Solana

How Solana stands to benefit from NVIDIA and the AI hype

Meme token NVDA on the Solana network experienced a massive growth after NVIDIA earnings.

- Solana meme token NVDA witnessed an extraordinary surge fueled by speculative enthusiasm.

- SOL prices were up nearly 2% in the last 24 hours.

Due to the AI hype and the recent NVIDIA earnings, semiconductor stocks have rallied on the American stock market. A meme token with the same ticker as NVIDIA on the Solana [SOL] network also witnessed a massive surge due to this hype.

Looking into the hype

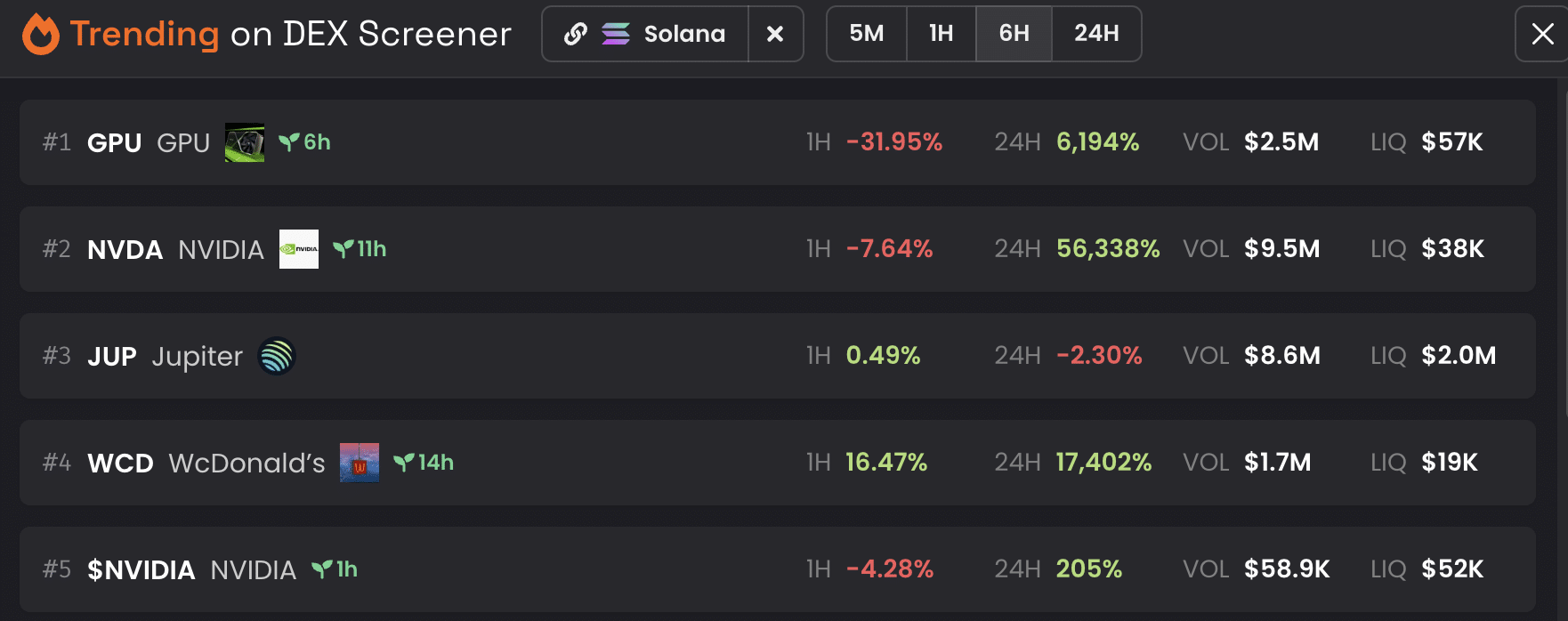

In the last 11 hours, the price of the meme token NVDA grew by an alarming 56,000%. Coupled with that, other tokens such as GPU and NVIDIA also grew massively in terms of price over the last 24 hours.

However, it should be noted that this surge in price was primarily driven by hype and may not be sustainable in the long term.

The temporary nature of the surge in the prices of these tokens may not benefit many investors, and some may even get rug pulled after buying these tokens.

Despite this, Solana could be a beneficiary of the surge in interest in these tokens.

The fact that people are using the Solana network to develop and trade these tokens may improve the overall activity on the network and may also help in providing liquidity in the ecosystem.

How is SOL doing

After testing the $79.20 support level on the 23rd of January, the price of SOL surged by 31.22%. During this period, SOL’s price exhibited multiple higher highs and higher lows, showcasing a bullish trend.

The $117 resistance level was weakened multiple times during the last few months. If SOL re-tests the level yet again, there is a chance that the token may push past it and reach new heights.

The RSI for SOL also declined and reached 42 at the time of writing, implying that SOL had moved into the oversold territory.

Is your portfolio green? Check out the SOL Profit Calculator

This may be interpreted by some traders and analysts as a signal that the asset is undervalued or that selling pressure has been excessive, potentially indicating a point of reversal.

However, in terms of volume, there was a significant dip observed. In the last few days, the volume at which SOL was trading at fell from 3.42 billion to 1.92 billion.