How MATIC reacted to Polygon zkEVM’s pre-launch hype

- Polygon zkEVM total transactions nearly reached 300,000.

- Whale interest increased in MATIC and market indicators looked bullish.

On 14 February, Polygon [MATIC] revealed updated statistics about its anticipated zkEVM. Polygon’s zkEVM was in the final stage of testnet testing at press time.

The testnet *nearly* reached 300k transactions, a milestone for the future of scaling Ethereum, and a testament to the maturity of Polygon #zkEVM.

Other BIG NEWS is coming soon. Until then, a quick rundown of all Polygon zkEVM metrics for last week, showing continued momentum ? pic.twitter.com/lMpYATtGfe

— Polygon ZK (@0xPolygonZK) February 13, 2023

Is your portfolio green? Check the Polygon Profit Calculator

During the time of the tweet, the zkEVM testnet’s total number of transactions has nearly reached 300,000, which was a milestone for the future of scaling Ethereum [ETH]. Not only did the number of transactions increase, but the total number of wallets rose from 83045 to 84702, which was a 2% increase.

The same remained true for total deployed contracts and the number of zk-proofs, as they increased by 5.8% and 2.75%, respectively.

Whales believe in MATIC

WhaleStats, a popular Twitter account that posts updates related to whale activity, pointed out that whales seemed confident in MATIC. As per the tweet, the token ranked third on the list of the cryptos being held by the top 500 Ethereum whales.

? The top 500 #ETH whales are hodling

$651,269,941 $SHIB

$146,616,720 $BEST

$142,570,607 $MATIC

$141,187,680 $CHSB

$140,224,778 $LINK

$111,691,903 $BIT

$80,792,390 $LOCUS

$80,503,864 $UNIWhale leaderboard ?https://t.co/tgYTpOm5ws pic.twitter.com/vHAvArgDoa

— WhaleStats (tracking crypto whales) (@WhaleStats) February 13, 2023

Let’s have a look at MATIC’s on-chain performance to find out, apart from zkEVM’s hype, what helped garner whales’ interest. CryptoQuant’s data revealed that MATIC’s exchange reserve was decreasing, which was a positive signal as it indicated less selling pressure. The total number of active wallets trading the token also went up.

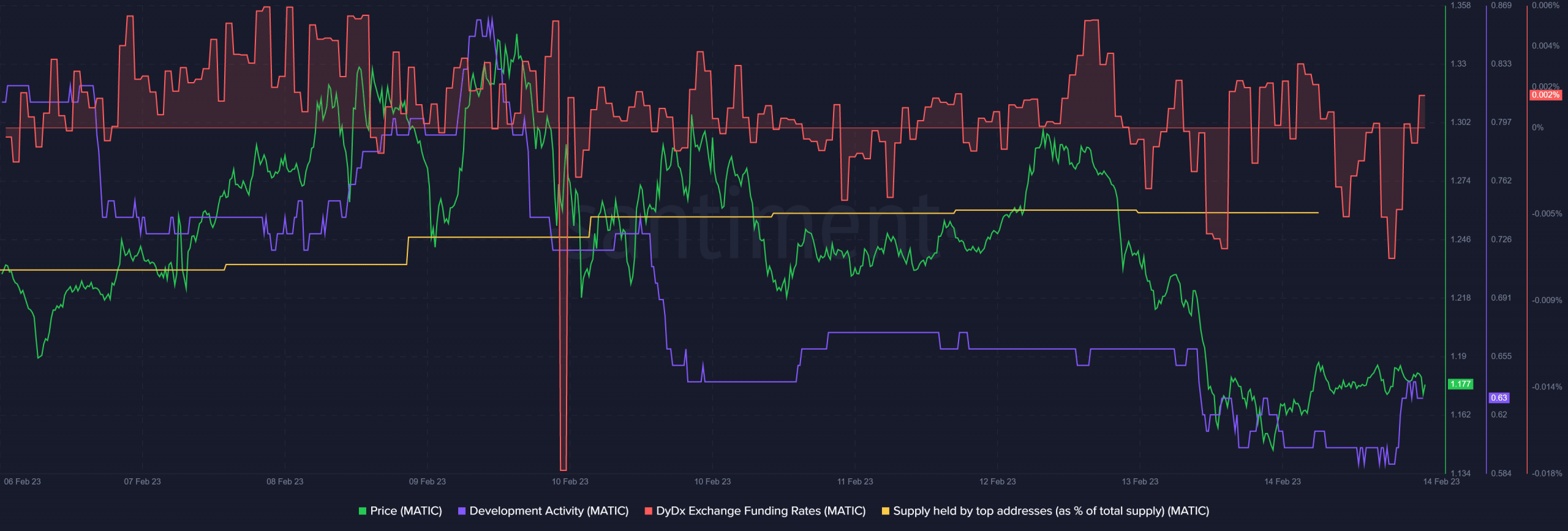

As per Santiment’s chart, MATIC’s DyDx funding rate remained relatively high over the past week, which showed high demand from the futures market. As whale interest increased, MATIC’s total supply held by top addresses also went up slightly, indicating investors’ confidence in MATIC. However, MATIC’s development activity looked a bit concerning as it decreased over the last few days.

