How HYPE traders are positioning themselves for a potential market breakout

- At the time of writing, HYPE’s trading volume on decentralized exchanges continued to rise, alongside a surge in TVL.

- There was also a confluence between a key support zone and the lower band of the Bollinger Bands.

Following a week-long decline of 12.17%, Hyperliquid [HYPE] has started to recover, posting a 2.22% gain in the past 24 hours.

Though this is a modest increase, AMBCrypto’s analysis suggests that market sentiment favors a stronger rally in the near term.

Positive momentum for HYPE

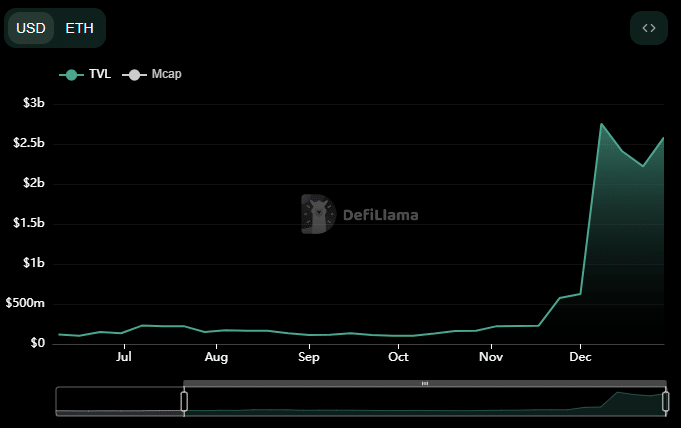

At press time, HYPE’s decentralized exchange (DEX) trading volume and Total Value Locked (TVL) have shown significant increases, a sign of healthy development within the ecosystem.

