Ethereum: How L2 activity helped its fees remain steady

- L2 scaling recently saw an all-time high.

- Ethereum’s overall fee was over 13.4 million.

The Ethereum [ETH] Layer 2 (L2) ecosystem has been expanding, with a recent surge in the number of transactions per second (TPS).

Notably, within the L2 space, Base has emerged with particularly impressive performance metrics.

Ethereum L2 registers more scale

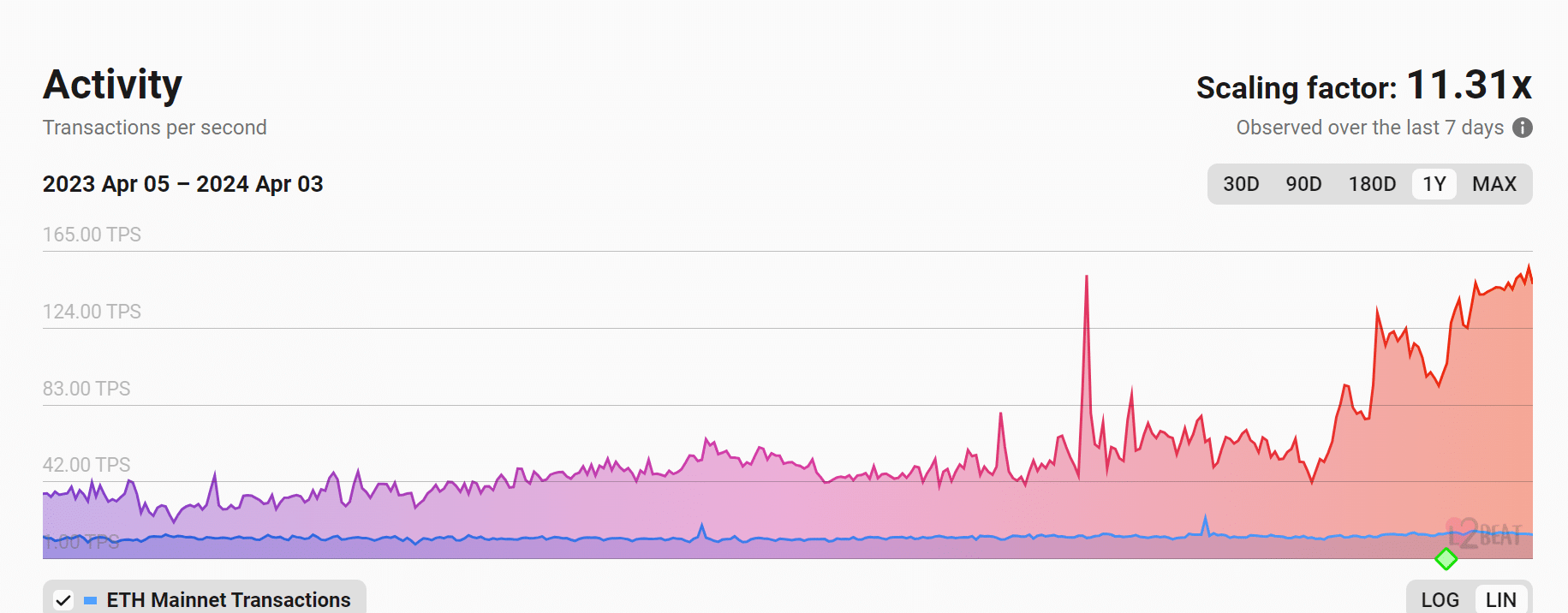

Based on information from L2 Beat, Ethereum scaling experienced a notable increase at the beginning of April, reaching a new peak on the 2nd of April.

AMBCrypto’s look at the Layer 2 data indicated a surge in the transaction count, surpassing 156 transactions and marking a record high.

The scaling metric rose to approximately 11.2, indicating it handled more transactions than the Ethereum mainchain.

As of press time, the transactions per second (TPS) had slightly decreased to around 147, but the scaling trend has remained upward. Presently, the scaling figure stands at about 11.3.

Base dominates Ethereum L2 space

Based on data from IntoTheBlock, Base has established itself as a prominent Ethereum Layer 2 (L2) solution, which is evident from recent statistics.

