How is Solana managing to stay relevant?

When Bitcoin drops the ball, most Altcoins follow its lead in the market. A similar story unfolded last month when the crypto market collectively nose-dived in the charts. Yet, there is one asset that didn’t really buckle much under bearish pressure.

Solana or SOL token has been impressive in 2021 but it has probably turned more eyeballs in its direction, after 19th May. While most Altcoins faced a decline of more than 60% from its ATH, Solana was down by only 35% at press time.

Agreed, 34% isn’t a minor correction either but in comparison, Bitcoin was down by 44% and Ethereum was down by 47% at press time, which meant SOL, managed to outperform the two top assets, even during a bearish period.

What is making Solana tick in the charts?

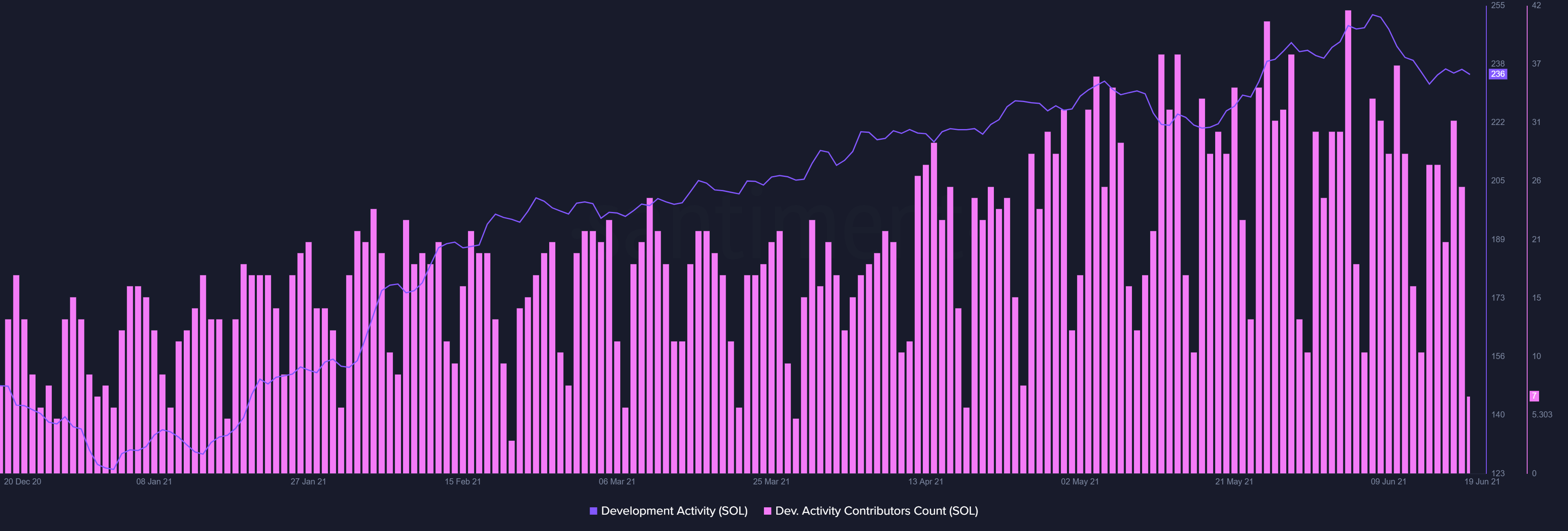

Hype and Sentiment aside, Solana is one of the most ambitious projects into progression, which is taking tremendous steps from a development standpoint. Data from Santiment indicated that its development activity hasn’t stopped even after the price drop, which is usually an idle long-term condition.

Developer Activity Contribution count was relatively high as well.

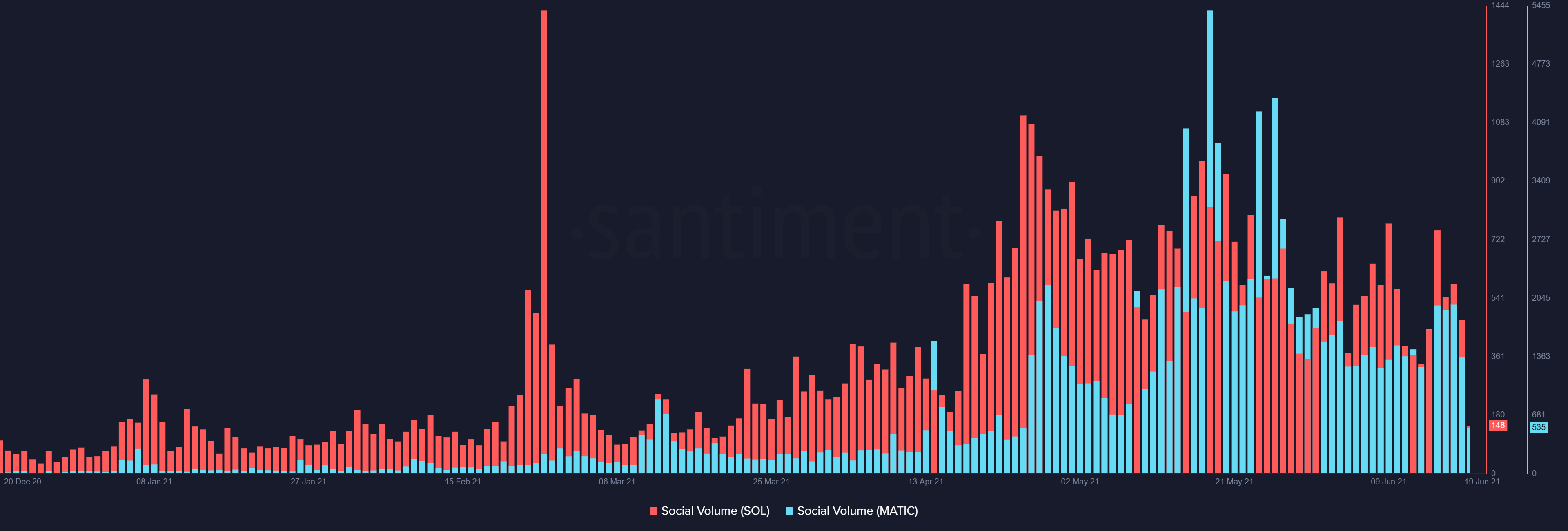

Now, there is one commonality between Solana and another popular project Matic; the fact that both these are intensely innovating the scaling process. The DeFi space emerged as the hub of innovation and Matic’s stake as an L2 scaling layer has meteorically improved.

From a market sentiment perspective, social volumes are indicative of a strong presence as well with Solana slightly outperforming Matic in the charts.

Big Boys are taking Notice

For both Polygon and Solana, it hasn’t been a quick off-the-bat success story as both of them came into the picture way back in 2017-2018 period. Yet, over time, its fundamentals accompanied by a bullish cycle has allowed these asset’s price to flourish.

Now, according to recent reports, Grayscale has taken notice of Solana and Polygon’s rising popularity, as they are considering the addition of these tokens under their investment products.

While such a development will not have any positive impact on its price in the short term, it is the kind of speculation which allows users to trust the likes of Solana, Matic on a higher scale.

Inclusion in Grayscale would mean that institutional investors would be able to invest in SOL, MATIC but it is important to note that the organization did mention,

“As a reminder, not every asset under consideration will be turned into one of our investment products. The process of creating an investment product similar to the ones we already offer is a complex, multifaceted process.”