How Lido solved Solana’s $24 million problem

- Lido also shared an updated guide to help users with a smooth withdrawal process.

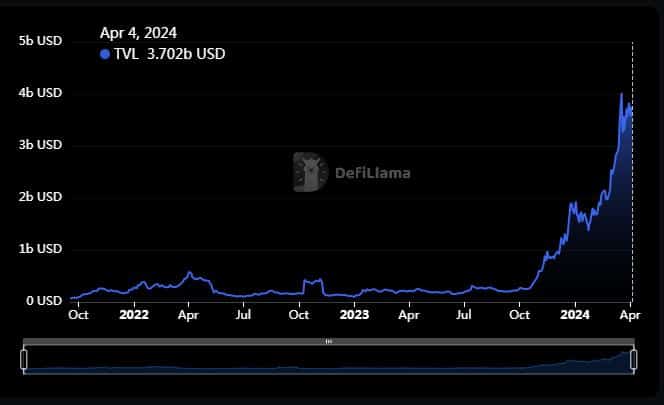

- Solana liquid staking remains largely untapped, with just $3.7 billion in deposits.

In what could be a sign of relief, popular liquid staking protocol Lido Finance [LDO] fixed a technical issue that prevented users from unstaking roughly $24 million in Solana [SOL] holdings.

In an X post dated 3rd April, Lido acknowledged that a bug in the smart contract of the withdrawal process hampered the unstaking operations. However, P2P Validator – the development team behind the now-discontinued Lido staking services on Solana – provided the fix, resuming the withdrawal process.

In addition, the Lido team shared an updated manual to ensure a “smooth” withdrawal process for users not well-versed with the technical side of things.

Why this matters?

Lido stopped support for SOL staking in October last year, and subsequently removed the webpage that let users exchange their liquid derivative stSOL for SOL in February.

Users who missed this deadline could now only withdraw their tokens through Solana’s command line interface (CLI) – a process deemed too complicated by many users on X.

As of this writing, about $24 million in SOL was still locked up on Lido Finance, according to AMBCrypto’s analysis of DeFiLlama data.

A peek into Solana staking

Like other proof-of-stake (PoS) networks, Solana has witnessed an upsurge in staking in recent years. More than 64% of SOL’s total supply, worth $68 billion, has been staked as of this writing, data from Staking Rewards showed.

Realistic or not, here’s SOL’s market cap in BTC terms

However, just about $3.7 billion of this was staked through liquid staking protocols. Amongst these, Jito and Marinade have taken the lead, with a total value locked (TVL) of $1.75 billion and $1.20 billion respectively.

SOL was exchanging hands at $185 at press time, following a 2.62% drop in value in the last 24 hours, according to CoinMarketCap.