitcoin (WBTC) holders.

The platform announced new features, including yield payouts from node operator P2P.org. Also, it announced staking options for uniBTC, a wrapped BTC variant.

These developments align with a broader trend of increasing demand for Bitcoin yield-generating alternatives as BTC holders seek diversification through staking.

Demand for Bitcoin restaking on EigenLayer rises

On the 4th of November, EigenLayer announced that ARPA Network would soon begin rewarding uniBTC depositors on its platform.

The development allows BTC holders to earn yields while contributing to Ethereum’s decentralized ecosystem.

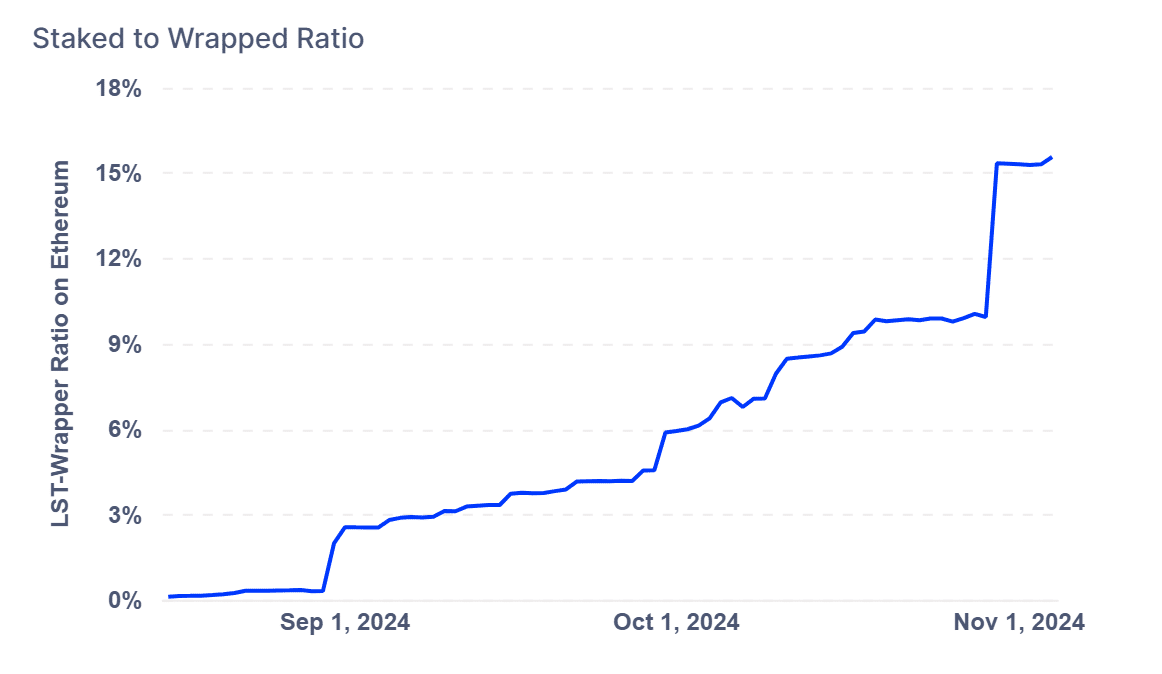

This move represents part of a broader trend, as over 15% of all WBTC is now actively staked across platforms.

This growth highlights the increasing desire for Bitcoin staking options as DeFi continues to expand, with BTC holders eager to leverage decentralized protocols for asset maximization.

Recent charts underscore this shift, with a marked increase in restaked BTC transaction volumes since early August.

The rising weekly transaction figures for WBTC and other wrapped Bitcoin assets reflect the growing appeal of yield-generating opportunities for BTC. This pointed out that staking and yield alternatives are increasingly viewed as viable options for Bitcoin holders.

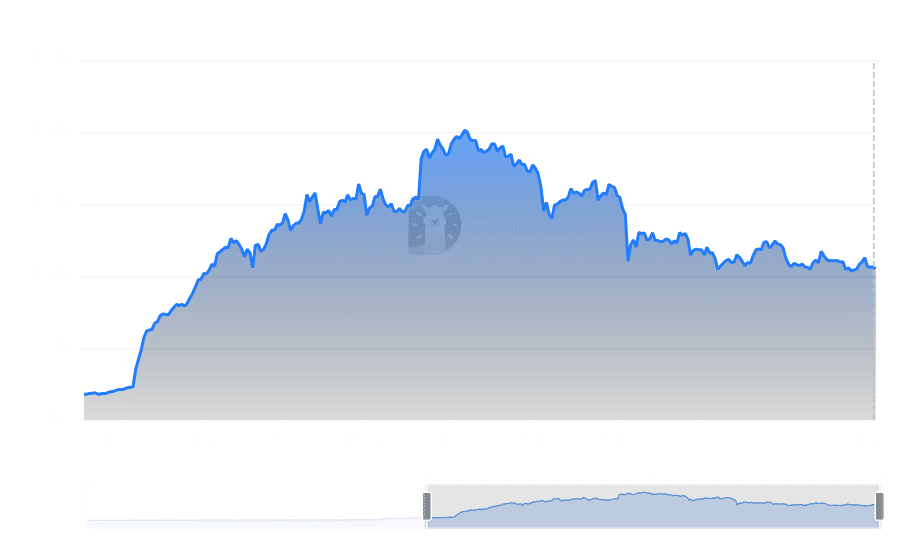

EigenLayer’s TVL maintains decent momentum

EigenLayer’s Total Value Locked (TVL) has shown steady growth, as reported by DefiLlama.