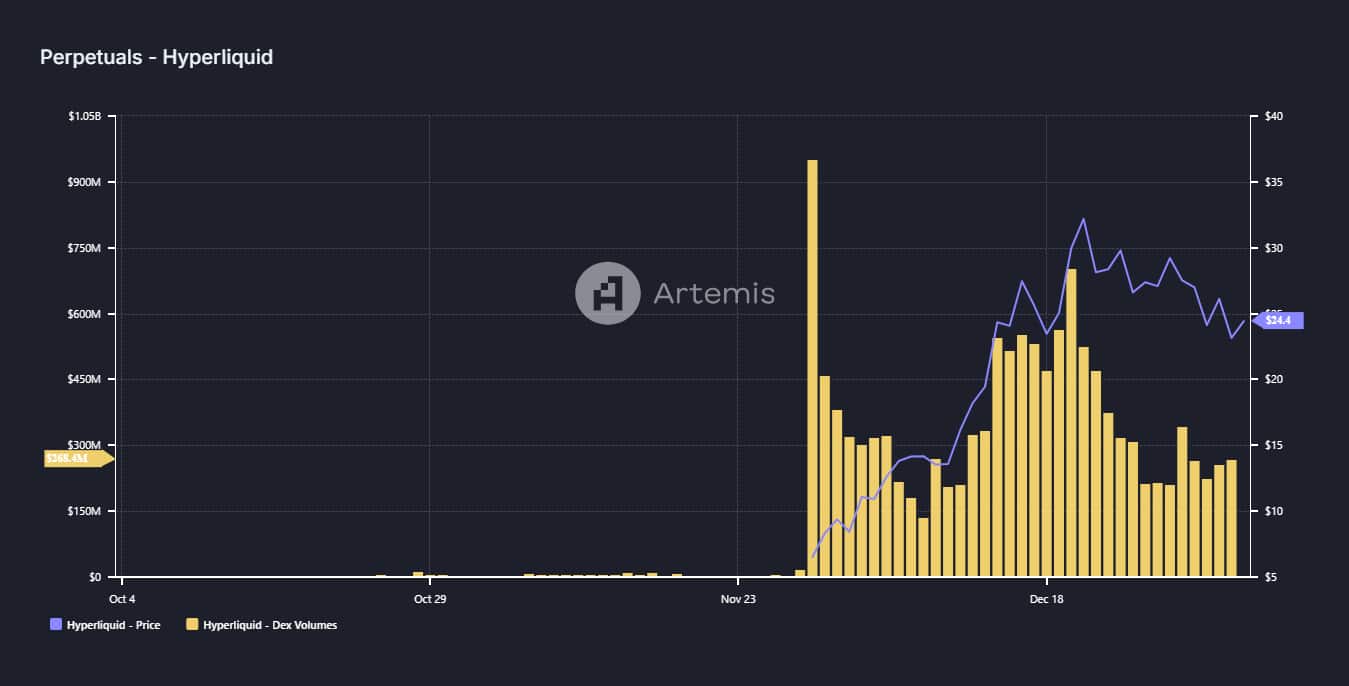

DEX trading volume, which measures the amount of HYPE transacted within a specified period, has begun to climb following a brief decline during the holiday period.

According to the latest data from Artemis, the trading volume was $268.4 million at press time, up from a low of $225.5 million.

This increase in volume, accompanied by a rise in price, often indicates a bullish trend. The chart’s blue line, representing price, reflected this upward movement.

Similarly, the weekly TVL—a measure of liquidity inflows and outflows within HYPE’s protocols—has surged. As of press time, TVL has risen to $2.582 billion, recovering from a drop to $2.221 billion on the 22nd of December.

The current conditions present a strong buying opportunity for investors, supporting the likelihood of continued upward momentum in the market.

Key chart alignment: A potential surge for HYPE

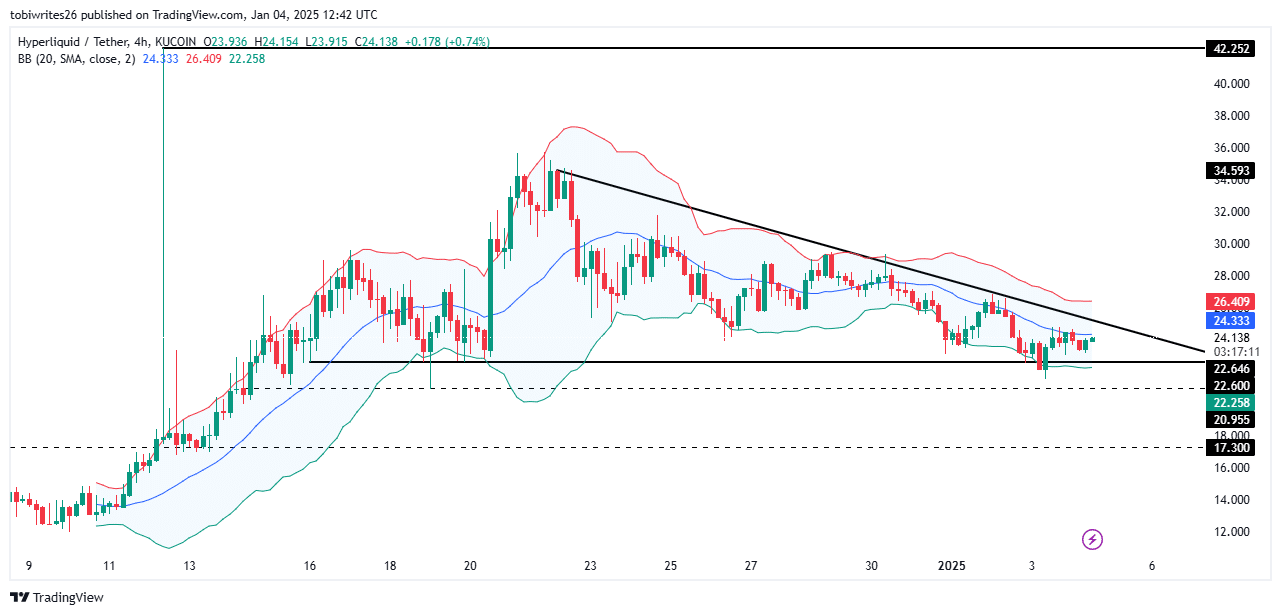

A key confluence has emerged on the chart at press time, as HYPE’s support level within its bullish structure aligned with a critical level—the lower band of the Bollinger Bands (BB) indicator.

