Can Lido [LDO] maintain its dominance despite declining APR?

![Can Lido [LDO] maintain its dominance despite declining APR?](https://ambcrypto.com/wp-content/uploads/2023/02/ciro-di-lauro-eylnE68kyZ8-unsplash-e1677061233309.jpg)

- Lido sees improvements in many areas.

- Prices of LDO and Lido’s APR fell.

Lido [LDO] has been dominating the DeFi space for a while. Over the last week, it even furthered the improvements on its protocol in several areas. However, its declining APR may cause trouble for the protocol in the future.

Is your portfolio green? Check out the Lido Profit Calculator

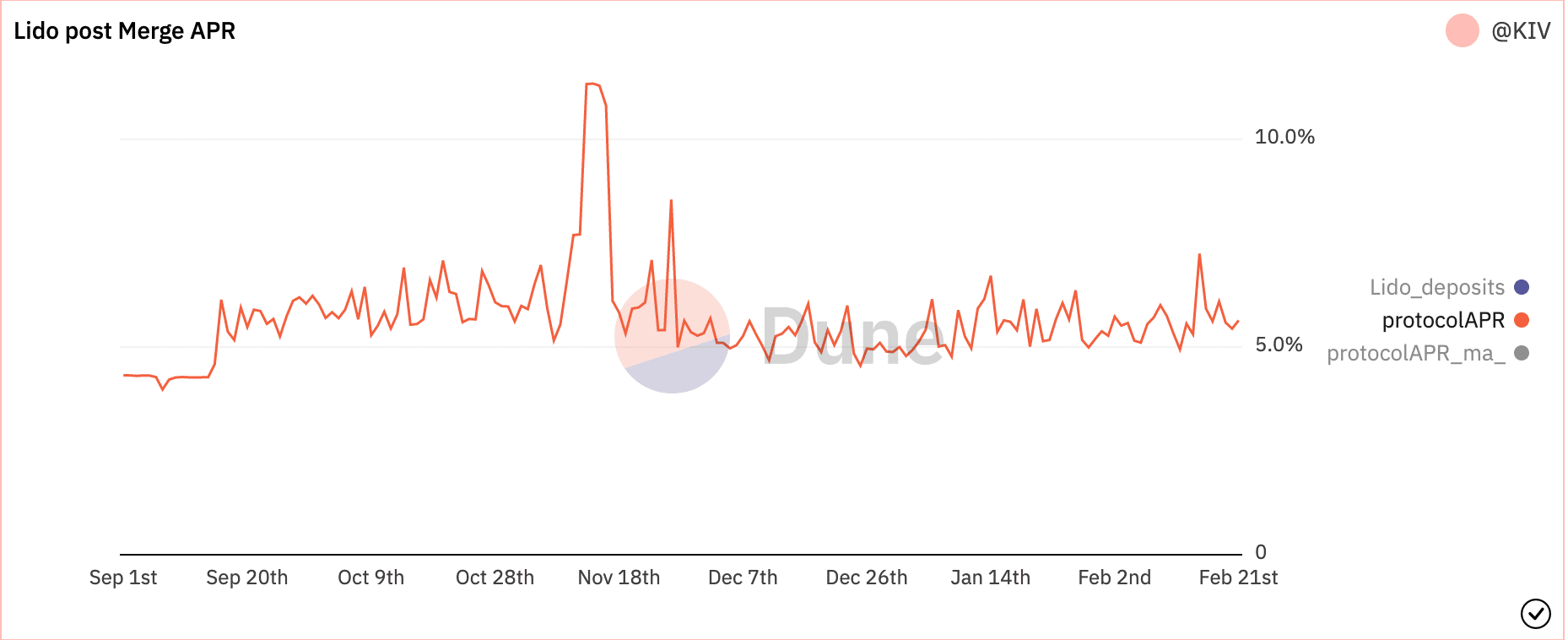

According to Dune Analytics’ data, the overall APR generated by Lido for its users has fallen from 7.2% to 5.6% over the past few weeks. A decline in APR could incentivize the users of the protocol to seek other alternatives to stake their ETH.

Lido stays unaffected

Despite this decline in APR, the Lido protocol has seen progress. In terms of TVL, the Lido protocol observed a surge of 11.89%. One reason cited for the spike in TVL was the surge of Ethereum’s [ETH] price over the last week.

Along with Lido’s TVL, the number of deposits on the network also witnessed growth. According to Lido’s data, Lido has a 44.8% share in weekly new ETH deposits. But it is not just ETH deposits where Lido showed improvements. The number of Wrapped stETH [wstETH] on both lending pools and L2 solutions also grew during the last week.

