How Ethereum scaling solutions continue to grow despite market volatility

- The total transaction count was 3x more than the bull market peak of 2021.

- The upcoming EIP-4844 upgrade could be the game changer for L2s.

Ethereum [ETH] layer 2 ecosystem has been a beehive of activity in 2023, with new scaling solutions getting onboarded to this already crowded ecosystem on a daily basis. Given their significance and proven track record of unburdening the base layer, it would be tough to imagine a future without the L2s.

How much are 1,10,100 OPs worth today?

Onwards and upwards for L2

Over the years, Ethereum has seen an extraordinary increase in user base and network traffic, spurred by the emergence of the decentralized finance (DeFi) and non-fungible token (NFT) verticals. This massive growth exerted capacity constraints on Ethereum, ultimately resulting in very high transaction fees.

And then came the L2 solutions. These chains, built atop the base layer Ethereum, process a large number of low-value transactions and submit the proof to the main blockchain. In this way, Ethereum handles security and decentralization while L2s provide scalability, thus solving the biggest trilemma of blockchain technology.

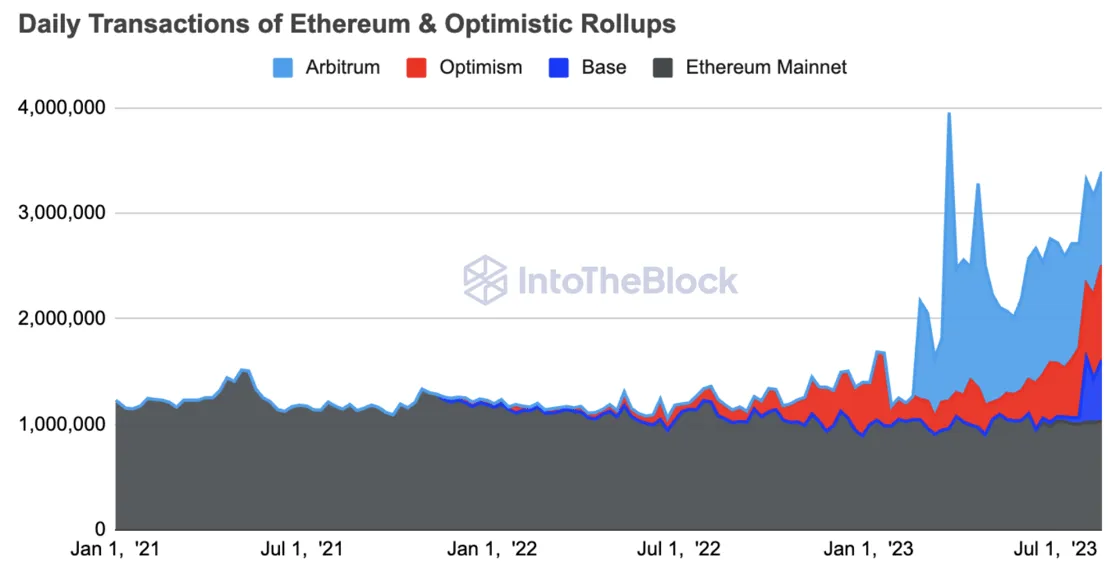

As per a report by on-chain research firm IntoTheBlock, the transactions processed between Ethereum and the major optimistic rollups like Optimism [OP] and Arbitrum [ARB] and the recently-launched Base, hit their second-highest level ever in the last week.

The all-time high (ATH) was attained in March earlier this year. This was when $1.7 billion in ARB tokens was distributed to users as part of the AirDrop.

The current frenzy could be ascertained by the fact that the total transaction count was nearly three times more than the bull market peak of 2021. Most of the network traffic at that time used to happen on the mainnet.

However, the rise of L2s didn’t result in lowering Ethereum’s dominance. The report highlighted that the L1 still handled approximately 1 million transactions on a daily basis, unchanged from last year.

All ‘Base’s covered

Base, the latest entrant to the red-hot world of scaling solutions, has been the talk of the town since its debut. Built on the same infrastructure as that of Optimism, Base is part of the ambitious Superchain ecosystem.

Base surpassed both Arbitrum and Optimism in terms of daily transactions immediately after its mainnet launch. Although it quickly fell back, the Coinbase-backed L2 still averaged 450k transactions over the last week.

Moreover, the scaling solution zoomed past some of its seniors like Starknet and Polygon zkEVM to hit a total value locked (TVL) of $230 million at the time of writing. Data from L2Beat revealed a 14.5% growth over the last week.

Optimism all over

The fight for the crown jewel of Ethereum L2s intensified in recent months. The launch of the Bedrock upgrade made Optimism more affordable than Arbitrum, grabbing the attention of a lot of users and developers.

In the last week, Optimism surpassed Arbitrum in daily transactions for the first time in 2023. Apart from the Bedrock upgrade, the launch of Worldcoin [WLD] tokens on Optimism helped in boosting the overall transaction count.

Additionally, a portion of the fees collected through transactions on Base are shared with the Optimism DAO. A combination of these factors aided in establishing a buffer for the governance token OP amid market turmoil. Unlike ARB, which recorded double-digit losses over the past week, OP was down just 5.3% over the past week, per CoinMarketCap.

Arbitrum still king of DeFi

While Base and Optimism grew in prominence, Arbitrum still remained the first choice for DeFi investors due to its massive liquidity. At press time, Arbitrum had a TVL of roughly $5.6 billion, more than twice that of the second-ranked Optimism.

In fact, Arbitrum had more liquidity than many top L1 blockchains like Solana [SOL] and Cardano [ADA], per data from DeFiLlama.

Is your portfolio green? Check out the Arbitrum Profit Calculator

Undoubtedly, 2023 has proved to be the moving year for L2 scaling solutions. With even publicly-listed companies like Coinbase throwing their hat in the ring, enthusiasts are hopeful that these networks would create the pathway for global adoption of blockchains and cryptos.

In this regard, the upcoming EIP-4844 upgrade is crucial. The scalability improvement, intended to achieve 10-100x cost savings from Ethereum, could prove to be just what the doctor ordered for L2s.