How Solana reacted as 83% transactions on Jupiter Aggregator fail

- Solana users faced heavy fees as 83% of transactions fail on Jupiter Aggregator, fueling centralization worries.

- Despite this, Solana’s market showed resilience, with a 33.97% price increase over the past week.

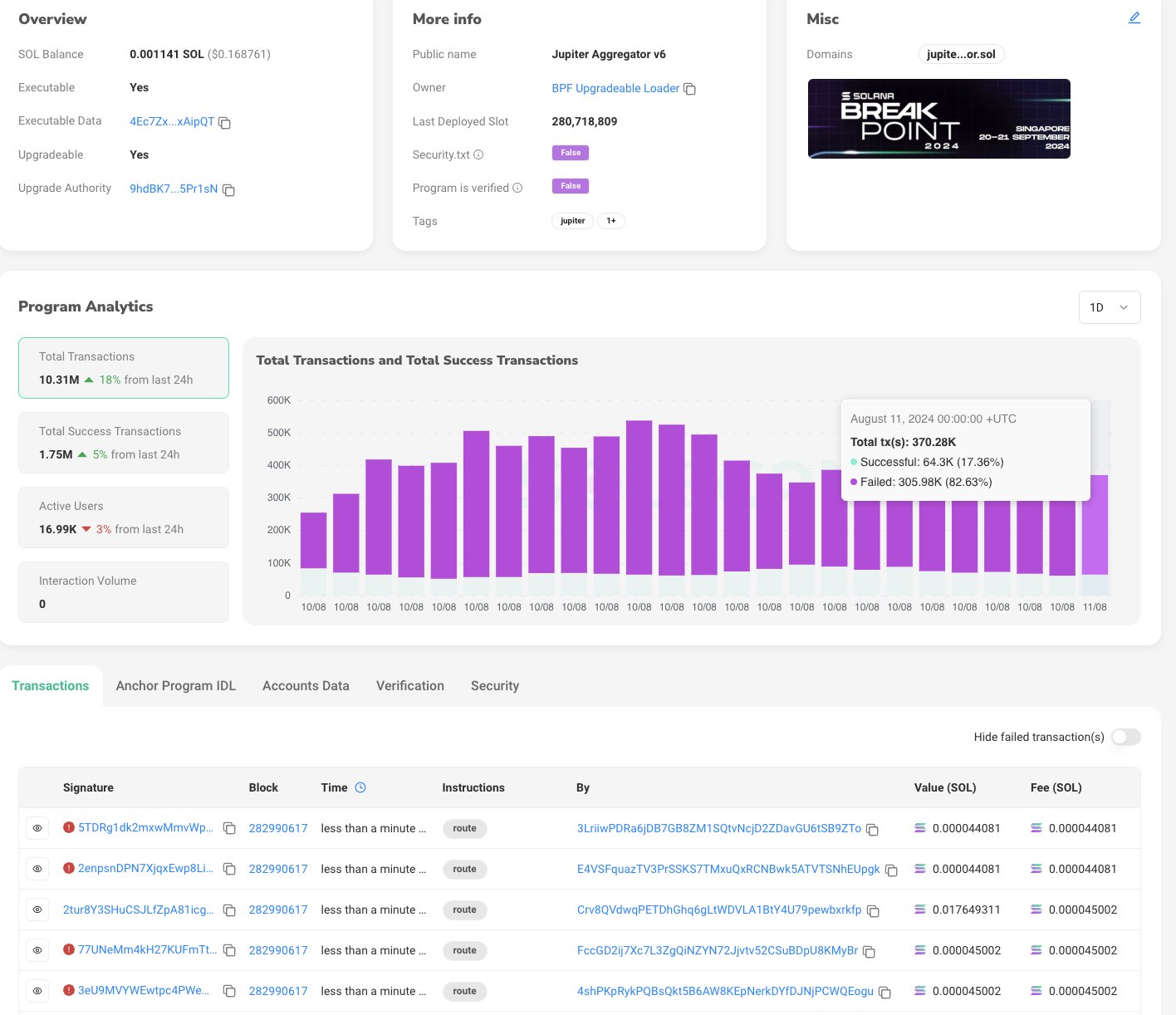

Recent data has revealed a troubling trend on Solana’s [SOL] Jupiter Aggregator, with an 83% failure rate on all transactions over the past day.

Out of the 10.31 million transactions processed, 8.56 million failed, leaving users with substantial fees despite unsuccessful trades.

The figures were highlighted by Dave, who posted on X (formerly known as Twitter), pointing out that users have been charged an average of $6,334.4 USD for these failed transactions.

This issue has sparked concerns within the Solana community, particularly regarding the role of validators and bots in these failed transactions.

According to Dave, when a transaction on Solana fails, the user is charged a small fee, which often prompts them to increase their slippage tolerance in an attempt to avoid repeated charges.

However, this action can expose users to front-running by bots, which can extract liquidity from the user before the transaction is completed.

Dave stated,

“The only people winning, are validators, and bots, or RPC endpoint operators that can see transactions before they are put on-chain.”

Furthermore, concerns were raised about Jupiter’s dual role as an aggregator and a validator.

