How U.S. exchanges lost market share after regulatory clampdown

- Binance.US saw its market share plummet to 1%, from an all-time high of 27% recorded recently.

- The dearth of liquidity was reflected in the sharp uptick in BTC outflows from Binance.

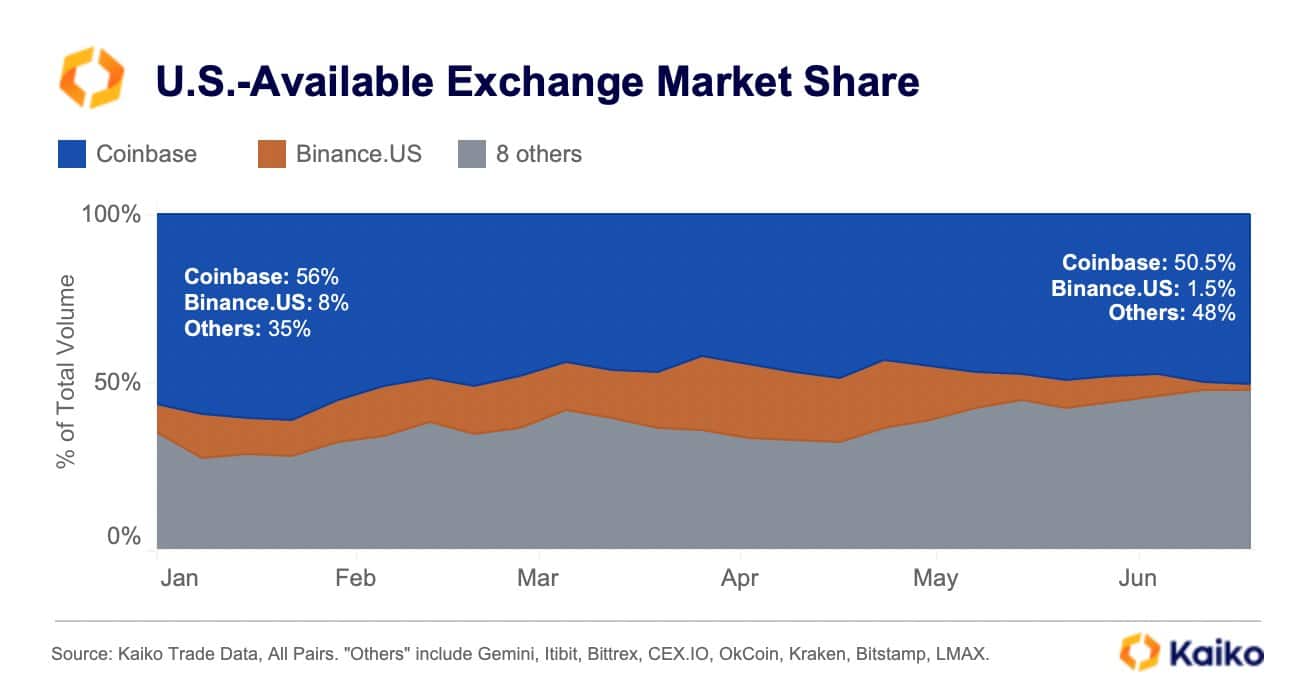

The crypto exchange market in the U.S. has been severely impacted by recent clampdown by regulators. Lawsuits against juggernauts Binance and Coinbase triggered a radical shake up of individual exchange market share of volume relative to competition.

As per a tweet by crypto market data provider Kaiko dated 20 June, Binance.US, the American arm of Binance, saw its market share plummet to 1%, from an all-time high of 27% recorded few months ago. This also marked a considerable drop on a year-to-date (YTD) basis. The market share of Binance.US at the start of 2023 was 8%.

On the other hand, the largest crypto exchange in the country, Coinbase saw its dominance fall from 56% at the start of 2023 to 50%.

