How Morgan Stanley’s ETF move is spurring Bitcoin’s ‘second-wave adoption’

- Morgan Stanley is set to pave the way for the wirehouse adoption of BTC ETFs

- Only aggressive risk-tolerant clients with over $1.5M will be eligible

Wealth management firm Morgan Stanley will now allow select clients to buy U.S spot Bitcoin ETFs (exchange-traded funds).

According to a CNBC report, on Friday, the firm instructed its financial advisors to start offering the products from 7 August. Citing people familiar with the matter, the report stated,

“The firm’s 15,000 or so financial advisors can solicit eligible clients to purchase shares of two exchange-traded bitcoin funds starting Wednesday.”

Is BTC ETF second-wave adoption here?

Right now, Morgan Stanley will only offer BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund ( FBTC). However, only clients with an aggressive risk tolerance will be eligible.

“Only clients with a net worth of at least $1.5 million, an aggressive risk tolerance, and the desire to make speculative investments are suitable for bitcoin ETF solicitation.”

This means it would be the first major Wall Street wealth management firm to offer BTC ETFs to clients. By extension, it would signal the beginning of the long-awaited second wave of adoption.

For perspective, the massive demand seen in H1 2024 was mainly from individual retail investors, hedge funds, asset managers, and venture capitalists (VCs).

Bitwise CIO Matt Hougan called the first-wave adoption a ‘down payment’ before wirehouses join. Major wirehouses deal with high-net individuals and institutional investors. Morgan Stanley is one of those. Others include Wells Fargo, UBS, JPMorgan, Goldman Sachs, and Credit Suisse.

According to Bloomberg ETF analyst James Seyffart, these wirehouses control $5 trillion of client wealth and could perhaps be the most bullish cue for BTC ETF adoption.

A ‘playbook’ for ETF Adoption?

After finalizing their due diligence, these major firms are now projected to offer BTC ETFs in Q3 or Q4. In fact, BlackRock’s Head of Digital Assets, Robert Mitchnick, also predicted that most of them would begin offering the products by this year.

“When you think about the big wirehouses and private bank platforms, none of them have really opened them to their advisers yet…But certainly this year is likely.”

As of May, Bitwise data showed that professional investors accounted for about 7%—10% of the AUM (assets under management) of BTC ETFs, which stood at $50B then. That’s about $3-$5 billion. It meant retail investors dominated the AUM, but that could change with wirehouses joining the party, according to Hougan.

“Beginning about six months after the initial allocation, many firms begin allocating across their entire book of clients, with allocations ranging from 1-5% of the portfolio.”

This is the playbook to watch out for as wirehouses join the party.

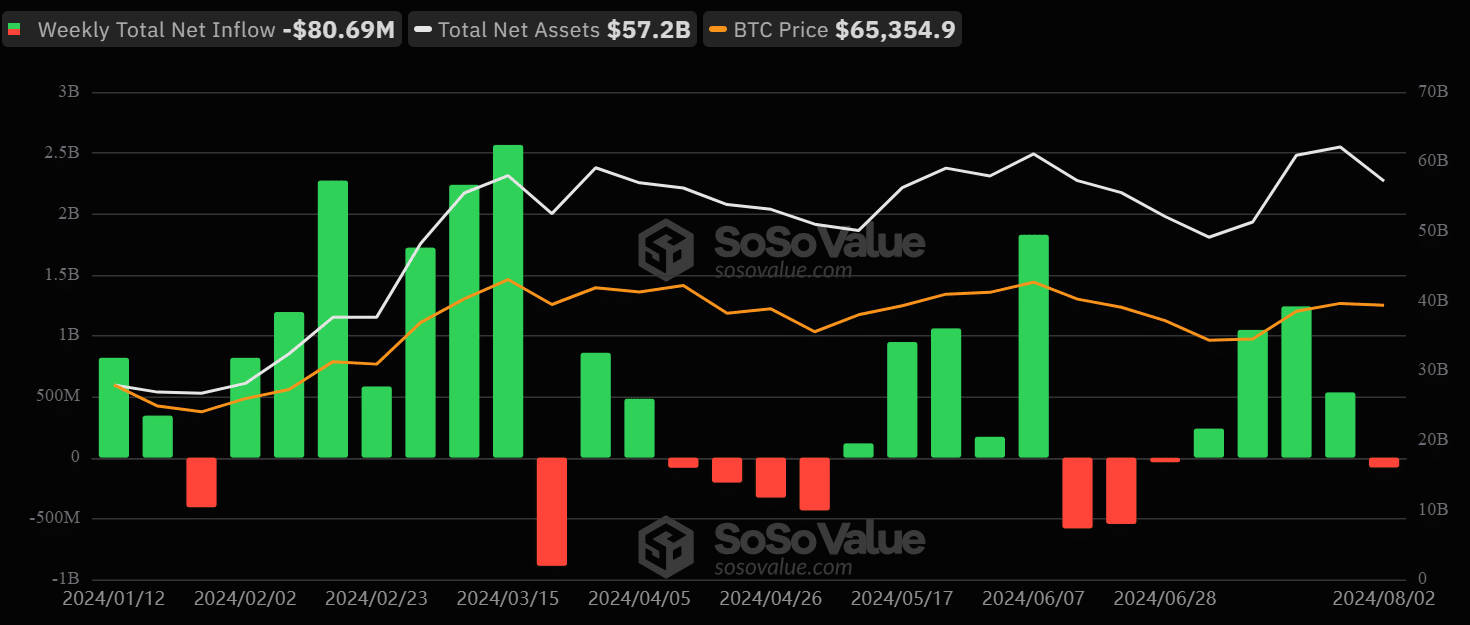

At press time, total AUM stood at $57.2 billion with weekly net outflows of $80.69 million, underscoring an overall risk-off investor approach this week. It remains to be seen whether the influx of wirehouses will change the current market trend and help BTC’s price.