Altcoin

How MakerDAO stands to generate millions in 2023

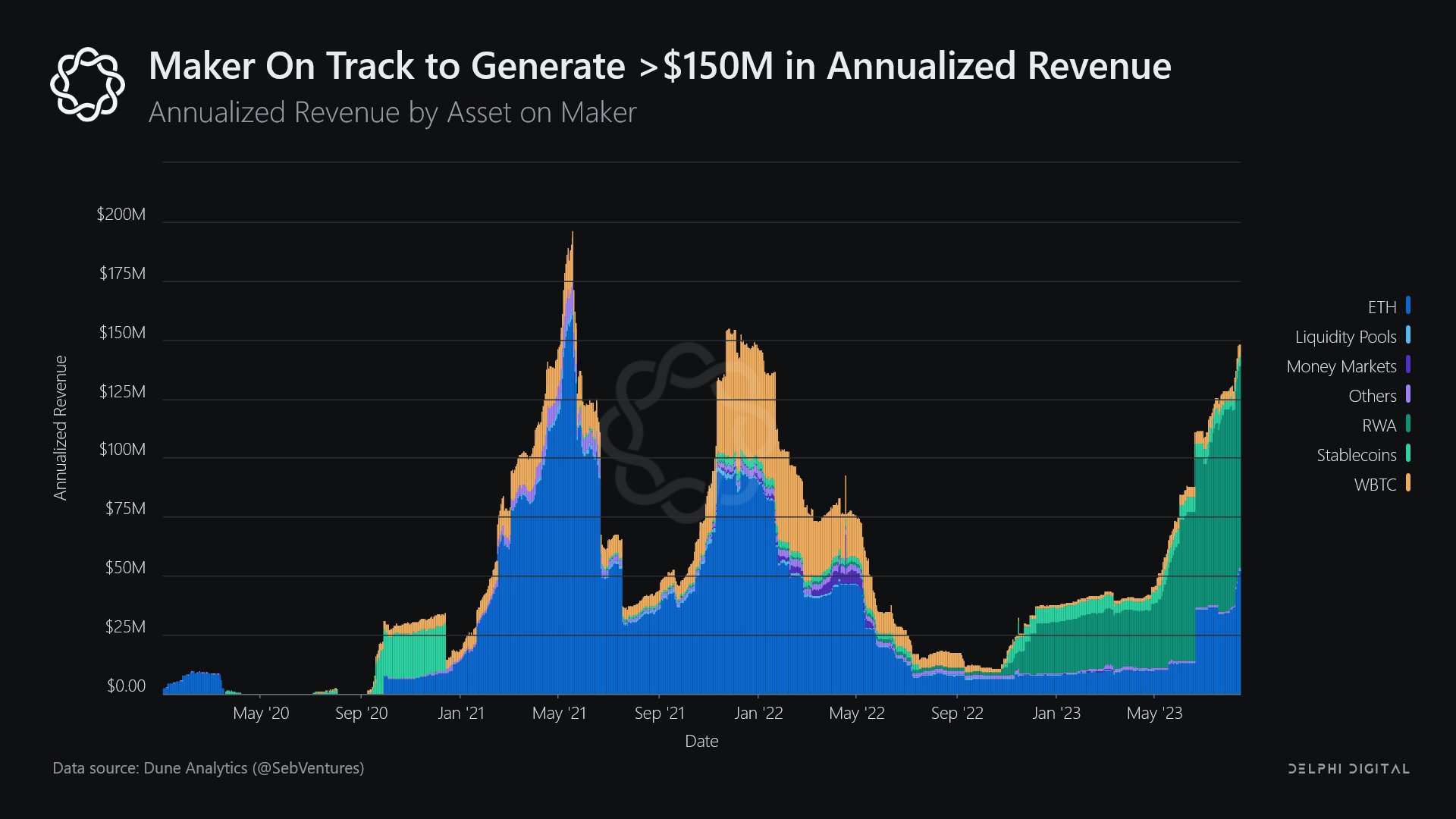

MakerDAO’s strategic move into Real World Assets (RWAs) could result in a significant revenue boost, with $150 million on the horizon.

- MakerDAO anticipated generating $150 million in revenue driven by Real World Assets (RWAs) and stability fees.

- While default risks loom, MakerDAO’s development activity remained robust.

The DeFi landscape has experienced a notable slowdown in recent months, marked by dwindling interest and activity across the sector. However, MakerDAO, a prominent player in the DeFi space, appears poised for a significant uptick in earnings.

Is your portfolio green? Check out the MakerDAO Profit Calculator

Riding the wave of Real World Assets

One key factor driving MakerDAO’s anticipated revenue surge was its strategic foray into Real World Assets (RWAs). According to insights from Delphi Digital analyst Ashwath,

MakerDAO was on track to rake in a substantial $150 million in revenue.RWAs represent a novel avenue for traditional asset managers to tokenize their portfolios, enabling them to leverage protocols like MakerDAO for enhanced liquidity access. This development opens up new credit channels for asset managers, albeit with a word of caution regarding potential adverse selection risks.

Maker derives a substantial portion of its revenue, approximately 70-80% from stability fees associated with RWAs. Within Maker’s RWA portfolio, various asset managers and debt instruments are represented, including investment-grade bonds, short-term Treasury bill ETFs, business loans, and more.

However, it’s essential to acknowledge the presence of risk factors, primarily associated with default risks. The vast majority of RWAs in Maker’s vaults comprise credit instruments, making them susceptible to non-negligible default risks. In essence, any RWA used as collateral for Maker’s services is exposed to potential default.

Notably, Ashwath emphasized that all RWAs currently held in Maker’s vaults are rated at BBB or higher, denoting an “investment-grade” credit quality. Nevertheless, given the current interest rate environment, the risk-reward profile of this opportunity may not be exceptionally favorable.

MakerDAO’s future outlook

Despite the industry-wide slowdown in DeFi, MakerDAO is forging ahead with robust development activity. Over the past week, code commits have surged by 47.9%, accompanied by a 9.1% growth in core developers actively contributing to the protocol.

The performance of Maker’s native token, MKR, remained relatively stable over the last few days. At the time of writing, MKR was trading at $1129.68, with minimal price movement recorded over the previous week.

Realistic or not, here’s MKR’s market cap in BTC terms

While the number of MKR token holders held steady, a significant decline in whale interest could potentially exert downward pressure on MKR’s price in the future.

Nevertheless, with its strategic focus on RWAs and a vibrant development ecosystem, MakerDAO appears well-positioned to seize opportunities amid the evolving DeFi landscape.