The chart showed the formation of a bullish triangle pattern, suggesting a likely upward price movement.

HYPE’s price has since dropped to the support level of this pattern at $22.646, a level that historically triggers rallies.

This support level also aligns with the lower band of the Bollinger Bands—a technical indicator comprising three components: the upper band (red), the lower band (green), and the middle band (blue), which represents a moving average.

A price drop to the lower band often shows oversold conditions and the potential for a rebound.

HYPE appears to be following this trend, with a bounce already underway. Strong momentum at this level could push the asset higher, breaking the resistance line of the bullish triangle.

If buying momentum continues to strengthen, HYPE could rally further, potentially reaching its previous all-time high of $42.

Exchange traders turn bullish

According to the Long/Short Ratio on Coinglass, which is used to determine whether there are more buyers than sellers in the derivatives market, HYPE was seeing strong bullish sentiment at press time.

A ratio above 1 indicates a bullish market, while a value below 1 implies bearish conditions.

Coinglass reported that OKX traders were overwhelmingly bullish on HYPE, with a Long/Short Ratio of 7.78.

This indicated a higher number of long contracts compared to short contracts, reflecting strong buying interest and supporting HYPE’s upward momentum.

Read Hyperliquid’s [HYPE] Price Prediction 2025–2026

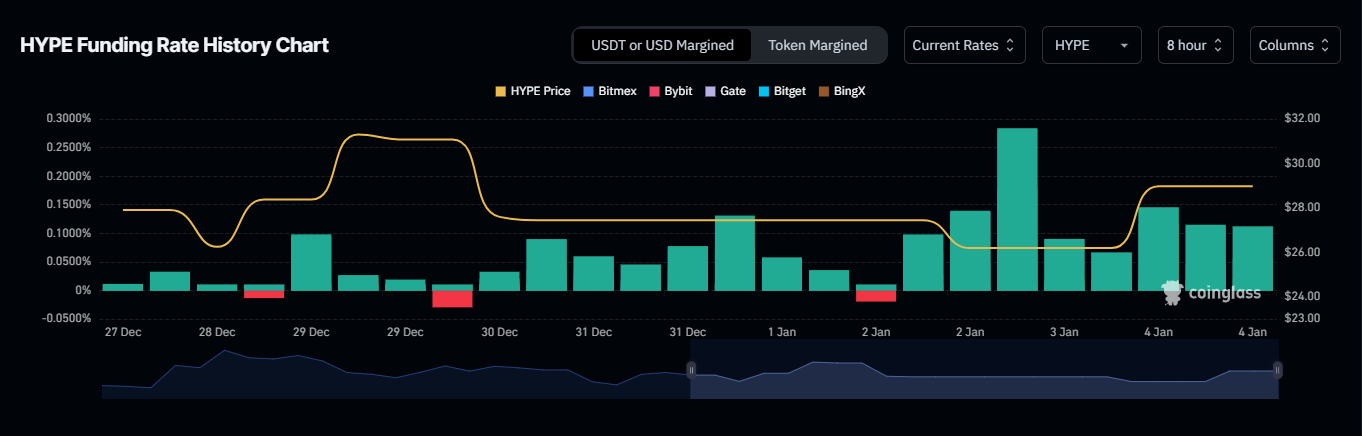

This bullish trend is further confirmed by a sufficiently high Funding Rate, another key indicator that tracks the balance of long and short positions in the market.

The press time Funding Rate of 0.0734% suggested that bulls dominated the market, as they were paying a relatively high premium to maintain the disparity between the spot and Futures prices of HYPE.