How memecoins affected Ethereum’s gas prices

- Memecoins and MEV bot activity affected Ethereum’s gas usage.

- Rise in NFT trades, increased selling pressure on ETH holders, and shifting trader behavior observed.

Ethereum’s [ETH] historically high gas prices have often deterred users from using the network, leading them to explore alternative protocols. However, the recent decline in gas usage could have positive implications for both Ethereum and ETH in the future.

Ethereum is gassed up

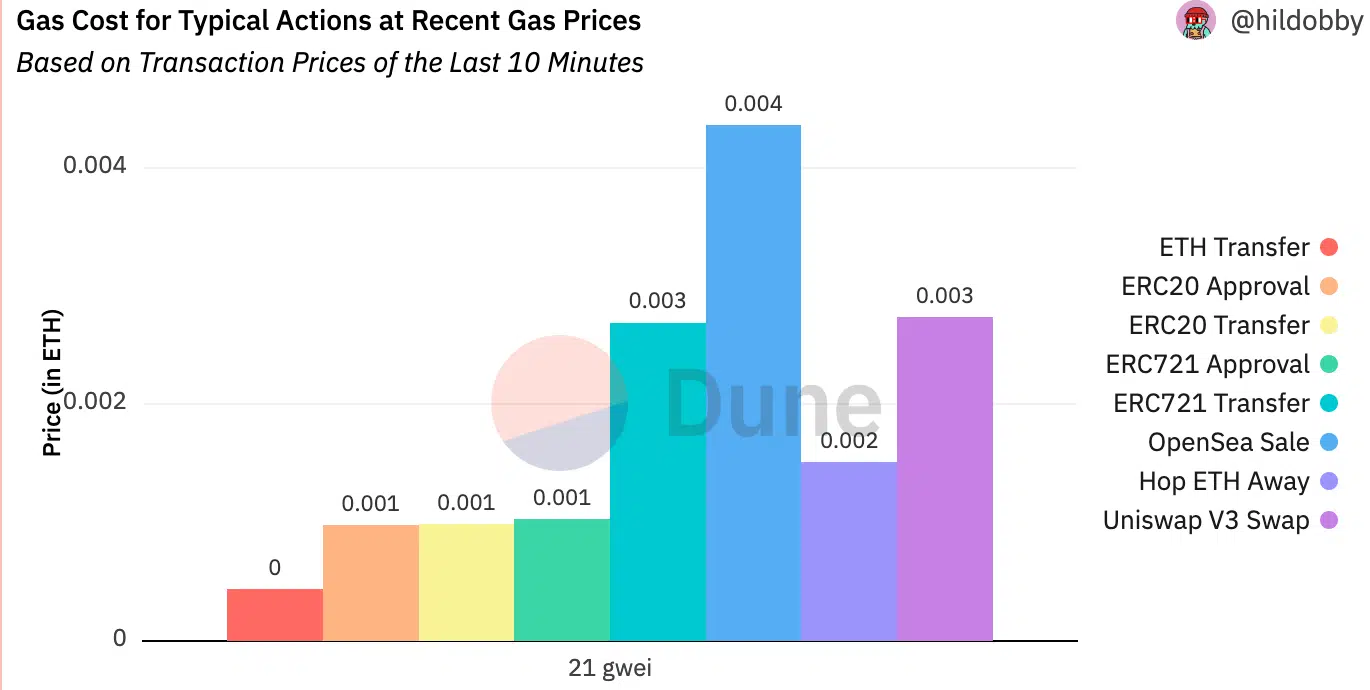

According to Dune Analytics, Ethereum’s daily average gas reached its lowest point in the past two months. As of 3 June, the average gas stood at 24gwei, with the press time gas at 17gwei.

The decrease in gas fees may be attributed to the recent hype surrounding memecoins, which has increased activity on the network. The utilization of Miner Extractable Value (MEV) bots could have further contributed to the decline as well.

MEV bots are automated systems that leverage transaction sequencing to exploit profitable opportunities in the Ethereum network. The prevalence of these bots can impact gas fees by optimizing transaction execution, potentially reducing costs for users.