Realistic or not, here’s MATIC market cap in BTC’s terms

Going forward

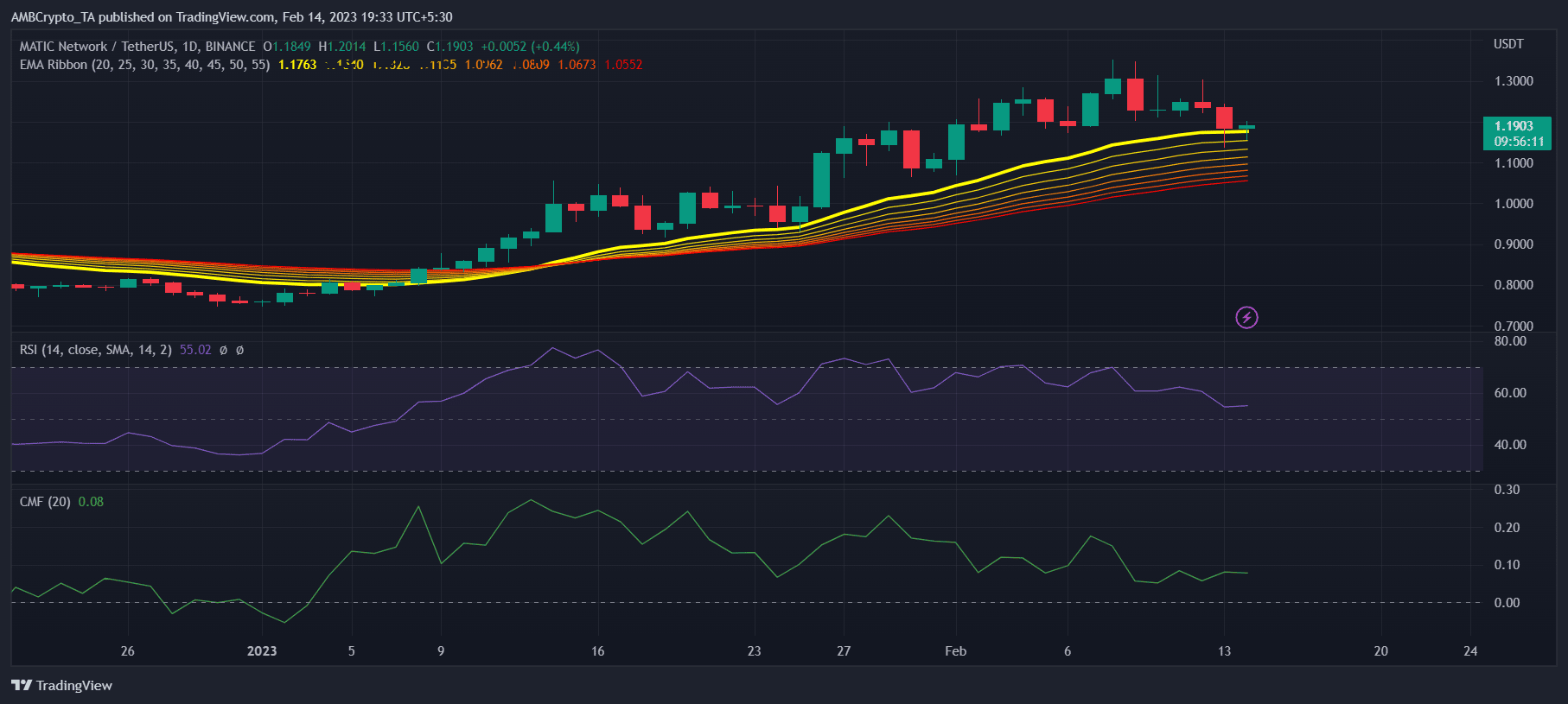

MATIC’s daily chart looked quite bullish, as most market indicators supported a price hike. Interestingly, the positive indicators reflected MATIC’s price performance, as its value increased by more than 2% in the last 24 hours. At press time, Polygon was trading at $1.20 with a market capitalization of over $10.4 billion.

MATIC’s Relative Strength Index (RSI) was resting quite above the neutral mark, which was a bullish signal. The Chaikin Money Flow (CMF) also followed the RSI and remained relatively up. Furthermore, the Exponential Moving Average (EMA) Ribbon revealed a massive bullish advantage in the market, increasing the chances of a continued uptrend in the coming days.