Market makers desert exchanges

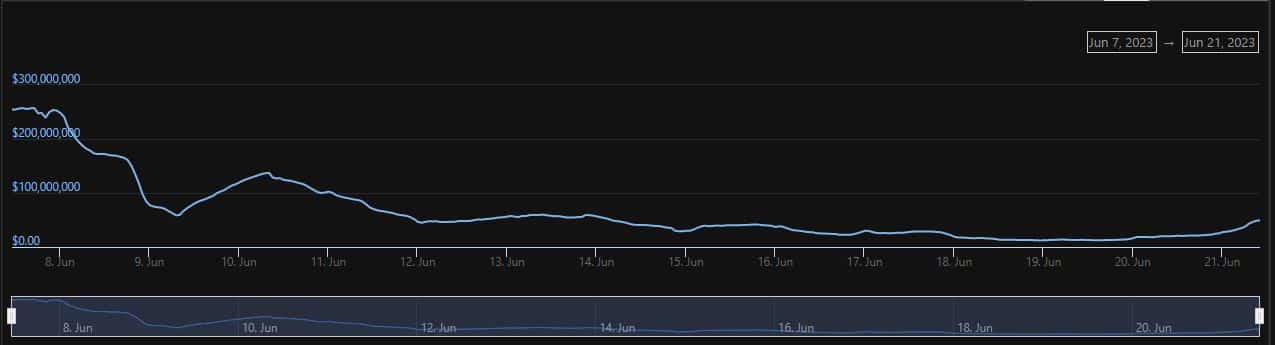

Binance.US has been one of the biggest victims of the entire episode as a large-scale exodus by jittery market makers and traders sucked liquidity out of the trading platform. According to CoinGecko, the daily spot volume on the exchange collapsed more than 80% since the lawsuit by U.S. Securities and Exchange Commission (SEC).