The NFT angle

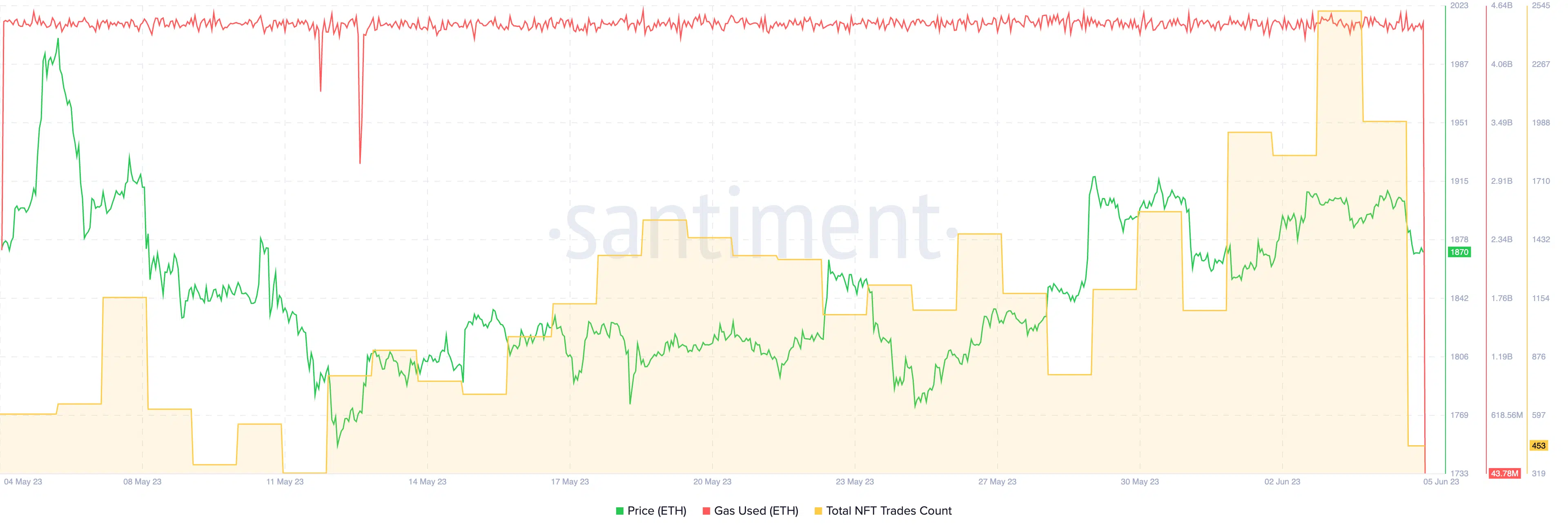

There was consistent gas usage in the Ethereum protocol, facilitated by low gas fees. Moreover, the number of NFT trades on the Ethereum network rose alongside.

Notably, prominent blue-chip NFTs like MAYC and Azuki drove the surge in NFT volume. DappRadar’s data indicated that over the past week, the volume of these NFTs increased by 29.9% and 129% respectively.

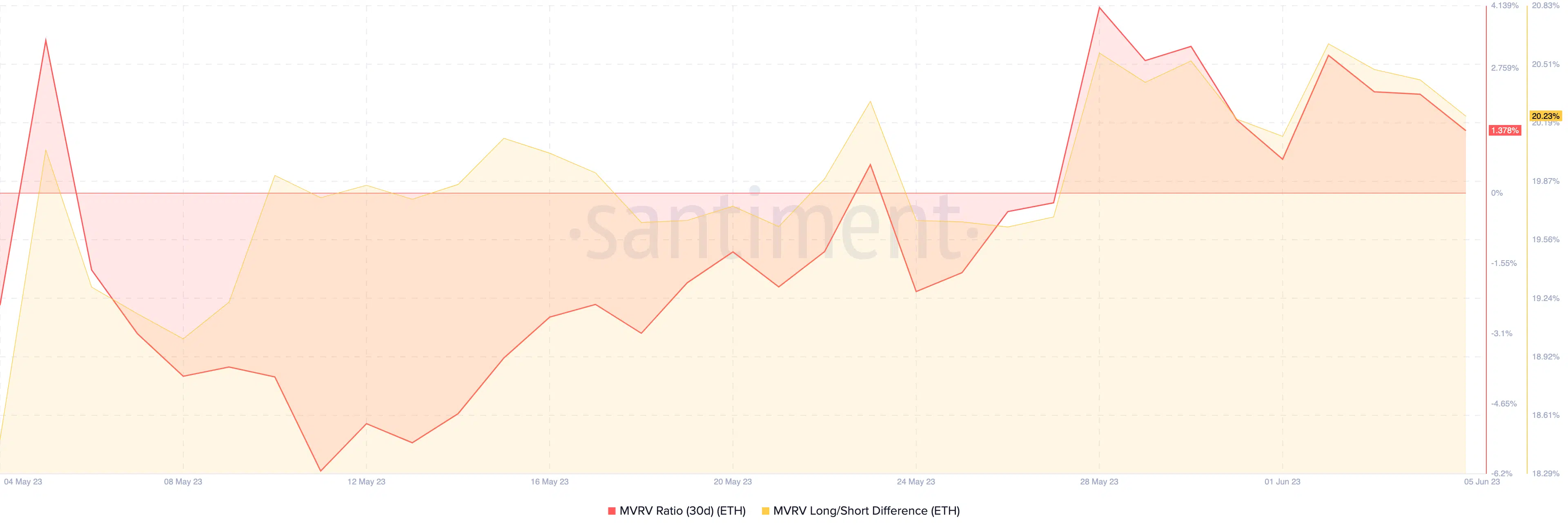

Meanwhile, Ethereum’s native cryptocurrency, ETH, was trading at $1,873 at press time. The coin’s MVRV (Market-Value-to-Realized-Value) ratio increased over the last month, suggesting that the profitability of addresses holding ETH is relatively high.

This could incentivize these address holders to sell and secure profits, potentially impacting the price of ETH in the near future.

Is your portfolio green? Check the Ethereum Profit Calculator

Lastly, the put-to-call ratio for Ethereum has declined during this period. This indicates a shift in trader behavior, with a decreased interest in protective put options relative to call options.

Such a trend may suggest growing optimism among traders regarding the future price movement of Ethereum.