Bitcoin

How Ethereum HODLers pegged Bitcoin to second place

There are a number of reasons for the change in the Bitcoin and Ethereum holder count. But the fundamentals, use cases, and developmental trajectories topped the list.

- The number of ETH long-term holders surpassed BTC by more than 40 million.

- Bitcoin’s inability to offer a plethora of use cases contributed to the switch.

As the top two most valuable cryptocurrencies, Bitcoin [BTC] and Ethereum [ETH] have not had to deal with any strong competition to yank them off the standings. However, there has been a change in the way market participants view both assets.

Realistic or not, here’s ETH’s market cap in BTC terms

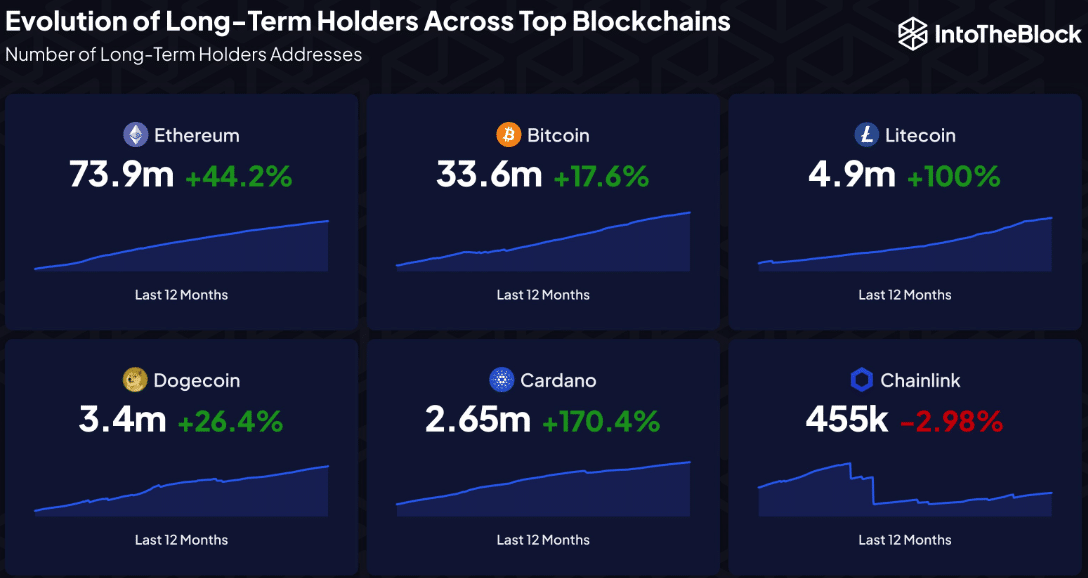

Bitcoin, being the foremost cryptocurrency, was the asset with the most long-term holders at one point. However, according to a recent infographic by IntoTheBlock, Ethereum has flipped the king coin with an over 40 million difference.

IntoTheBlock noted that Ethereum has 73.9 million long-term holders. Bitcoin, on the other hand, has 33.6 million HODLers. Although both cryptocurrencies registered increases in the metric on a Year-on-Year (YoY) basis, Ethereum led again with a 44.2% increase.

But how has this occurred? Well, there are a number of reasons for the change. And the top of the list has to be the fundamentals, use cases, and developmental trajectories of both projects.

BTC stays true to the core, ETH evolves

For Bitcoin, it has maintained its position as a peer-to-peer payment network and store of value for its holders. However, Ethereum has continued to evolve since Vitalik Buterin’s 2013 whitepaper. At that time, the Ethereum c0-founder only explained the blockchain as a model of building decentralized Applications (dApps).

While the dApp development was mostly done on the Ethereum mainnet, the advent of creating other layers on the blockchain brought about an increase in interaction with ETH.

For instance, Ethereum has also solidified its position as the building block of Decentralized Finance (DeFi), game development, and Non-Fungible Tokens (NFTs).

Although the second-largest blockchain has not yet been able to scale as much as Bitcoin in terms of transaction costs, the development of scalable solutions under it has been able to attract more holders of ETH.

When it comes to price action, BTC has obviously been the better asset since it existed long before the arrival of ETH. According to CoinMarketCap, ETH’s all-time performance was a 61,363.72% hike. BTC, however, could boast of a 44.22 million all-time increase.

Attracting holders with their desires

However, in recent times, the adoption of cryptocurrency has not been limited to price action alone, especially in seasons where the market condition isn’t exactly favorable.

At the same time, developments that suit the desires of market participants have played a part, and Ethereum seems to have won in this regard. Notable examples are the Merge and the Shapella upgrade which provided validators access to stake and unstake at any given period.

Regarding NFTs, the Ethereum blockchain proved to be the star of the season during the 2021 bull cycle. One must admit that these collectibles impact the adoption ETH has seen to date.

This year, some developers on the Bitcoin network tried making NFTs mainstream on the blockchain. But after a period of impressive adoption through Bitcoin Ordinals, the hype dwindled.

How much are 1,10,100 ETHs worth today?

And at press time, Ethereum NFT sales have totally outclassed its Bitcoin counterpart, based on CryptoSlam’s data.

As it stands, it may be challenging for the number of Bitcoin holders to flip Ethereum. However, the possibility may not yet be gone. But it could depend on a number of factors including retail and institutional adoption, regulatory policies, and undoubtedly, price action.