How ETH holders scrambled for shelter following CFTC’s ‘commodity’ proscription

- ETH’s supply outside of exchanges reached an all-time high.

- Increase in adoption has been challenging since the token was called a commodity.

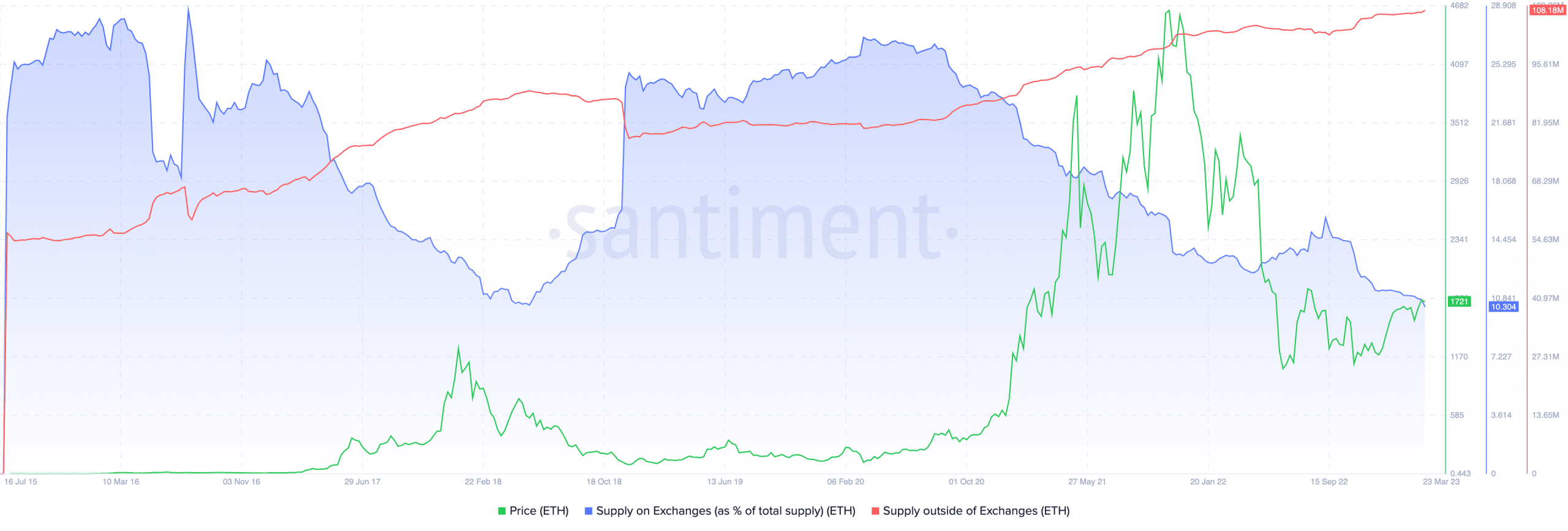

The number of Ethereum [ETH] held in self-custody reached its highest for the first time since the cryptocurrency became public in 2015, Santiment disclosed. At the time of writing, this number was 101.18 million, despite experiencing some drawbacks in September 2022.

Is your portfolio green? Check the Ethereum Profit Calculator

Without fail, the ETH supply on exchanges reached an all-time low, closing at 10.30%. A situation like this implied that holders of the altcoin were confident in its long-term relevance, with a possible positive effect on the price action. However, the same measures reflected the skepticism investors may have towards keeping assets on exchanges.

Breaking down the aftereffects

The development arose after the U.S. Commodity Futures Trading Commission (CFTC) accused Binance of breaking the country’s financial laws. Before the latest indictment, a number of exchanges were mounted with pressure as regulators seem in lurking mode.

However, ETH was not left out of the picture. The SEC seemed resolute in its position to proscribe assets under the Proof-of-Stake (PoS) consensus as securities. But the CFTC had a different opinion about the cryptocurrency, as it called ETH a commodity in a statement made by Chairman Rostin Behnam.

.@CFTC Chair Rostin Behnam Says Stablecoins Are Commodities At Senate Agriculture Hearing https://t.co/g4jnFsSFkc @SenGillibrand pic.twitter.com/0Zg9ULZvVs

— blockchain tipsheet (@blockchaintpsht) March 8, 2023

ETH’s self-custody ATH might come as a shock, as other cryptocurrencies, including Bitcoin [BTC], had recorded high numbers. One undeniable factor that could have impacted the rise was Vitalik Buterin’s response to the FTX issue last November.