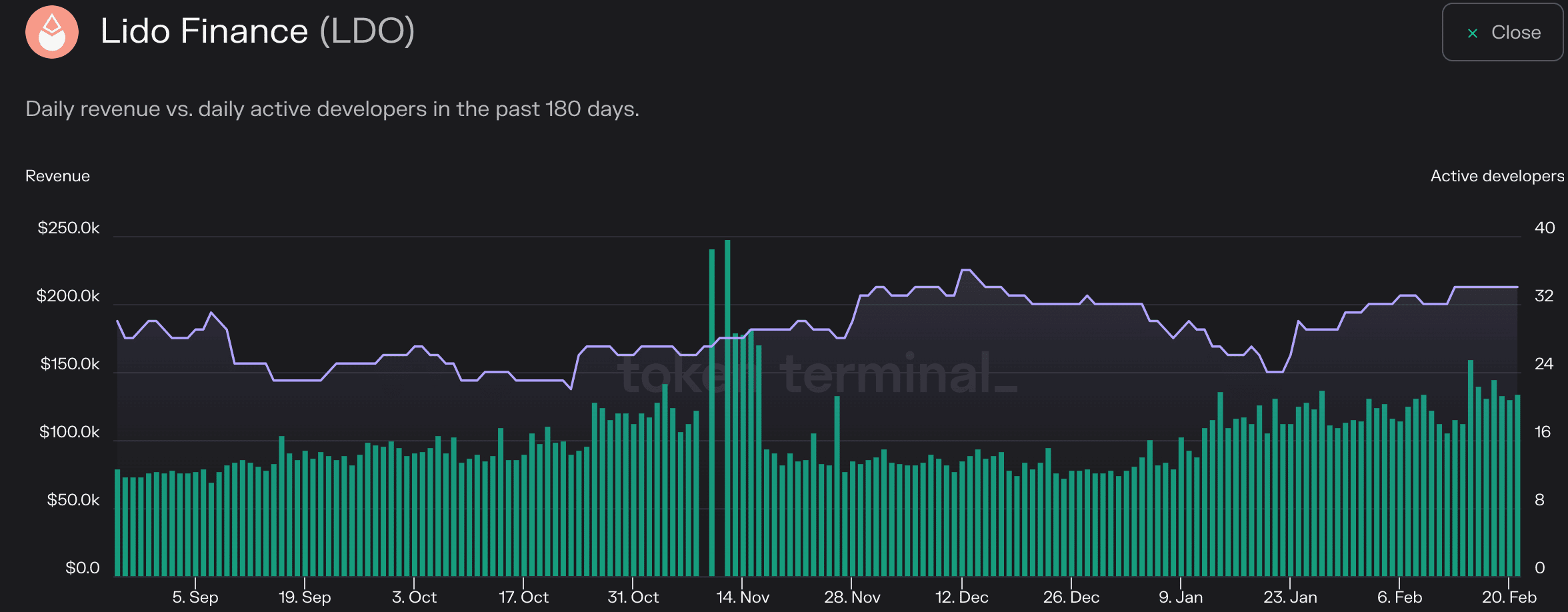

These developments aided Lido in generating even more revenue. According to Token Terminal, the revenue generated by Lido increased by 30.7% over the last month. It seemed that this revenue that was being generated by Lido was being put to good use. This was showcased by the increasing number of active developers on the Lido protocol.

A high number of active developers on the protocol suggested that the number of contributions being made to Lido’s team to its GitHub had increased. This surge in development activity could suggest future upgrades and updates to the Lido network.

Not all good news

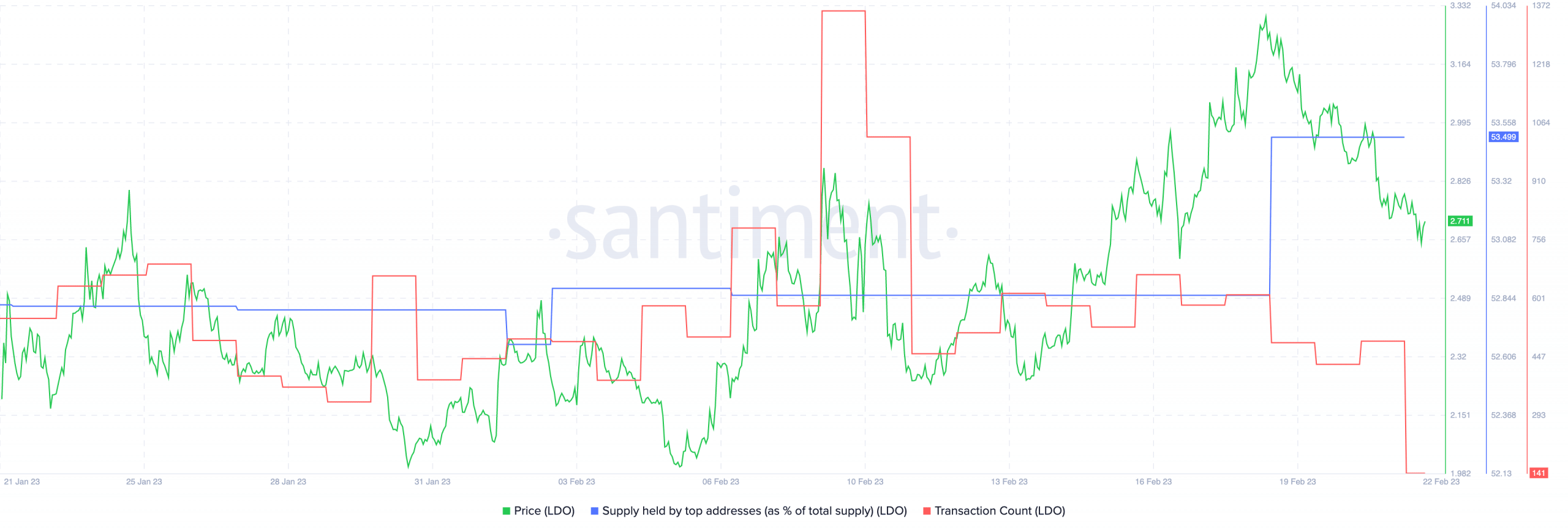

Regardless of these developments, LDO’s prices declined.

Realistic or not, here’s LDO market cap in BTC’s terms

However, even though the prices fell, it did not discourage whales from buying the LDO token. This was indicated by the growing percentage of large addresses holding the LDO token. However, during the last week, the transaction count of LDO fell. This implied that developer activity had declined over the past week.

Even though the APR of Lido has declined, its protocol has continued to show improvements. And despite LDO’s prices falling, many whales continued to show interest in the token. It is yet to be seen if Lido could sustain interest in its protocol and overcome the challenges it faced.