With 1.09% of Solana’s entire staked supply under their control, Jupiter stands to profit when they become a leader, as they collect fees from these failed transactions.

This situation has led some community members to criticize the centralized nature of Solana, with one commenting,

“They went to Solana to protect their money from their government… Government steals less than Solana.”

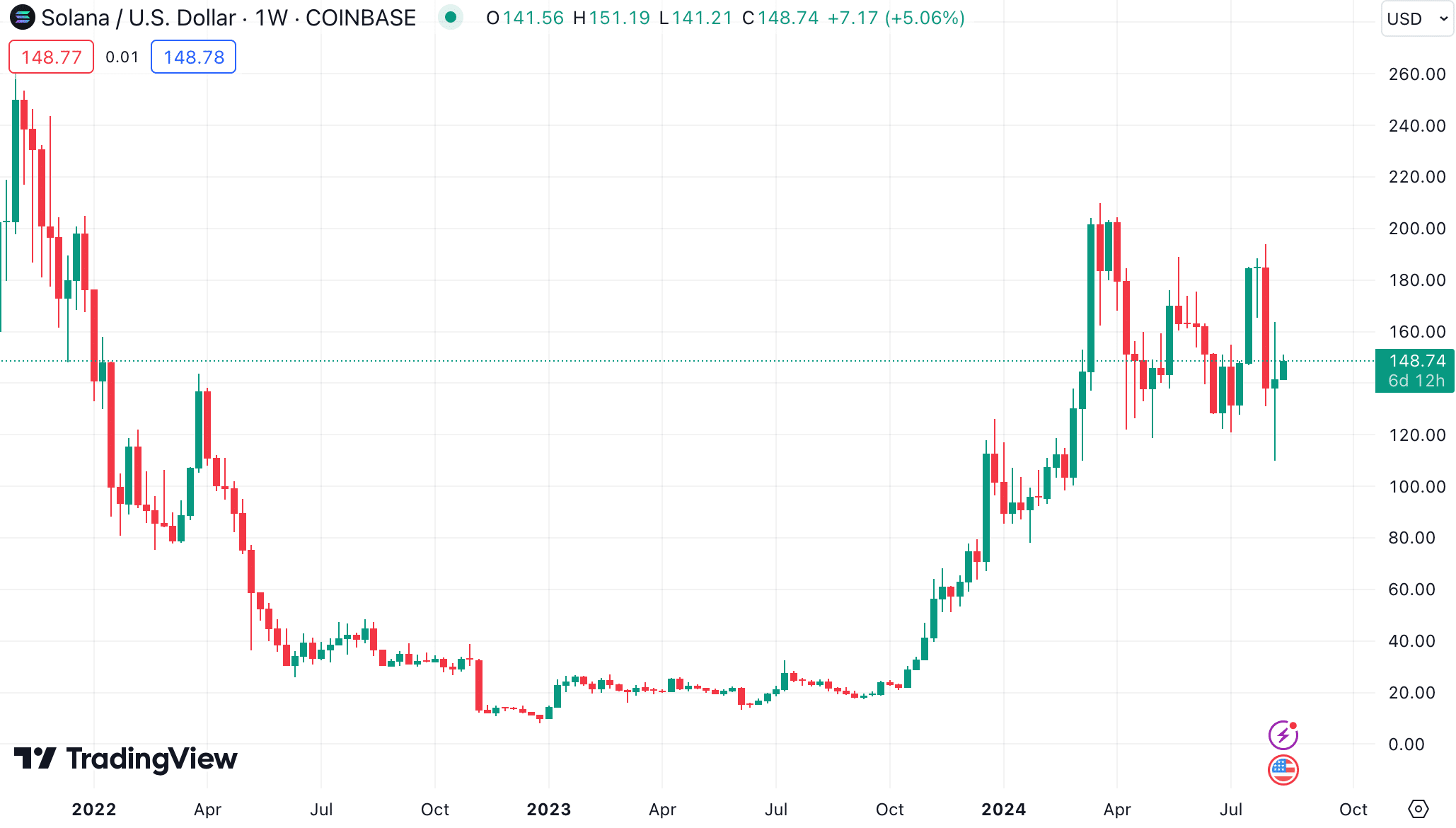

Solana’s market performance amid controversy

Despite these issues, Solana’s market performance has been relatively stable. Solana was trading at $150.38 at press time, with a 24-hour trading volume of over $4.3 billion.

Although the price has seen a 2.08% decline in the last 24 hours, it has increased by 33.97% over the past week.

According to DefiLlama, the network also maintains a Total Value Locked (TVL) of $4.744 billion, with 867,607 active addresses and 37.2 million transactions processed in the last 24 hours.

In a broader context, Solana continues to make strides in the blockchain sector.

A recent report by AMBCrypto noted that Solana saw its first spot ETF approved in Brazil in August, with plans to launch within the next three months.

Is your portfolio green? Check out the SOL Profit Calculator

This development could pave the way for SOL spot ETF approvals in other major markets such as the U.S. and the UK.

Solana is also leading the DePIN sector, hosting 78 projects and gaining ground as a preferred blockchain for development, even surpassing Ethereum in some aspects.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)