How Latin America found refuge in crypto amidst its troubles

- Brazil, Argentina, and Mexico were among the top 20 countries in grassroots adoption.

- Nearly every country in the region had a greater dominance of CEXes when compared to the global average.

Cryptocurrencies became a global phenomenon in recent years with countries across the world witnessing a surge in adoption.

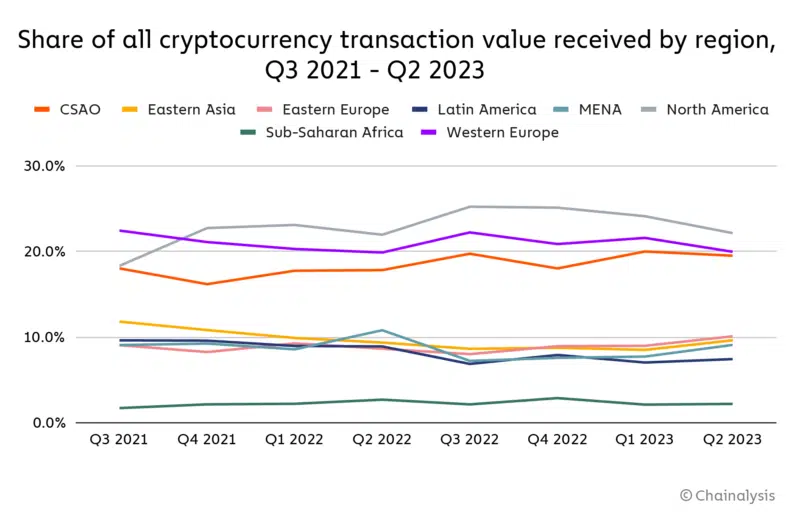

Latin America, though having a smaller crypto economy than hotspots like Europe and North America, experienced steady growth since the Covid-19 pandemic, as per a Chainalysis report on crypto adoption trends in the region.

Comprising of nations like Mexico, Argentina, and Brazil, Latin America was the seventh-largest region for crypto transactions from Q3 2021 to Q2 2023.

Greater penetration of crypto exchanges

In fact, according to the 2023 Global Crypto Adoption Index, Brazil, Argentina, and Mexico were among the top 20 countries in grassroots adoption. This implied that a considerable chunk of the general public in these nations were putting their wealth into cryptos.

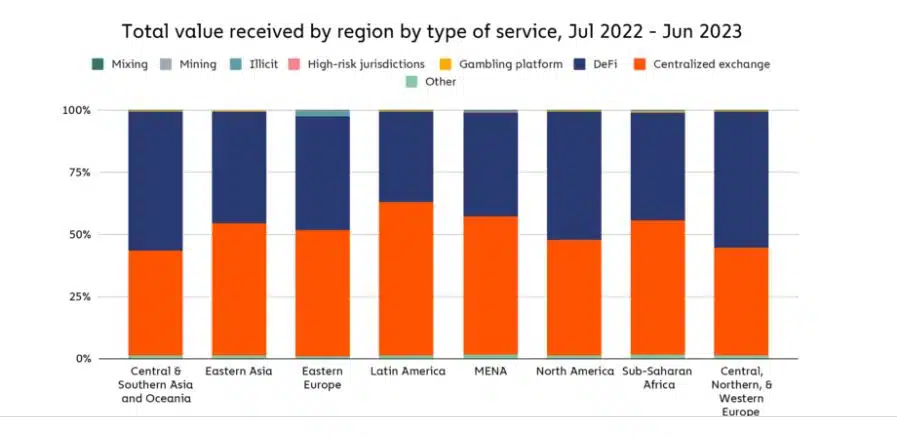

Notably, most of the people were using centralized crypto exchanges (CEX) to buy and sell digital assets. More than 60% of the crypto activity in Latin America was facilitated through such platforms, compared to less than 50% for much of Europe and North America.

Moreover, almost every country in the region had a greater dominance of CEXes when compared to the global average. While Venezuela had more than 90% of the crypto activity through exchanges, Argentina and Brazil observed CEX dominance of 63.8% and 60.7% respectively.

The outlier was Mexico, with a fairly equitable share of CEXs and decentralized exchanges (DEX). Chainalysis attributed the divergence to the higher share of altcoin volumes in Mexico. Altcoins, in general, were more accessible on DEXes.

