How Lido impacts the supply and demand of Ethereum

- Lido lowered Ethereum’s new supply entering the market.

- Staked ETH saw higher demand for lending applications like Aave.

Since Ethereum’s [ETH] transition to a proof-of-stake (PoS) mechanism, liquid staking protocols have taken center stage, plugging gaps prevalent in the conventional staking method. Popularity of projects like Lido Finance [LDO] has skyrocketed, catapulting it to become the largest DeFi protocol with a total value locked (TVL) of a $14.59 billion, according to DeFiLlama.

Realistic or not, here’s LDO’s market cap in BTC terms

However, the rise of liquid staking has resulted in significant changes in the supply dynamics of Ethereum’s native token and shifts in its demand, especially on other DeFi sectors such as lending.

How Lido impacted ETH’s emission

The conventional method fixes a minimum staking amount of 32 ETH for anyone to become a node validator, which is prohibitively expensive for many.

Hence, individuals join a liquid staking pool and delegate their ETH to the node operators, who in turn stake on their behalf. The person delegating their ETH gets a receipt token in the form of liquid staking tokens (LSTs).

These tokens allow users to participate in staking while also giving them the right to use them elsewhere in DeFi for higher yield opportunities.

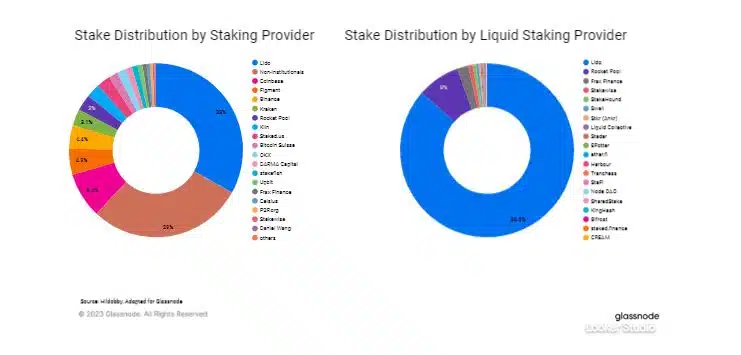

According to a report by on-chain analytics firm Glassnode, Lido was the dominant player in the market, with nearly 32% of ETH’s total circulating supply getting staked through the largest liquid staking protocol.

Moreover, it meant that Lido received 32% of all the rewards accrued staked ETH, and hence 32% of new ETH was entering circulation through Lido. After deducting a 10% charge, which is split between the node operators and the Lido treasury, the remaining incentives, or 28.8%, are distributed to Lido Staked ETH [stETH] holders.

This is where Lido has altered Ethereum’s planned emission dynamic. If there were no liquid staking, solo stakers would receive the entirety of the validator rewards.

Additionally, Lido offsets ETH’s supply influx by restaking some portion of the total rewards as part of its compounding strategy.

As per Glassnode’s analysis, if Lido receives a 221k in newly created ETH, about 105k is locked back again in the staking pool, lowering net emission by 116k ETH.

Growing demand for staked ETH

LSTs like stETH represent every unit of ETH locked on the staking pool. As they continuously receive rewards and are free to be used elsewhere, many experts have termed stETH as a yield-bearing version of ETH.

It was observed that number of new users using ETH and its wrapped version, WETH, has stagnated since the collapse of stablecoin Terra USD [UST] last year.

To the contrary, demand for stETH and its wrapped version wstETH jumped by 142% since then. Notably, the Shapella update completed earlier this year played a significant role in its rise.

stETH’s demand was also reflected in the increasing transfer volume vis-à-vis ETH. After remaining stable for 2022, stETH gained momentum in 2023. It rose from $127 million, to a range of $450 million – $880 million.

Shifting dynamics in the DeFi space

As argued earlier in the article, new doors of opportunities in DeFi have been unlocked for LSTs. Trends showed increasing willingness to hold wstETH when compared to the wrapped version of ETH.

Since the beginning of 2022, wstETH supply held in smart contracts increased by a whopping 1829%. On the other hand, wETH supply plunged 62% in the given timeframe.

In fact, the receipt token and its wrapped version have surpassed ETH as one of the top collateral assets on lending protocol Aave [AAVE]. Approximately 14.4% of the stETH and 25.3% of the wstETH supply were utilized in Aave.

Is your portfolio green? Check out the ETH Profit Calculator

However, the increase in lending protocols occurred at the expense of diminishing liquidity on decentralized exchanges (DEX). This was most likely due to leveraged stETH positions offering more attractive yields.

Glassnode stated that the switch posed potential risks for stETH. As much of the trading occured on DEXs, the reduced liquidity could lead to depegging of stETH. In turn, this could lead to liquidation of the collateral.