At that time, the Ethereum founder discussed the idea of non-custodial Centralized Exchanges (CEXs) while rooting for users to look in the Decentralized Exchanges’ (DEXs) direction.

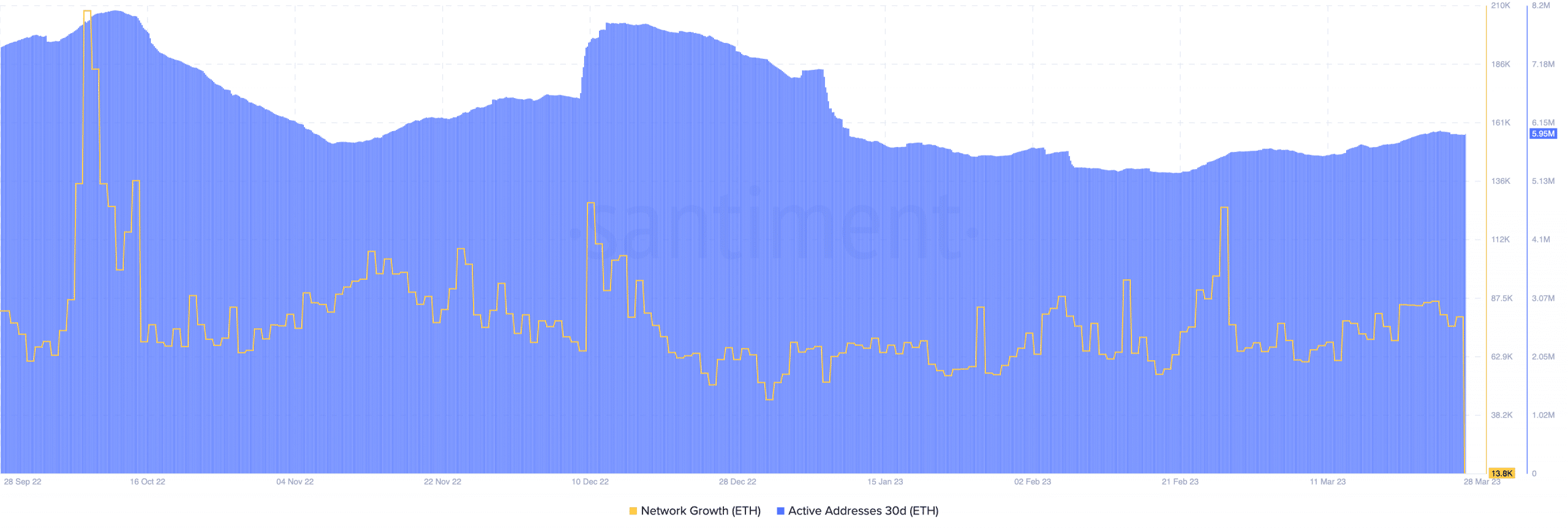

Despite the conviction displayed by ETH holders, the project’s network growth took a sharp dump in the last 24 hours. The metric shows the number of new addresses being created daily on a network.

Hold in traction, but ETH validators have a task

At press time, ETH’s network growth was down to 13,800. This implied that new entries were low, and Ethereum’s user traction was struggling. But there was a minute compensation for the blockchain with the state of the active addresses.

Read Ethereum’s [ETH] Price Prediction 2023-2024

According to the on-chain analytic platform, there was a 467,000 rise in active addresses in the last 24 hours. This helped the 30-day performance of the metric to hit 5.95 million. The hike represents an increase in transactions on the Ethereum blockchain by already existing addresses.

Meanwhile, there has been a new update to the Shanghai upgrade as Prysmatic Labs announced a necessary node and validator operation. The core implementation team of the Ethereum PoS noted that failure to do such could lead to a fork in the chain or loss of rewards.

Announcing v4.0.0 for the upcoming Shapella upgrade!

This release is mandatory for all the mainnet beacon nodes and validators. You must upgrade before April 12. See release notes for further detail.https://t.co/75tpgP50Ry

— Prysm Ethereum Client (@prylabs) March 27, 2023