This climb mirrors the heightened adoption of Bitcoin staking solutions, enabling BTC holders to engage in staking activities without liquidating their assets.

EigenLayer bridges a gap for those looking to earn returns on Bitcoin holdings. This strategy supports the platform’s upward trajectory in total assets locked.

Price analysis: EIGEN token outlook

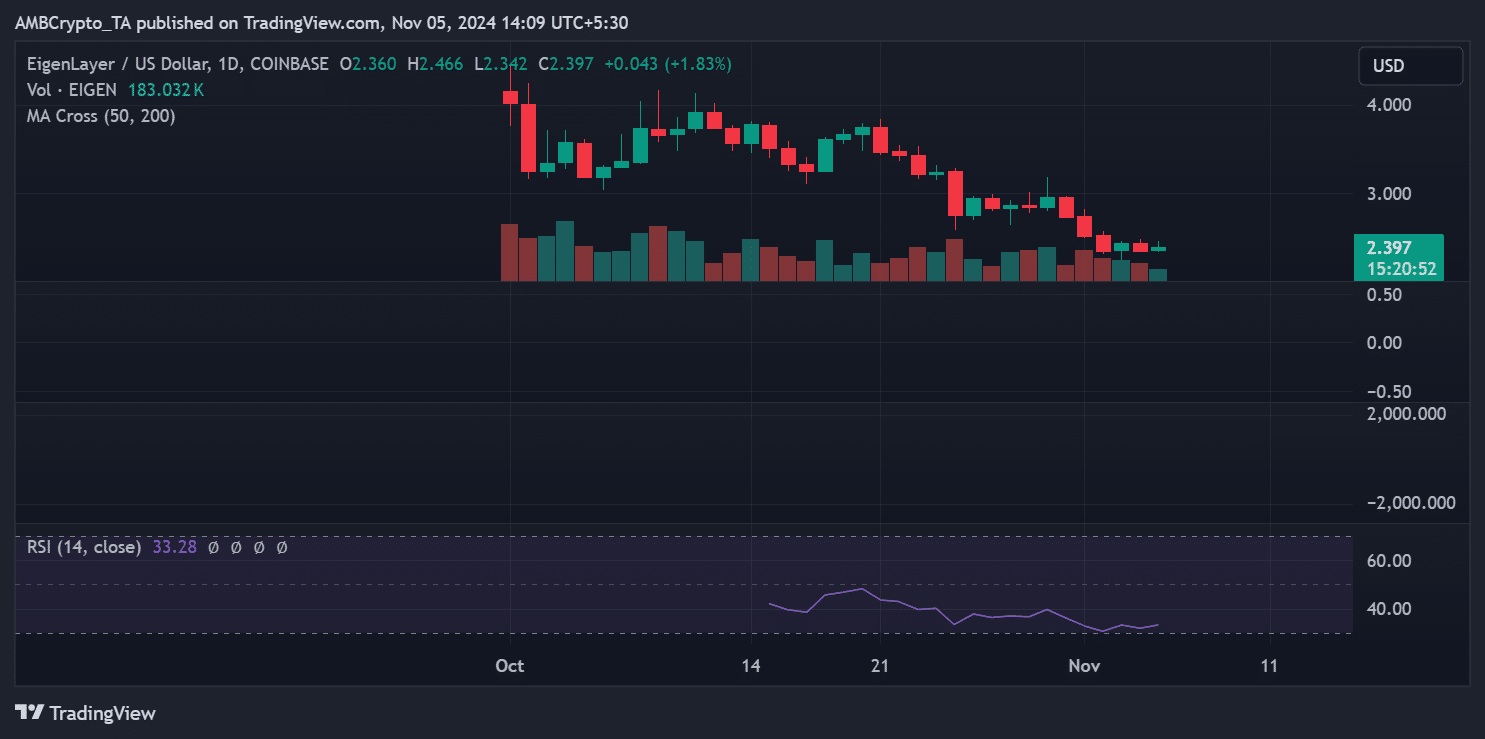

Regarding EigenLayer’s native token, EIGEN, recent activity has indicated price consolidation.

At press time, the coin was trading around $2.39, EIGEN’s price movements reflect both market sentiment and platform-specific growth.

At the time of writing, the Relative Strength Index (RSI) for EIGEN was near 33, suggesting that it is close to oversold levels.

This could potentially present a buying opportunity if the downward pressure stabilizes.

The trading volume for EIGEN has seen modest fluctuations but remains stable overall.

If EigenLayer’s expanded Bitcoin restaking options attract more BTC holders, EIGEN’s value may experience upward pressure.

This could potentially surpass its resistance level near the $2.50 mark.

Is your portfolio green? Check out the EigenLayer Profit Calculator

The platform’s recent updates offer Bitcoin holders new ways to explore yield-generating options without parting with their holdings. With potential further adoption, the coming months could determine if these enhancements will translate into sustained growth for EIGEN.

This could solidify EigenLayer’s role as a key player in Bitcoin staking within the DeFi ecosystem.