How Ripple can help Uniswap in its clash against the SEC

- Uniswap’s CEO receives SEC’s Wells notice, similar to Coinbase.

- Ripple’s resilience offers lessons for Uniswap.

Amidst the ongoing legal battle between Ripple [XRP] and the Security and Exchange Commission (SEC), the spotlight has now turned to Uniswap Labs.

On the 10th of April, Uniswap’s [UNI] CEO, via an X (Formerly Twitter) post, informed the crypto community that he had received a Wells notice from the SEC.

Uniswap CEO’s persistent optimism

Expressing his concerns, Hayden Adams, Uniswap’s CEO, in a recent conversation with the “Bankless” podcast, noted,

“The SEC is essentially taking very aggressive stances and basically trying to shut down crypto.”

He further shed light on the Wells notice regarding Uniswap’s interfaces. This coincided with a recent court ruling involving Coinbase’s classification as a broker.

He said,

“They just lost in court like two weeks ago with Coinbase right? It didn’t like go to trial and they lost in court, it lost at the earliest possible stage that you can lose.”

The comparison underscores the significance of the ruling and suggests a potential precedent for Uniswap’s case.

Uniswap to follow Ripple’s footsteps

Additionally, Stuart Alderoty, Ripple’s CLO citing criticism against SEC highlighted,

“The SEC continues to lose. The Second Circuit Court of Appeals refused to reconsider their decision in Govil which held that if a buyer suffers no financial loss, the SEC is not entitled to disgorgement from the seller.”

This suggests that Uniswap might want to take some notes from Ripple’s resilience playbook. Notably, despite regulatory hurdles, Ripple sustained positive trading momentum until the recent market downturn.

Considering the recent crypto bloodbath, many tokens experienced significant double-digit declines. However, some investors seemed to seize the opportunity to accumulate more XRP.

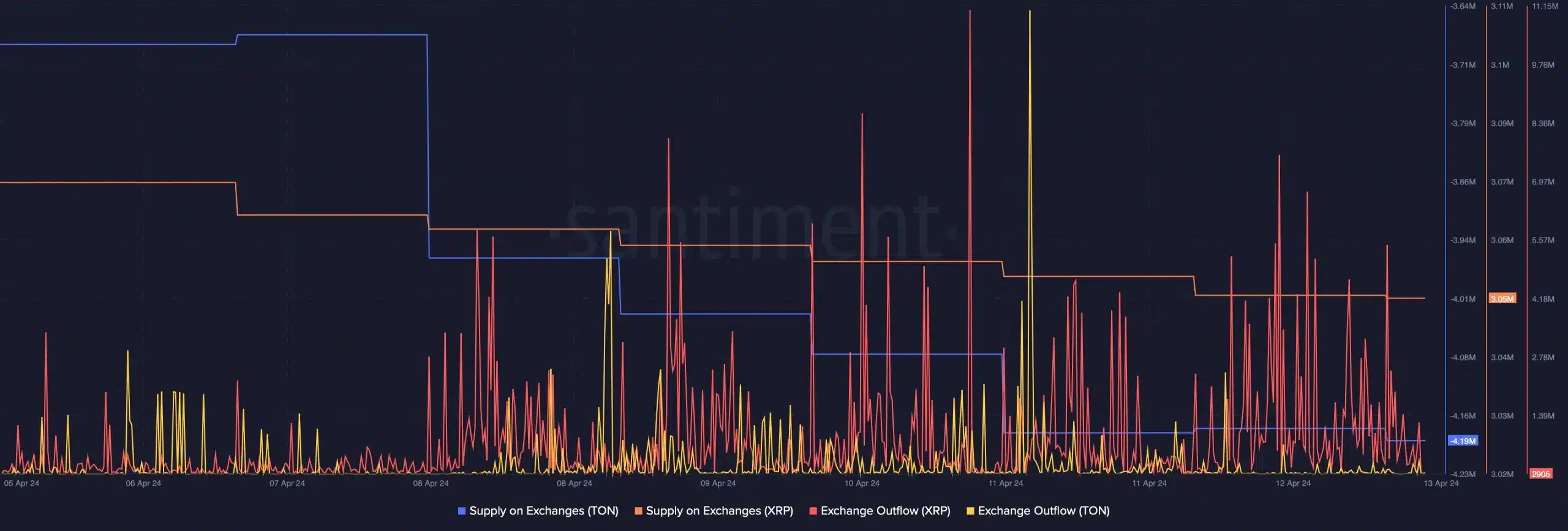

This was underlined by AMBCrypto’s analysis of Santiment’s data, wherein XRP exchange outflows increased in the last few days.

This indicated that despite the overall market decline, certain investors viewed the drop in prices as a buying opportunity.

What’s lies ahead for Uniswap?

In the face of these challenges, UNI experienced a significant decline of 12.64% over the past 24 hours, signaling a consolidation phase.

The weekly chart revealed a sharp 28.21% decrease, plummeting from $11 to $7 in just three days.

As Uniswap’s legal battle’s duration remains uncertain, the question remains unresolved: How far will the SEC go?

However, with continued resilience and learning from other altcoins, especially XRP, UNI token holders might foresee a significant value rise in the coming days.