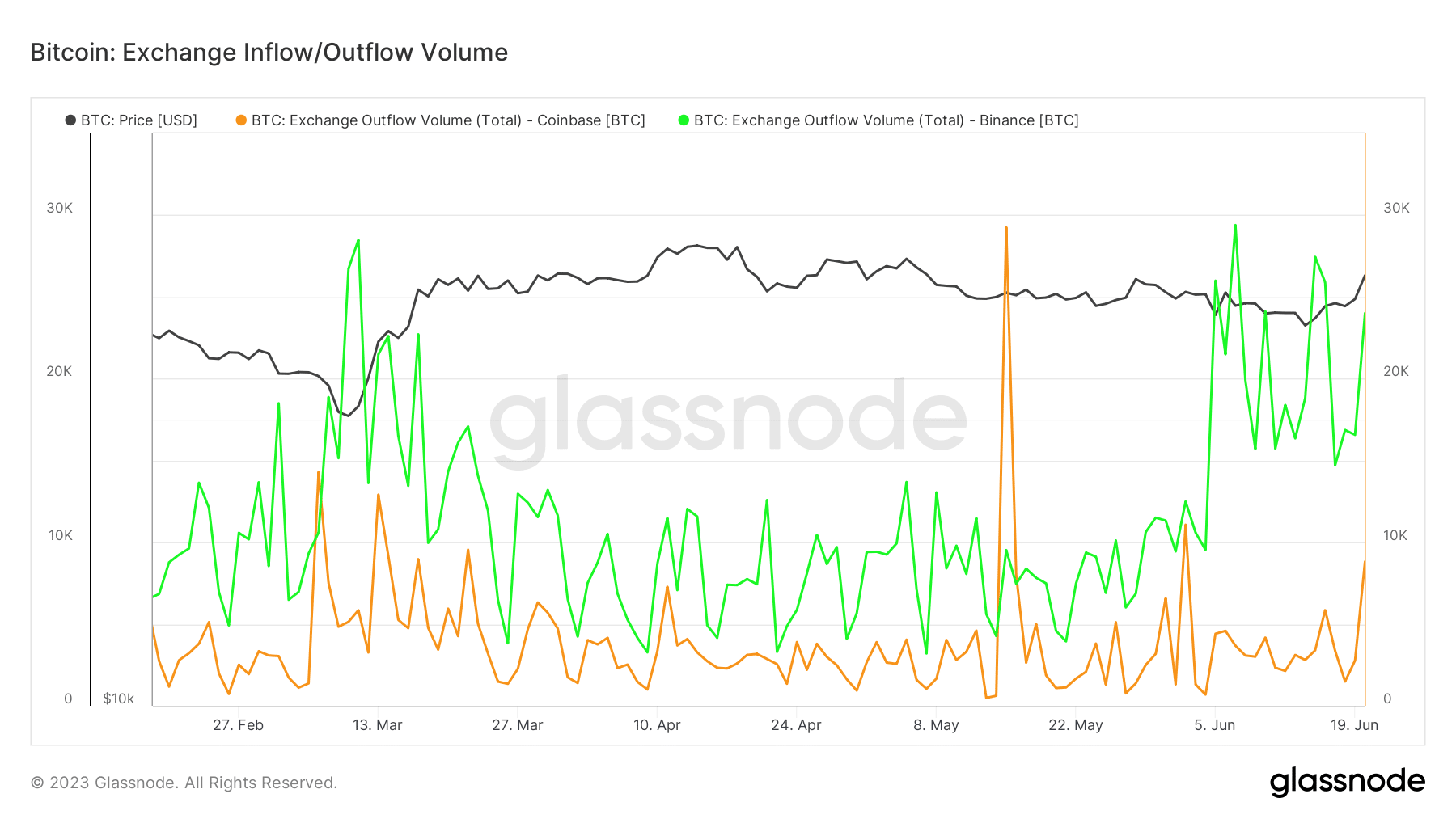

After the exchange’s decision to transition into a crypto-only platform and suspend USD trading, many investors rushed to cash out their Bitcoin [BTC], further impacting trading volumes. The dearth of liquidity was reflected in the sharp uptick in BTC outflows from Binance since 5 June, per Glassnode.

Additionally, the flight of BTC from Coinbase accelerated as well since the start of the week with investors withdrawing more than 8,000 BTC tokens from the exchange on 20 June.

The jump in withdrawals boosted the trading activity on Coinbase. However, at a broader level, the daily spot volumes on the exchange have been on a decline.

Are DEXes filling the void?

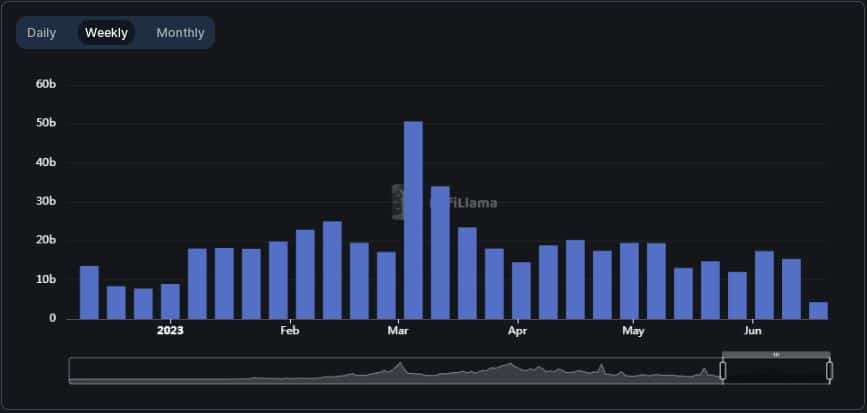

As per conventional belief in the crypto space, declining activity on CEXes is seen as a result of investors’ preference for self-custody and switch to decentralized exchanges (DEXs), something which was evident following FTX collapse. However, only the first part seemed to be true as per the prevailing trend.

According to DeFiLlama, weekly trading volume across non-custodial exchanges plunged 71% as of 18 June. The drop indicated that a wider market FUD was at play. Traders were leaning towards accumulation and HODLing.