Altcoin

How Polkadot staking and DOT have helped each other this bull run

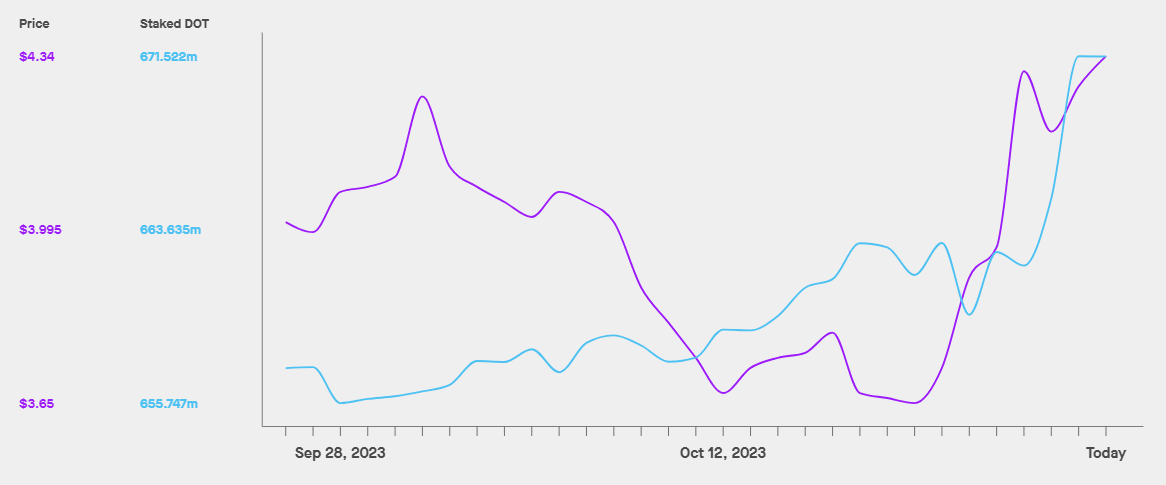

The total number of tokens staked on Polkadot increases substantially during the latest bull market. Concurrently, DOT witnesses a price rise.

- Polkadot’s staking market cap reached over $2.88 billion.

- DOT was up by 19% in the last week, but it has since witnessed a slight correction.

Polkadot [DOT] has witnessed growth in its staking ecosystem of late, which looked promising. In fact, the altcoin’s staking ecosystem can get a further boost in the days to follow, and here’s how.

Read Polkadot’s [DOT] Price Prediction 2023-24

Bird’s-eye view of the Polkadot staking space

Staking Rewards’ 26 October data

revealed that Polkadot’s staking space has grown in the recent past. Thanks to the bullish market, when DOT’s price rose, its total number of tokens staked also spiked substantially. At the time of writing, the figure stood at 671.51 million.Apart from that, the staked tokens surged by a whopping more than 500% in just the last 24 hours. Polkadot had a staking ratio of only 49% and a staking market capitalization of more than $2.88 billion.

Additionally, DOT’s total staked wallets also increased by 2%, reaching 39.22k at press time.

Moreover, StellaSwap, a parachain of Polkadot, made a new announcement that could propel further growth in DOT’s staking ecosystem.

? StellaSwap's newly-launched stDOT will have its own farm tomorrow! ??

Our successful relaunch of stDOT doesn't stop just here; we're launching our stDOT – $DOT farm with the highest incentives! ?

Start staking your $DOT now: https://t.co/q2j9w0TG04#DotUnlock pic.twitter.com/nJUnEQTo82

— StellaSwap ☄️- Top DEX on Polkadot (@StellaSwap) October 25, 2023

As per the tweet, StellaSwap’s newly launched stDOT token will have its own farm from 26 October. Unlike DOT staked directly on the Polkadot network, stDOT will be free from the limitations associated with the lack of liquidity.

The new launch can attract more users on the network and help spur Polkadot’s staking ecosystem even more in the weeks to come.

Polkadot is moving up

While the blockchain’s staking space grew, DOT also followed a similar path, as its price went up in double digits over the last seven days. According to CoinMarketCap, the token was up by nearly 20% last week.

At the time of writing, DOT was trading at $4.32 with a market capitalization of over $5.4 billion. The token’s volume also rose during that period, reflecting investors’ willingness to trade the token.

Thanks to the rise in value, DOT’s Price Volatility 1w witnessed a surge. Its Social Volume remained high throughout the week, meaning that it remained a steady topic of discussion in the crypto space until press time.

Is your portfolio green? Check out the DOT Profit Calculator

Though DOT’s weekly chart was bullish, it was interesting to know that a sell-off happened in the recent past that slowed down DOT’s momentum. This was evident from Hyblock Capital’s data.

As per the chart, liquidation levels started to increase on 24 October, after which the candlestick turned red, causing a slight price correction.