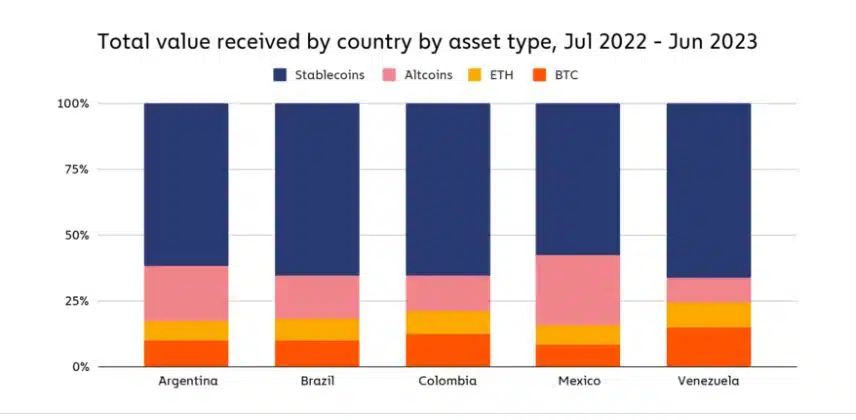

However, despite the increased demand for altcoins, the majority of the populace were buying stablecoins. This behavior was observed across all major countries of the region. Well, the reasons could be found by looking at the example of Argentina.

Stablecoins: A refuge against inflation

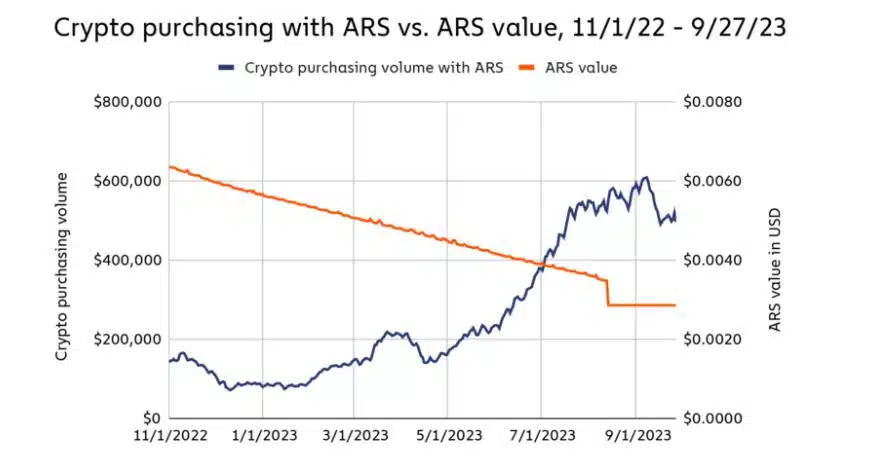

The South American nation was reeling under hyperinflation, with the annual rate surging to 124.4% in August, the highest in 32 years. The national currency Argentinian Peso (ARS) has been on a multi-year downtrend for the last few years, with value plunging more than 50% in a year.

The sharp rise in consumer prices has triggered a cost-of-living crisis with many residents cutting down on the intake of essential food items.

Now, generally when native currency undergoes massive devaluation, people look to convert their savings to safe-haven assets like the U.S. Dollar (USD). Conventional methods of exchange like commercial banks and online forex services could be time-consuming. What’s the next option – stablecoins.

Most stablecoins are tethered to the value of USD and unlike other cryptos, they stick to the peg invariably. This makes them an attractive hedge against inflation and more importantly convenient, as they can be easily availed through crypto exchanges.

Alfonso Martel Seward, Head of Compliance & AML at local cryptocurrency exchange Lemon Cash said and Chainalysis quoted,

“We have really high inflation, and there are lots of restrictions against buying foreign currencies. That makes crypto a valuable option for saving. As crypto adoption has grown, lots of people here will now get their paycheck and immediately put it into USDT or USDC.”

The chart below perfectly encapsulates the correlation between growing preference for cryptos and soaring inflation.

Evidently, the volume of digital assets purchased with Argentinian Peso increased as the currency fell in value. Notably, crypto volumes spiked in April, the time when inflation had crossed 100%.

A look at Brazil’s market dynamics

The largest economy of Latin America has always boasted of a well-developed crypto infrastructure. The country was amongst the first in the region to adopt crypto and other verticals like decentralized finance (DeFi).

Even though large institutional transactions have declined, largely a fallout of the crypto winter, there were signs of a comeback. Three consecutive months of increase was seen in professional-driven volumes in Q2.

It was important to note that Brazil, unlike Argentina, wasn’t a crisis-hit economy. Hence, the demand was distributed across a diverse set of assets, including Bitcoin [BTC] and altcoins, rather than just stablecoins.

It also highlighted that Brazilians interest in cryptos was rooted in long-term investment and speculation instead of hunting for an asset to shield them from inflation.

Richard Gardner, CEO of trading technology developer Modulus, stressed on the varied use cases of cryptos in the region while talking to AMB Crypto. He said,

“When we think of Latin America, there’s a tendency to think of the countries therein as a block — similar both culturally and economically. However, there’s really a great deal of difference when you consider what’s driving interest in cryptocurrencies within these countries. It is easy for Americans and Europeans to forget that there are a number of real-world problems that Bitcoin solves, even if they are problems not often found in our own backyard.”