It boasted approximately 890,000 active addresses, indicating the highest number of active addresses among L2 platforms.

Additionally, its transaction volume surpassed $1.6 billion, three times greater than its nearest competitor, Optimism [OP]. On the 2nd of April, the network processed 2.6 million transactions.

However, when considering Total Value Locked (TVL) and Transactions Per Second (TPS), data from L2 Beat revealed that Base lagged behind other L2 networks.

Ethereum fees remain low

Despite the increased activity witnessed on its Layer 2 (L2) solution, Ethereum’s fees have remained relatively low. As of the time of writing, the total fee was over $13.4 million.

AMBCrypto’s analysis of the fee trend indicated an overall decline over the past few weeks.

This decline commenced around the 13th of March, coinciding with a significant network upgrade and contributing to lower gas prices on L2 networks.

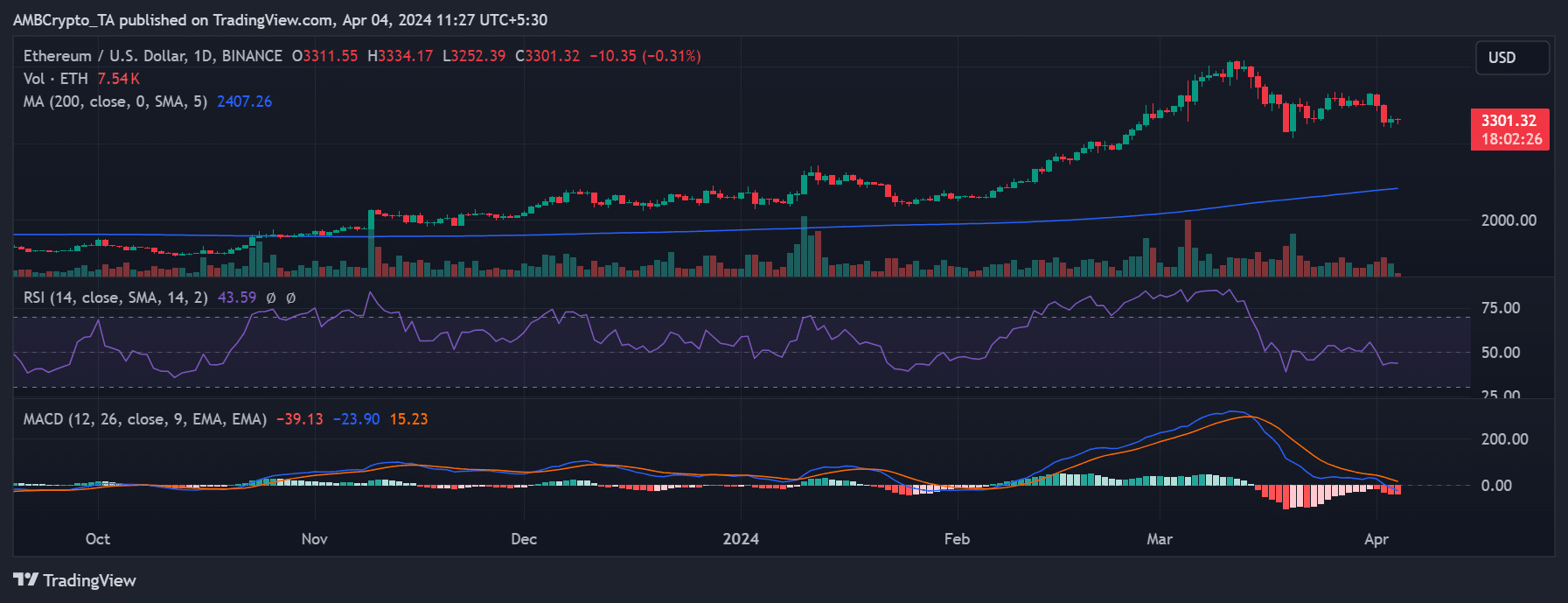

ETH was trading at around $3,301 at the time of writing, experiencing a less than 1% decrease.

Is your portfolio green? Check out the ETH Profit Calculator

The daily timeframe chart analysis revealed that the king of altcoins was among the few assets that closed the previous trading session with a profit.

The altcoin concluded trading on the 3rd of April with a price increase of over 1%.